Our regular readers will remember that we have discussed low-vol strategies here before, as recently as May of this year. That discussion was inspired by a recent paper by Clifford C. Asness and two associates. The bottom line of that and a lot of research is that there is solid empirical evidence that low-vol strategies, also known as betting against beta (BAB) pay off. Low-vol strategies produce lower returns than they ‘should.’

Our regular readers will remember that we have discussed low-vol strategies here before, as recently as May of this year. That discussion was inspired by a recent paper by Clifford C. Asness and two associates. The bottom line of that and a lot of research is that there is solid empirical evidence that low-vol strategies, also known as betting against beta (BAB) pay off. Low-vol strategies produce lower returns than they ‘should.’

Now Axioma, the software development firm perhaps best known for its Axioma Portfolio Optimizer and the daily updates to its Axioma Robust Risk Models, has weighed in on the subject of low-vol, a subject it proposes to de-mystify.

Why it Works

There are at least three extant theories about why BAB works. Why don’t the excess profits do what the textbooks suggest excess profits will do? The bears are supposed to find the meadow with the most picnic baskets, so that in short order the number of picnic baskets there is down to normal.

The success of BAB has been a fact since at least the mid-1970s, a very early period in the development of modern portfolio theory, when Robert Haugen and James Heins published “Risk and Rate of Return on Financial Assets.”

Why don’t the excess profits draw in the bears, consuming the picnic baskets? The three theories are:

- Delegation of portfolio management: even money managers who are aware that BAB works are constrained to avoid the strategy due to their benchmark mandate;

- Inability on the part of many investors to leverage themselves at the rate necessary to exploit BAB (this is Asness’ view);

- The skewing of incentives during bull markets. During such periods, the managerial incentive is to go for the big score, to swing for the fences, thus dispensing with the singles-and-doubles sort of strategy that makes BAB work.

As Frank Siu, of Axioma, says, the underlying idea has become sufficiently accepted that it has inspired “a flurry of low-volatility themed indexes and corresponding exchange-traded funds hitting the market” in recent years. The S&P 500 Low Volatility Index is quite venerable as indexes go. It has been around since 1991, measuring the performance of the 100 least volatile stocks within the S&P 500, weighting its constituents inversely to their corresponding volatility.

On the whole the S&P Low Vol has solidly outperformed the S&P 500 TR.

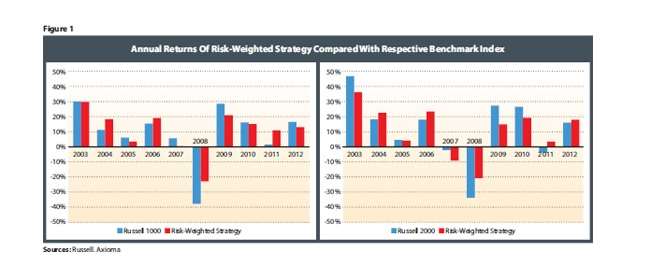

Figure 1 of the Axioma report, below, is a summary of an analogous inverse risk-weighting approach applied to the Russell 1000 and 2000 (the right and left half of the figure, respectively), from 2003 through 2012.

Bargain Basement Risk Management

In the dramatically down year of 2008, the risk-weighted approach (red bar) produced a far less bad result than the unweighted underlying index (blue). What is more, although investors do pay for that benefit in the up years, or at least in some of the up years, they don’t pay an equivalent price. They buy their risk-protection at a considerably discounted price.

In 2003, for example, the risk-weighted and the unweighted performance of the Russell 1000 were nearly identical. In 2004 and 2006, the risk-weighted strategy paid off on the up side .

.

Minimum variance strategies, though, are a different fish from such straightforward inverse risk weighting.

Axioma’s report describes minimum variance strategies as a purification of the original risk-weighting strategies, one that “requires the use of … optimization technology as well as a risk model.”

The risk model need not be mathematically or financially sophisticated. A simple, even one might say a naïve, model can be constructed using historical stock returns to create a covariance matrix of realized stock volatilities and correlations.

“[A] number of minimum-variance products on the market do indeed use a simple risk model constructed in this regard, or minor variations thereof,” Axioma says.