A new white paper from KPMG discusses both the challenges and the opportunities facing women in the alternatives investment world, as elucidated by an online survey. Responses to the survey came from “328 female alternative investment fund managers, investors, and other professionals in the alternative investment industry,” the white paper says.

A new white paper from KPMG discusses both the challenges and the opportunities facing women in the alternatives investment world, as elucidated by an online survey. Responses to the survey came from “328 female alternative investment fund managers, investors, and other professionals in the alternative investment industry,” the white paper says.

One of the many striking finds of the study is that nobody, literally 0% of investor respondents, expect to decrease their allocations to women owned-or-managed funds. More than a quarter of those respondents expect an increase in those allocations.

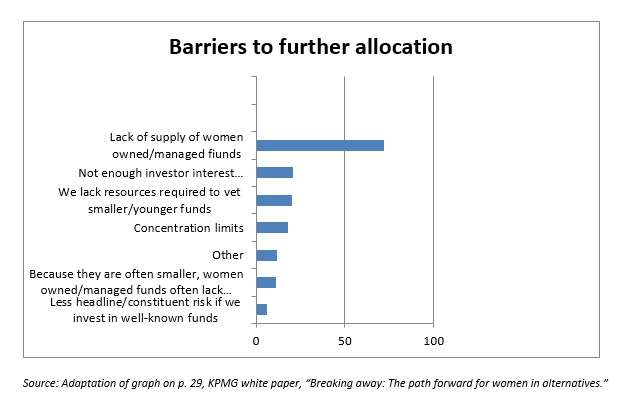

Indeed, answers to other questions confirm the general expectation that allocations will increase. For example, 72% of investor respondents say that the biggest obstacle to increasing allocations to such funds is … that there aren’t enough of them. More on that later.

First, Performance Numbers

The obstacle certainly isn’t poor performance. Woman-headed funds have outperformed the two key performance composites every year since 2007. Specifically, since that time the annualized return of the HFRI fund weighted composite Index has been 3.75%, while the annualized return of the HFRI Women Index has been 5.64%. Meanwhile, the HFRX Global Hedge Fund Index has recorded a woeful annualized return of -0.39%.

Looking at totals, those numbers are: 59.43% for the HFRI Women’s Index; 36.69% for the FWC, and -3.28 for the Global Hedge Fund Index.

The survey records confident expectations for the HF industry for 2016. KPMG’s report reflects such optimism, quoting the president and CEO of the Rock Creek Group, Afsaneh Beschloss, thus: “Historically speaking, hedge funds have outperformed the market when interest rates are rising. This has been the case not just for alpha, but for beta.” Parenthetically, Ms Beschloss (portrayed above) is both former chief investment officer and former treasurer of the World Bank, and (according to a BusinessWeek profile) she has taught economics at Oxford University. What Beschloss’ comments convey is the expectation that interest rates in fact will rise in the remaining months of 2015 and/or through the year 2016. That continues to be how the “smart money” is betting but it no longer seems as certain as it once did that actions of the Federal Reserve will get us there.

But, continuing that line of thought further would constitute a digression. What is germane is that the report quotes Beschloss often, on several points, and we as readers get the gist of her perspective, to wit, that if there is a general increase of interest rates, passive investing in stocks will take a hit, and active investing there will look relatively better. The white paper also quotes Beschloss naming two strategies that will benefit especially from that environment: macro and event driven.

Meanwhile, Beschloss sees pension and sovereign wealth funds continuing to add to their alternatives portfolios. They will start allocating, she says, “not just to the largest hedge fund managers but also to the next tier of smaller and midsize funds.” This development may favor “women and minority owned and managed funds as they tend to be smaller.”

Above, I mentioned that 72% of investor respondents say that the biggest obstacle to increasing allocations to such funds is a lack of supply. Here is a full set of responses to that question.

There is some overlap in the answers, since for example a dearth of supply of such funds is a significant part of the reason why some investors might be deterred from further such investment by their concentration limits (that is, by the degree to which further investment in such funds would make the investors at issue the main investor in one or more such funds).

Final Thoughts

Also, two of the above responses derive limits from the fact that such funds tend to be small or medium sized funds. One group worries over the vetting difficulties that might involve, the other the lack of infrastructure, prime brokerage, or compliance support it would entail. It is this limit, or this combination of limits, that Beschloss sees as falling in the months to come as institutional investors widen their portfolio into that middle and small sized frontier.

In an upbeat conclusion, KPMG writes, “women in alternatives have charted their own paths to success, and we hope the next generation of women entering and rising through the ranks within the industry will follow in their footsteps.”