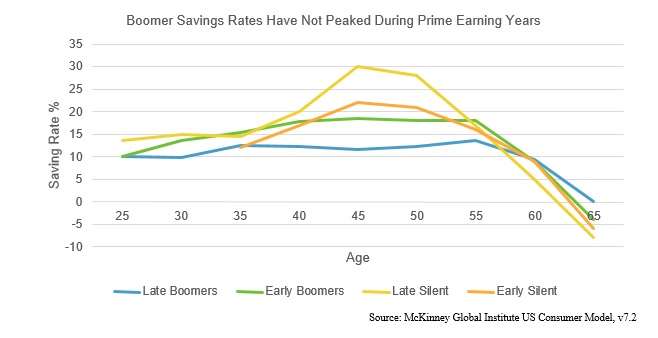

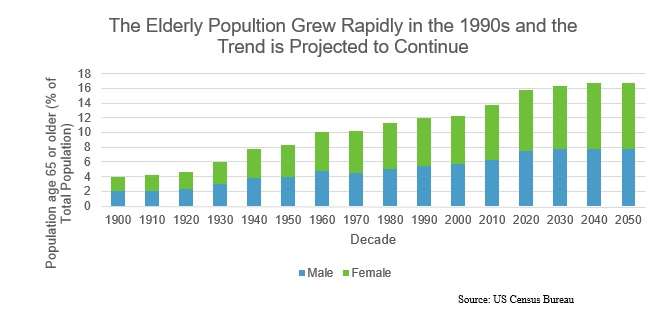

Andrew N. Smith, CAIA, interviews Doug Himmel of Melville Capital and Adam Meltzer of Vida Capital, both experts in the life settlement industry. Andrew: The reason why we're getting together today is to talk about the life settlement market. Not a lot of people know about life settlements. So, with that said, what are life settlements? Doug: A life settlement is the sale of an existing life insurance policy to an institutional investor at a price higher than the current cash surrender value, but lower than the face amount of the policy. The investor then takes over all the premium obligations and the original owner is relived of the ongoing financial burden while getting a lump-sum that is a lot more than the insurance company told them it was worth if it was surrendered. If a policy does not have cash surrender value, for example with a term policy, a life settlement is still usually possible because most term policies are convertible into cash value policies and, because of that nuance, they can be monetized as well. Andrew: How did the life settlement market evolve? Doug: The business in general has been around for about 30 years. It started in the eighties with young insureds who unfortunately had AIDS or cancer and needed or wanted current dollars to either fund some sort of experimental treatment or to perhaps go on a once in a lifetime vacation. However, over the last 10-15 years, the market has evolved into more of an industry focused on helping people who have had a change in life circumstances versus only those who had a drastic change in health, such as changes to an estate plan, selling a business or because of a lack of liquidity. Andrew: How big is the life settlement industry and what types of companies are involved? Doug: Overall, several billion dollars of face amount is transacted every year and some of the biggest investment and financial services companies in the world are involved as purchasers of policies. Andrew: So are these investors hedge funds? Adam: There are definitely hedge funds in the space -- but also private equity firms, pension funds, banks, foundations, and Family Offices that are actively acquiring policies in the secondary and tertiary life settlement market. Andrew: Give me some examples. Adam: Like I said, these really are huge names from the financial industry. Over time, players such as Fortress, Apollo Capital Management, Credit Suisse, Deutsche Bank, Highland Capital, Wilton RE, Berkshire Hathaway, AIG and others have been active. Andrew: It sounds like life settlements are becoming a big industry, but my impression is that the vast majority of investors haven’t heard of it. Doug: That's exactly right and I think that's for a lot of different reasons, including the fact that a lot of broker dealers and captive life insurance agents are forbidden to even broach the subject with their clients – whether that’s on the investment side or even the mere fact that the industry exists. All the while, their client may have a policy that they don’t need, don’t want or can no longer afford - and there is money being left on the table because that policy could have been monetized. Andrew: Why is that? Doug: Well, in my experience, the short answer is twofold – #1 - Most FA’s and BD’s don’t understand the business, so they arbitrarily put it in the ‘selling away’ box - thus making it a ‘prohibited transaction’. #2 - the insurance carriers, who give a lot of soft dollar support to the BD’s and wire houses don’t like the life settlement business. This is due to the fact that it allegedly interferes with their profit margins since they’re betting that most people will cancel or cash in their policy long before they die. Here, the carrier is collecting and investing the premiums all along the way and if the policy gets cancelled, the carrier doesn’t have to pay out the death benefit…But, if someone sells the policy, the new investor is buying it because they want to keep it in force and will very likely hold it until they collect the death benefit. So, the net-net is that it’s in the best interest of the insurance industry to keep this under wraps. Andrew: My guess is that you both talk to financial advisors all the time. How aware are they of life settlements? Doug: In general, I find that many advisors, whether FA’s, CPAs, estate planning attorneys, corporate consultants and so forth are still totally unaware that they have clients that are sitting on these hidden assets, that could be worth substantial amounts of money. Adam: That’s been my experience as well. Producers either do not know about the industry or they have misconceptions about it. Andrew: Is it because most advisors look at life insurance policies as liabilities instead of as an asset? Doug: Yes, but you only know what you’ve been taught right? And since the BD’s and Life Insurance Carriers are doing a good job of keeping this under wraps, it’s no real surprise. Most people only see an insurance policy as an asset that will benefit the wife, family or the company after the death of the insured. It’s our job to educate advisors and clients about the benefits of life settlements, alerting them to the fact that they have an asset on their balance sheet that they're not paying enough attention to and that they can use this strategy to unlock new found capital for things like long-term care, stay at home care, buying a vacation home, investments or any other use that they so choose. An important fact in regards to the development of the life settlements market is the lack of savings and investments among the part of the population entering into their final working years and retirement. I’ll send you a chart that shows that the baby boomer generation has saved and invested significantly less money during their peak earnings years, a stark contrast to previous generations.  