Sharesleuth, a business-investigating website backed by billionaire Mark Cuban, is an experiment in the making of a legitimate profit from the exposure of not-so-legitimate profits. Cuban’s professed plan is to buy and sell stock, sometimes at least to short sell stock, based on disclosures that he knows in advance that Sharesleuth is about to make.

Sharesleuth, a business-investigating website backed by billionaire Mark Cuban, is an experiment in the making of a legitimate profit from the exposure of not-so-legitimate profits. Cuban’s professed plan is to buy and sell stock, sometimes at least to short sell stock, based on disclosures that he knows in advance that Sharesleuth is about to make.

This experiment has been underway for eight years now. Why am I discussing it today? We’ll come to that.

Let’s begin at the beginning, though. Prior to the appearance of the first investigative piece in August 2006, Cuban short sold 10,000 shares of Xethanol, the object of that first piece, a company that claimed to be in possession of breakthrough technology about to revolutionize the ethanol industry. The report was harshly critical. It said for example that when Sharesleuth representatives “paid a visit to the [plant in Hopkinton where the technology was supposedly in operation] we found the doors locked, the building dark, and no employees present. A large filtration system sat on a grassy patch outside the plant, and an air system serving the building was in obvious disrepair.”

Xethanol fell 14% on the day of the publication of that report. That day alone.

A Brave New Business Model

The whole Sharesleuth business model stirred up a lot of controversy. At the heart of the controversy was the question: does stock price manipulation cease to be manipulation, or cease to be objectionable under any terms, if the manipulator is sufficiently open about it?

As to Xethanol, it has to be said, Cuban and his Sharesleuth editor, Chris Carey, did have the goods. In September 2006, in an SEC filing, the company listed “risk factors” that threw very frigid waters over the hopes of its remaining true believers. “We have a limited operating history ….We have had a history of net losses….Our biomass-to-ethanol technologies are unproven on a large-scale commercial basis … Our licensed biodiesel fuel additive technology could fail to perform, or to do so in a manner that makes its production commercially feasible.”

Xethanol tried to rebrand itself soon thereafter as Global Energy Holdings Grohup. Global Holdings, in turn, filed for bankruptcy court protection in September 2009.

So: whatever you think about the Sharesleuth business model (and I have criticized it myself), you have to allow that their first investigation was a “fair cop.”

Why bring this up? Because we have another Sharesleuth call to discuss: the Houston American Energy Co. and John Terwilliger.

Selling a ‘Colombian Reserves’ Dream

On August 4, 2014, the Securities and Exchange Commission announced that it has begun civil proceedings against Terwilliger and Houston American over actions in which they engaged in late 2009 and early 2010. During that time they claimed that a Colombian exploration company owned between 1 billion and 4 billion barrels of oil reserves underground. Billion with a b. And they added (this bit was accurate enough) that HUSA owned a share of that exploration company. It was selling a dream. Or, in the cautious language of the new SEC charge, its statements about the size of the Colombian oil reserve had no “reasonable basis.”

Where might you have read about this before? Back when a caution might have done you some good? Sharesleuth. In August 2010, Carey wrote that HUSA had purchased its share in this prospect from a South Korean company, SK Energy Group Ltd. Carey also said that it seems “unusual” that they could do so at the announced price, without having to pay SK Energy “a substantial premium for its stake,” if the reserves were as claimed, enough to “send the company’s revenue and market capitalization into the billions of dollars.”

Ah yes, the old suspicion about how somebody was claiming to be getting something for nothing. It didn’t require great insight, but making that point is always a service.

There, too, Sharesleuth was upfront about its business model. “Mark Cuban, majority owner of Sharesleuth.com LLC, has a short position in Houston American’s shares,” the report says in italics.

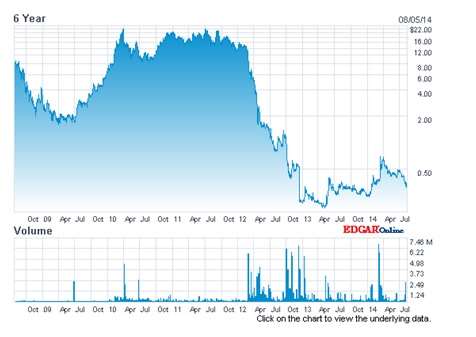

Look at the 6-year stock chart above, pasted with gratitude from Nasdaq. You’ll see that the spring and early summer of 2009 was the low valley on the left hand side, when the share price was about $2. Largely on the basis of its representations that it had this magnificent Colombian reserve, HUSA’s stock price climbed steadily through the end of that year and the first three quarters of 2010.

Sharesleuth’s report doesn’t seem to have had much of an immediate impact, HUSA stayed strong until the end of 2011. Nonetheless, it accurately anticipated the long slow slide thereafter.

Nowadays, HUSA is a penny stock. Indeed, it closed on August 4, 2014, at $0.34. The one month chart is below. Both charts are pasted from Nasdaq.com, with gratitude.

The point? Just this: Sharesleuth didn’t pioneer any new model for business journalism, as Cuban in some of his more grandiose pronouncements eight years ago seemed to think. But it is worthwhile keeping an eye on the reports it runs, because from time to time it does tell you to avoid an enthusiasm stoked by old-fashioned pump-and-dumpers. And, yes, it is the conventional strong point of short sellers that they can smell the boiler rooms from miles away.