A recent Neuberger Berman analysis, by Conrad A. Saldanha, makes the case that the emerging markets as an asset class have hit their bottom and are poised for growth.

Of course Saldanha understands that since the “overall asset class” is such a huge one – half of global production –different parts thereof, both between and within the nations involved, have to be the subject of bottom-up scrutiny. For example, investors should be cautious about including in their portfolios the issuances of exporters headquartered in EM nations, especially those who are exporting commodities into a very competitive world market. Neuberger Berman’s “preference” is for those EM sectors and businesses with a domestic focus.

Also, the report understands that for two countries in particular, India and Indonesia, gains from the euphoria that a change in leadership can produce have already been realized. Indonesia elected Joko Widodo in July 2014, and he was widely seen in the investment world as a breath of fresh air entering into a room where the air has been very stale for decades. Likewise, in the elections that autumn, India gave a mandate to the Bharatiya Janata Party and to Narenda Modi. The new leadership in India in the year plus since the election has, as was expected, been more friendly to foreign investors than was the old.

But in both cases, India’s and Indonesia’s, the euphoria is behind us. Investors must now adjust “to the reality that change is tougher to implement in large democracies.” Hell, and heaven, both reside in the difficult details of implementation.

Look for the Buyers of Commodities

The present depressed commodity prices spell continued trouble for those companies that export said commodities, but they also spell opportunity for those that import and make use of them. For commodity importing markets in the EM world, “inflation and fiscal balance sheets have improved, and both manufacturers and consumers have benefitted from lower input costs.”

China, the source of much of the bad news in recent months, may be poised to become a source of good news, because it has been executing a (painful but necessary) shift from its dependence on fixed-asset investment to a greater focus on consumption. This will create more long-term investment opportunities in domestically oriented businesses. Present low valuations, along with “stabilization and more sanguine sentiment could drive upside for bottom-up investors in various niche areas.”

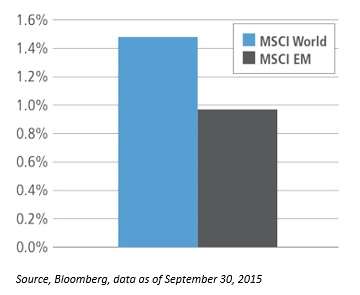

The low-valuations part of that formula is emphasized in Saldanha’s analysis by the above chart. The world’s PE to growth ratio, as of the end of the third quarter, was above 1.4%. The EM ratio is roughly just two-thirds that. This creates potential for outperformance by the latter, given again, an investor’s ability to find domestically oriented businesses with pricing power and with solid earnings.

Two points that are often seen as negatives for an EM strategy look not-so-negative in Saldanha’s hands. First, as mentioned above, China. Saldanha’s suggests that the market simply ought to get over “its obsession with China’s percentage growth rate….”

The Federal Reserve

Second, there is the U.S. Federal Reserve. Economies that are less sensitive to Fed whims may do better than those that are more so, but in general the Fed’s new preference for normalization “suggests the potential for improving current account balances.”

All of the above observations apply especially to equity, as well as to debts denominated in the local currency. Saldanha does not specifically mention the asset class that consists of EM debt denominated in U.S. dollars, but it is worth mentioning that his analysis probably doesn’t apply there. Such hard-money debt has outperformed in 2015, so the question of whether it has yet “troughed,” the question that frames Saldanha’s discussion of the assets with which he is chiefly concerned, doesn’t really arise.

Russ Koesterich of BlackRock, on the other hand, has recently treated of the question of whether EM dollar denominated debt can continue to outperform. He concludes that given “expectations of mildly higher U.S. rates next year, the positive Treasury impact we’ve seen the last two years” in this particular asset class, “may have been a gift that we shouldn’t expect to keep getting.”