Andrew: Tell me about the legal underpinnings of life settlements. Adam: Well, it actually started over a hundred years ago with a ruling from the famed Supreme Court Justice Oliver Wendell Holmes in the case of Grigsby v Russell. Essentially, Justice Holmes stated that life insurance policies are ordinary property or, in laymen terms, an asset that can be sold or transferred. Over the last three or four years, most of the US has clarified how they want life settlements to be treated in their particular jurisdiction, and as of 2015, 45 states regulate life or viatical settlements, covering over 90% of the United States population. This increase in regulation has been a blessing for the industry. It has given comfort to both policy sellers and investors, creating transparency and consumer protection. Also some states are now passing regulation that requires insurance carriers to notify the policy owner of the life settlement option prior to surrendering their life insurance policy. Andrew: Like any other asset, why shouldn’t someone be able to sell their life insurance policy? Adam: It’s really that simple. There is no reason to restrict a policy owner from getting the most out of their asset. Andrew: How can financial advisors use life settlements to benefit their clients and their business? Doug: I’ll say this, after having a series 7 myself for over 20 years, I recognize how difficult it is to set yourself apart in the market and either get a new client or raise new AUM. The best advisors, the ones that I’ve seen raise the most assets and have the greatest longevity, learn about new ways to benefit their clients and provide the highest returns with the appropriate level of risk. Life settlements may be a great way for advisors to separate themselves from the other advisors who are in the clients’ ear and benefit their client ‘and' raise AUM. The bottom line is that if a client is going through some sort of life change - whether its kids graduating from college, doing a new estate plan, getting divorced or retiring and they no longer need their policy, the advisor may be able to generate $50k, $500K, a million dollars for the client. Since they brought this option to the client to begin with, the Advisor is in a very favorable position and the client likely leave all or a portion of that ‘new money’ to manage. Andrew: Not to mention the goodwill from informing them of this option they didn't know they had as well as saving them from having to pay thousands of dollars in premiums for a policy they didn’t even want anymore. Doug: I couldn't agree more. In fact, I think goodwill in a highly competitive advisory business is what separates you from someone else who does the same type of work as you are. No one wants to compete on price so you have to do things differently since most clients find it difficult to distinguish any difference between one CPA or FA and another. The clients are busy in their own life and business and, in general, many advisors really aren't that unique in the products they offer. It’s the service they offer that differentiates them from their peers and I’ve seen time and time again, advisors getting substantially more referrals after they introduce a novel or unique concept like Life Settlements or help a client sell their life insurance policies. It’s that proverbial ‘lightbulb moment’ where all of the sudden, the client sees that advisor very differently… Andrew: We touched on this earlier, but tell me why people may want to sell their life insurance policies? Doug: There really are many reasons why someone would choose to sell their life insurance policies. I’ve seen a myriad of different situations, including clients selling their businesses, divorce, the death of a beneficiary, and also the reasons that I mentioned a few minutes ago. The buyers in the market aren’t particularly interested who is selling the policy; an individual, a Trustee of an Irrevocable Life Insurance Trust(ILIT), a former Partner ridding themselves of the policy that funded a Buy-Sell agreement or a key person policy on the CEO of a business. They only care that the policy was procured and funded in a legal and compliant manner. As the baby boomer generation and the general population continue to live longer, we've seen many clients in their early to mid-eighties selling policies because their kids are 50 or 60+ years old and don't need their parents money and they’d rather have the parents keep the money to enjoy, pay for long term care, or whatever they may need the money for. It’s an alternative to a reverse mortgage or selling other assets that may have appreciated. Adam: To Doug’s point, the elderly population continues to grow rapidly (see chart below). Further, people are living longer and longer, outliving their retirement savings and investments. Often, these people have life insurance that at such an old age, with grown children, there is no longer a need for the benefits at death. The ability to sell a life insurance policy and use it to either purchase an income producing investment, or subsidize their annual living expenses could potentially provide a lot of utility.

