EDHEC-Risk Institute recently surveyed institutions around Europe for their views on the transparency and governance of indexes.

EDHEC-Risk Institute recently surveyed institutions around Europe for their views on the transparency and governance of indexes.

As Noël Amenc, professor of finance, EDHEC Business School, puts it in an editorial on the results, the respondents “collectively provide protection to hundreds of millions of scheme participants and clients in Europe and beyond.”

Amenc is one of the two authors of a full report on the survey, along with Frédéric Ducoulombier, (portrayed here): director of EDHEC Risk Institute – Asia and the creator of the executive education arm of EDHEC-Risk.

Motive for the Survey

EDHEC undertook the survey because index providers have of late been making the case that transparency requirements should not be imposed upon them by regulators, or should be kept undemanding if imposed at all, because there is no real problem that rigorous requirements would solve. The index providers, on their own account, already have strong incentives to offer transparency and, in their self-interest, they do so.

Source: EDHEC Publication, “Index Transparency,” 2014.

The end-users, according to this survey, are not as favorably impressed by the indexing industry as it is by itself. Key findings are these:

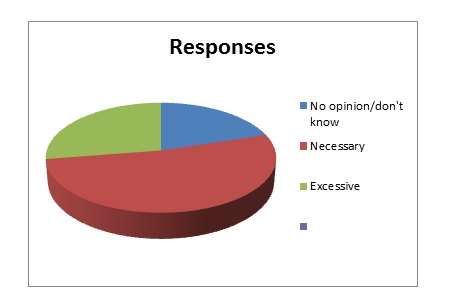

- Twice as many respondents regard new regulation in the field as necessary over those who regard it as excessive – as illustrated by the above pie;

- Only 16.5% of respondents agree that conflicts of interest are no threat when equity indexes are calculated from observable transaction prices;

- A strong majority (85.2%) view transparency (rather than governance) as the best route to the mitigation of conflicts;

- Only 12% view good governance as sufficient in mitigating conflicts;

- End investors regard the transparency requirements of IOSCO as inadequate, preferring at least the requirements that ESMA has imposed in the UCITS context;

- They want the ESMA transparency rules to be extended to non-UCITS products and mandates;

- There is also majority support for the proposition that intermediaries who import indexes into their products, then offered to end investors, should be required to conduct due diligence thereon;

- Almost three-quarters of respondents (73.4%) support the unrestricted use of index information for purposes of research and evaluation;

- An even larger percentage (77.1%) believe that the new prominence of strategy indexes makes transparency an even more pressing issue.

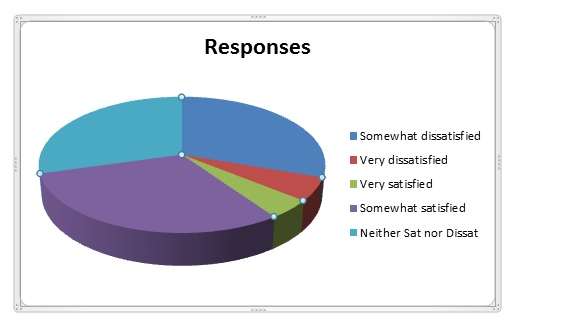

The survey’s introductory question was: how satisfied or dissatisfied are you with the current level of transparency in the index provision industry? The pie below captures the result:

Source: EDHEC Publication, “Index Transparency,” 2014.

The results indicate that, at a very high level of abstraction, the range of responses is what one might expect. The two extreme answers [“very” one way or the other] are the statistical outliers.

Difficult to Reconcile

Understandably, though, EDHEC sees this result as indicative of trouble. The percentage of those who are either very or somewhat satisfied adds up to only a little more than one third of the whole (34.9%). This says Messrs. Amenc and Ducoulombier, is difficult to reconcile with the contention of index providers that they already have a strong incentive to provide an optimal level of transparency to stakeholders, an argument that IOSCO seemed to have accepted when it adopted the lax standards mentioned above.

EDHEC, then, wants Europe’s lawmakers to use the opportunity provide by ongoing discussion of indexes to create standards of transparency that will answer the legitimate information needs of users, reducing the risks of abuse, and promoting both competition and innovation in the indexing industry.

Responses to the survey were geographically wide-ranging: the 109 respondents represented a total of 20 countries and dependencies.