GFIA’s latest “Research Insights” begins with an essay that describes itself as “ruminative and wide-angled,” a reflection on ivory towers and practitioner-oriented data in the world of alternative investments.

GFIA’s latest “Research Insights” begins with an essay that describes itself as “ruminative and wide-angled,” a reflection on ivory towers and practitioner-oriented data in the world of alternative investments.

The essay observes that GFIA “has always tried to carry out its own primary research,” from the perspective of practitioners. GFIA is of course aware that there is a lot of academic work in the field, but it isn’t favorably impressed by much of it. Many papers purportedly investigating AI simply crank up the machinery of “heavy duty statistical analysis” applied to “database information” to no end other than another publication credit for the author.

These ruminations acknowledge that some academic work is useful, and that some non-academic research has its own flaws, especially to the degree that it is trying to sell something. But the upshot of the essay is that practitioners are better off listening to and learning from other practitioners, and that academics might be better off learning from practitioners too, since theoretical changes, “Big Ideas”, are more likely to come from outside of their own overly cross-fertilized flower bed than from within it.

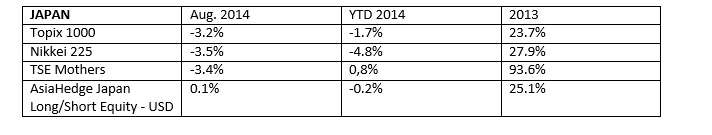

After this essay, GFIA turns as usual to its region-by-region discussion of the latest data. It tells us, for example, that Japan is in an “evidence-collection period.” The Bank of Japan is assessing (one might even say “ruminating over”) where to go next, and some managers think that this spells trouble for the Japanese equity markets.

Meanwhile, retail trade and industrial production numbers from Japan are weak.

Japan re-assesses monetary moves

The index numbers from Japan for August are given in the table above. As you can see there, the relevant equity indices all retreated in August and the managers’ performance in US dollars was positive but quite flat.

Most of the Japanese managers that GFIA tracks came in net neutral on equities in August, and that worked pretty well for many of them. Akito Fund, 3.3%; Four Seasons Asia, 3.2%; Instinct Japan Opportunity Fund, 2.9% were the leaders here, demonstrating positive performance on both the long and the short sides of their books.

Carnico Fund returned 1.6%, with most of its positives coming on the short side.

In Greater China

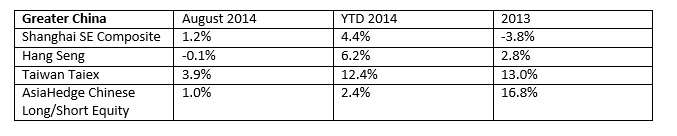

Meanwhile, in Greater China, the Hong Kong’s equities were flat (very slightly down) while the Shanghai SE Composite was up. As you can see in the table below, fund performance in the region (1.0%) reflects the pause in Hong Kong, where most Greater China managers have a lot of exposure.

The GFIA report gives Spring China Opportunities Fund some credit for starting to “adjust its portfolio composition to include a wide cross section of sectors and lists of stocks.” This fund rose 0.7% in August.

In tech stocks, the month of August was a time of anticipation for new product launches from both Apple and Samsung, and this anticipation worked out well for stocks in that sector.

But healthcare stocks faced pressure. The government is pressing down on prices there. It was the losses in the healthcare sector that dragged down the monthly results from Quam China Focus SP (0.3% in August).

Miran Long Short Equity Segregated Portfolio, on the other hand, did very well in August (4%), getting boosts on both the long and short side.

Elsewhere

The report mentions briefly that “relentless” foreign purchases continue to push up the India indices.

Funds focused on the subcontinent are doing well. The AsiaHedge Indian Long/Short Equity fund rose 3.2%. Meanwhile, long-only funds like Karma Select and Alchemy India Long-Term Fund “rode the beta tide well.”

Emerging markets generally had a good month; again the reason involves “favourable foreign capital inflows.”

Russia and Eastern European markets, where the headlines through August involved Ukraine fighting and related sanctions, did significantly less well than did markets in Asia or Latin America. Russia’s stock market fell 2.1%. The UFG Russia Select Fund experienced “a rather notable drawdown of 3.6%.”