The combined inflows of equity, bond, and hybrid hedge funds have been remarkably steady over the last 10 years, according to research newly released by Deutsche Bank Global Prime Finance, in its Monthly Hedge Fund Trends newsletter. into equity, bond and asset allocation (hybrid) funds running around $325 billion a year for the last 10 years.

Yes, as one might expect, total flow did slow for a bit through the world financial crisis, specifically between June 2008 and March 2009, with investors re-allocating to money market funds, that is, effectively, to cash. But after the great Bottoming of March, volatility subsided a bit, and the steady rate of inflow into the threesome listed above resumed. The report calls this steadiness “an empirical regularity.”

The mathematical implication of such regularity is that any growth above that average for one region or asset class will represent a decline to a below-average rate elsewhere. Indeed, rotations have taken place along many axes: bond fund inflows fluctuate greatly vis-a-vis equity funds, emerging markets versus developed markets, different developed markets against one another, etc.

The DB Prime researchers highlighted the multi-year outflows from EM to DM as one such rotation. EM equity inflows reached a peak in early 2011. But EM bond inflows didn’t peak until the 2013 taper. Since then EM equities have seen an outflow which has benefitted primarily Europe and Japan within the developed world.

Recent years have also seen a very large outflow from US equities into the same two places, Europe and Japan.

DB Mavens on EU and the ECB

In a separate section of the report that may shed some light on that last point, the DB Prime researchers also look at recent developments in ECB monetary and EU fiscal policy. They expect the European Central Bank to cut the deposit rate by 10 basis points in December. They also expect that the U.S. Federal Reserve will be heading in the opposite direction at that time, which will amplify the effects of the ECB move.

The point is that ECB monetary policy can still be effective, so it doesn’t have to be supplemented on the fiscal side. There is little pressure right now for an easing of fiscal policy. “Only in a serious escalation of crisis, and if confidence in ECB policy were lost, might the fiscal rules be strongly revised.”

The rules in question limit the size of the total government debt of member states, and their budget deficits, as a percentage of GDP. As an enforcement mechanism the rules create an “excessive deficit procedure,” countries in violation become subject to surveillance and fiscal penalties. All this creates what the DB report calls a “veneer of control over fiscal risk.”

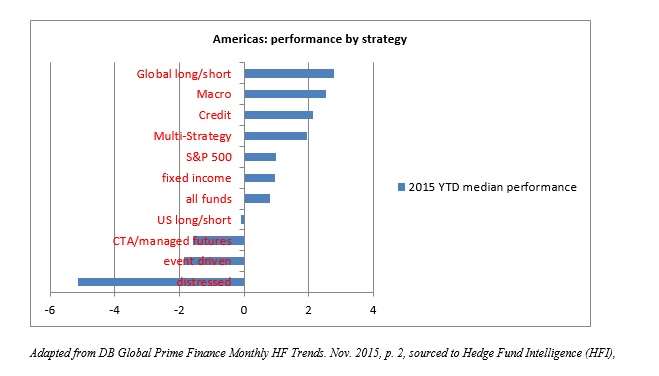

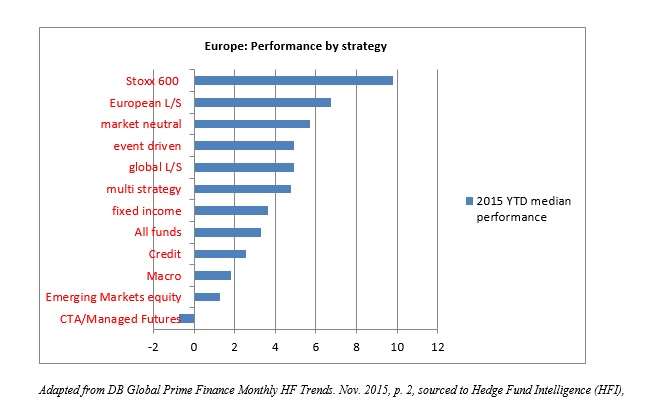

Much of the newsletter provides a straightforward region-by-region and sometimes country by country breakdown of hedge fund performance in October 2015, and year-to-date for 2015 through October. The charts reflecting the YTD data, for the Americas and Europe, have been adapted above.

In the United States, equities rallied in October and short funds unwound their positions. The three sectors that saw the greatest monthly drop in short exposure were: materials, energy, and information technology. The single-name stand outs were: Freeport-McMoRan, Petrobras SA-ADR, SandRidge Energy, and Alcoa.

Short Positions and Corporate Names

Although the DB report doesn’t go into the particulars as to why those companies performed as they did, allowing/encouraging the close-out of short positions, one of those corporate names has enough notoriety to encourage some reflection.

Petrobras (NYSE:PZE) has been contending of late with a bid-rigging and bribery scandal. In March of this year it was widely reported that the Treasurer of Brazil’s ruling party was among those under investigation, as was the former head of services as Petrobras. In mid-October the process of the ADRs hit a bottom at 4.80. They rose through the remainder of the month, closing October 30 at 6.28. The market may be signaling that the worst is over for the scandal and its scar tissue.

Meanwhile the greatest net additions to short exposure came from Sprint, Consol Energy, Century Aluminum, Bank of NY Mellon, and Morgan Stanley.