Andrew: Tell me about the legal underpinnings of life settlements. Adam: Well, it actually started over a hundred years ago with a ruling from the famed Supreme Court Justice Oliver Wendell Holmes in the case of Grigsby v Russell. Essentially, Justice Holmes stated that life insurance policies are ordinary property or, in laymen terms, an asset that can be sold or transferred. Over the last three or four years, most of the US has clarified how they want life settlements to be treated in their particular jurisdiction, and as of 2015, 45 states regulate life or viatical settlements, covering over 90% of the United States population. This increase in regulation has been a blessing for the industry. It has given comfort to both policy sellers and investors, creating transparency and consumer protection. Also some states are now passing regulation that requires insurance carriers to notify the policy owner of the life settlement option prior to surrendering their life insurance policy. Andrew: Like any other asset, why shouldn’t someone be able to sell their life insurance policy? Adam: It’s really that simple. There is no reason to restrict a policy owner from getting the most out of their asset. Andrew: How can financial advisors use life settlements to benefit their clients and their business? Doug: I’ll say this, after having a series 7 myself for over 20 years, I recognize how difficult it is to set yourself apart in the market and either get a new client or raise new AUM. The best advisors, the ones that I’ve seen raise the most assets and have the greatest longevity, learn about new ways to benefit their clients and provide the highest returns with the appropriate level of risk. Life settlements may be a great way for advisors to separate themselves from the other advisors who are in the clients’ ear and benefit their client ‘and' raise AUM. The bottom line is that if a client is going through some sort of life change - whether its kids graduating from college, doing a new estate plan, getting divorced or retiring and they no longer need their policy, the advisor may be able to generate $50k, $500K, a million dollars for the client. Since they brought this option to the client to begin with, the Advisor is in a very favorable position and the client likely leave all or a portion of that ‘new money’ to manage. Andrew: Not to mention the goodwill from informing them of this option they didn't know they had as well as saving them from having to pay thousands of dollars in premiums for a policy they didn’t even want anymore. Doug: I couldn't agree more. In fact, I think goodwill in a highly competitive advisory business is what separates you from someone else who does the same type of work as you are. No one wants to compete on price so you have to do things differently since most clients find it difficult to distinguish any difference between one CPA or FA and another. The clients are busy in their own life and business and, in general, many advisors really aren't that unique in the products they offer. It’s the service they offer that differentiates them from their peers and I’ve seen time and time again, advisors getting substantially more referrals after they introduce a novel or unique concept like Life Settlements or help a client sell their life insurance policies. It’s that proverbial ‘lightbulb moment’ where all of the sudden, the client sees that advisor very differently… Andrew: We touched on this earlier, but tell me why people may want to sell their life insurance policies? Doug: There really are many reasons why someone would choose to sell their life insurance policies. I’ve seen a myriad of different situations, including clients selling their businesses, divorce, the death of a beneficiary, and also the reasons that I mentioned a few minutes ago. The buyers in the market aren’t particularly interested who is selling the policy; an individual, a Trustee of an Irrevocable Life Insurance Trust(ILIT), a former Partner ridding themselves of the policy that funded a Buy-Sell agreement or a key person policy on the CEO of a business. They only care that the policy was procured and funded in a legal and compliant manner. As the baby boomer generation and the general population continue to live longer, we've seen many clients in their early to mid-eighties selling policies because their kids are 50 or 60+ years old and don't need their parents money and they’d rather have the parents keep the money to enjoy, pay for long term care, or whatever they may need the money for. It’s an alternative to a reverse mortgage or selling other assets that may have appreciated. Adam: To Doug’s point, the elderly population continues to grow rapidly (see chart below). Further, people are living longer and longer, outliving their retirement savings and investments. Often, these people have life insurance that at such an old age, with grown children, there is no longer a need for the benefits at death. The ability to sell a life insurance policy and use it to either purchase an income producing investment, or subsidize their annual living expenses could potentially provide a lot of utility.  