At the behest of the Bank of England, Anthony [Lord] Grabiner has studied whether, between 2005 and 2013, any B of E official engaged in (or knew of and winked at) any improper behavior in the forex market between 2005 and 2013.

At the behest of the Bank of England, Anthony [Lord] Grabiner has studied whether, between 2005 and 2013, any B of E official engaged in (or knew of and winked at) any improper behavior in the forex market between 2005 and 2013.

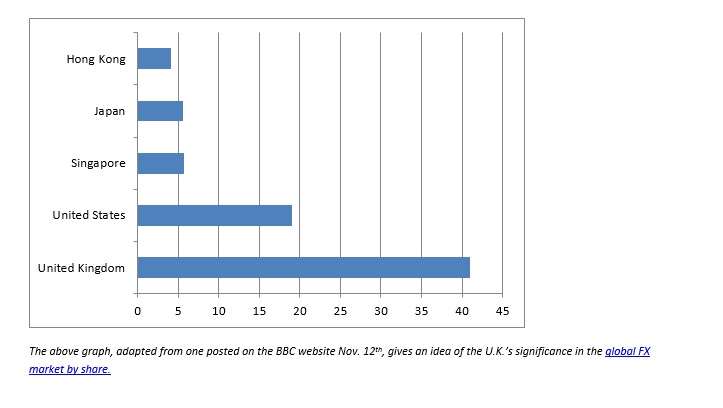

Shares of a $5.3 Trillion Market

The release of the resulting paper serves as counterpoint to the heavy fines issued by U.K.’s Financial Conduct Authority, Switzerland’s FINMA, and two U.S. agencies, against the private banks alleged to have manipulated foreign exchange rates.

The above graph, adapted from one posted on the BBC website Nov. 12th, gives an idea of the U.K.’s significance in the global FX market by share.

One can understand how the Bank of England drew the conclusion that it ought to ensure that its own walls are made of something other than glass, and commissioned Grabiner’s report. But I’m afraid this report, together with a single firing, falls far short of that goal.

Lord Grabiner is rather gentle on the B of E and even on the one official thereof who has now lost his job. Still, his report encourages the inference that people in the market knew they could safely collude with one another in “bullying” the fix because, after all, the B of E knew all about it. Not only is the B of E not the cure for manipulation, it is the enabler, the wink-and-nod clearing house.

Yes, Grabiner found “no evidence to suggest that any Bank official was involved in any unlawful or improper behavior in the FX market.” But [a big “but”] he quotes some conversations that show the now-discharged Martin Mallett in particular playing an enabling role.

Martin Mallett, the B of E’s chief FX dealer, “was aware that bank traders were sharing aggregated information about their client orders, “ Grabiner says. He “did not escalate this issue to an appropriate person.” Grabiner believes this “deserves criticism” but he also works rather hard to soften any such criticism, saying that Mallet was “not aware of the improper behavior with which the FCA is concerned.”

Fired From What Job?

Participation in the Foreign Exchange Joint Standing Committee (FXJSC), a forum employed by banks and brokers for the airing of broad market issues, was part of Mallett’s job as chief FX dealer. He was expected to view the FXJSC, also just called the JSC if one is pressed for time, as an instrument for the collection of market intelligence for the benefit of the B of E. By the same token, market participants surely viewed their interaction with him, in the JSC or otherwise, as part of their market intelligence activities.

Much of the ongoing scandal involves attempts to manipulate the WM/Reuters 4 pm and the ECB 1:15 PM fix rates. As a quick refresher, WM/Reuters is a joint venture of the WM subsidiary of State Street on the one hand and publisher Thomson Reuters on the other. They maintain a two-decade old benchmark calculated as a snapshot of activity over one minute, from 30 seconds before until thirty seconds after the moment of “fix,” 4 pm in London. That benchmark is of critical importance for the exchange of the pound against … well, anything else. The European Central Bank fix serves the same function for the value of the euro against anything else, using Central European Time [one hour ahead of London] 1:15 P.M. as its snapshot.

In terms of the raw data behind this report, the bit that has already gotten a good deal of press attention is the exchange between Mallett and an unnamed forex trader on October 3, 2011, an exchange in which the trader told Mallett, “some of these banks want to build a book and try and bully the fix.”

Mallett replied merely, “Mmmm.”

The trader continued, “It’s not genuine, you know they’ll go in and say, ‘I’m a buyer’ when they’re actually a seller, just to build a book but it does seem to be getting bigger and bigger and bigger.”

After some discussion about whether “accusation” is the right word for what the trader had just said, the trader settles on describing various numbers as “exaggerated.”

Mallett asks, “Well, that’s market manipulation, isn’t it?”

Trader replied, “Yes, absolutely.”

From Appendix 3

As on-point as that exchange is, another is rather buried in Appendix 3 of the report, and I’d like to highlight that now. This is a transcription of a conversation between Niall O’Riordan [a senior trader at UBS] and the aforementioned Martin Mallett, on the afternoon of March 19, 2012.

O’Riordan: …and I know we touched on this before in the JSC.

Martin Mallett: You’re talking about FX fixing….

O’Riordan: Yeah, 4 PM fixing.

Martin Mallett: Yeah, yeah.

O’Riordan: Ok, and you know the situation where you have you know Bank A, B and C say well actually I'm getting and the other guy says well I'm losing and Bank C says I'm not doing anything and then we match off and everybody is happy and it's probably good for the shareholders of the company, good for the shareholders of the bank etc. etc. Now the situation is where people say well actually A B and C we're all losing say a hundred quid and the market rallies. Now, eh, sure these things happen, but broken down we're not in control of it. The fix is, is deemed by I guess most of the asset managers as the benchmark that has to be benched against, so there's nothing we can do about that. But what's your take though on, how can I put this, chat activity on Bloomberg?

I’ll interrupt to say that there is some back-and-forth while the two men decide that each knows what the other is saying, and then Mallett summarizes it thus: “…as far as I am concerned that is, that’s good, that, y’know, in terms of swapping information and ideas it’s good. It’s where it starts to get into the realms of, um, something that looks like off-market transactional behavior…”

Then the two discuss the “reputational” difficulties of such off-market transactional behavior for the forex industry, and Mallet says more than once that he isn’t a lawyer so he doesn’t mean to make any legal judgments.

O’Riordan asks point blank, “Does it concern you, Martin?

Mallett replies, “Does it concern me? Umm…”

After some further thought, Mallett seems to say that what concerns him is the possibility that it will become generally known, that is, “if it as a practice kind of gains currency among the people in y’know outside of our industry….”

So O’Riordan would have had no reason to report back to his bosses, “The Bank of England opposes the practice of bullying the fix.” He might have had better reason to report, “the Bank wants us to be discreet.”

A somewhat different message, no?