Andrew: Doug, earlier you mentioned that someone can sell their policy for greater than the cash value but less than the death benefit. Can you give me some examples? Doug: I'll give you two quick ones. The first one is really unique because there was a $15 million term policy on the owner of a company that was in trouble. The lender, who had been assigned the policy as part of their loan agreement had decided to cancel the policy because they didn’t want to continue making the premium payments – and since it was a term policy, it obviously had no cash value. However, after we looked closer at the policy, we recognized that the policy was still convertible – meaning that with minimal paperwork it could be converted into a Universal Life policy. At the end of the day, we ended up selling that policy for over $3 million dollars and the advisor who introduced us to the client looked like a hero by generating several million out of something the Lender was on the verge of canceling for nothing. Another example is a current case where the owner of a $4MM dollar policy that they don’t need any more but have been paying into for 10 years. In that case, the policy has approximately $150k in cash value and we have multiple offers on the table in excess of $750,000. Andrew: So let's take a closer look at that second example. Approximately how much premium was he paying on a yearly basis for those ten years? Doug: In regards to this specific policy, the client has been spending somewhere in the neighborhood of a hundred thirty thousand per year in premiums. Selling their policy for somewhere around $750,000 and reducing their yearly outflow by 130-140k…that's a very meaningful transaction regardless of how wealthy the client may be. So, in addition to bringing in a lot more cash than they were expecting, another huge benefit is that they no longer have the burden of making those ongoing premium payments. Andrew: This definitely makes so much sense for policy sellers. Why are hedge funds and institutional investors buying policies? Adam: In this market, investors are chasing yield… You hear that term all the time and here, these institutional investors are looking for that yield bump in an alternative asset class that is uncorrelated to stocks, bonds and currencies. It’s certainly not without risk, but the risk is not correlated to other markets. Doug: Agreed - This makes sense since an asset manager is essentially purchasing a double or triple A rated receivable from a huge insurance company like New York Life or John Hancock at an above market yield of approximately 14%. For pension funds, or those with any long dated risk, this is a way to hedge their longevity risk going out 10, 15 and 20 years. Andrew: What type of annual returns can investors expect when buying life settlements? Adam: Currently we see the market generally trading in the mid-teen IRR range (gross). The Net Death Benefit of the policy is a large driver of the type of IRR that a life settlement can be acquired for. For example, smaller life settlements (1.5m NDB or less) are trading a much lower IRR levels while larger policies are trading at higher IRR levels. This is mainly because there is an influx of smaller funds who realize that diversification is extremely important and are willing to pay-up for smaller face polices instead of getting a more limited number of large face policies at a higher IRR. Andrew: What are the main items investors should analyze when considering buying a life insurance policy in the secondary market? Adam: Longevity risk is a key issue when investing in life settlements that is not generally associated with other asset classes. Knowing how to analyze this risk on a per-policy and portfolio basis is key for an investor in building a portfolio. Using tools such as independent life expectancy reports, internal medical underwriting, and market specific software allows investors to evaluate this risk appropriately, in an effort to mitigate both extension risk and certain tail-risk factors that can be detrimental to a portfolio. Additionally, diversification is important to mitigate against other potential risks. Investors should look at diversifying many aspects of their portfolio, including carrier, insured age, primary impairment, and state. Andrew: What are the most prevalent structures through which investors can access life settlements? Doug: Over the years, we have heard of many different structures being used to buy policies including on and offshore vehicles, special purpose vehicles, and even funds. Often, because of taxation implications, these vehicles are held in places like Ireland or Luxembourg. Andrew: From everything I am hearing, it seems to me that a life settlement transaction is beneficial to all parties involved. The policy holder benefits by generating substantial capital and avoiding future costly premium payments, the investor benefits by earning high yields from an uncorrelated asset class, and the advisor benefits from the management of more capital and helping their clients. So what’s the catch? Is selling a policy an extremely difficult process? Doug: I wouldn't characterize it as a difficult process – but it is a process like selling any other major asset like a house or a business. It takes some time. There are key steps in the process including getting an application signed by the insured and policy owner, ordering medical records and life expectancy reports, obtaining policy illustrations from the carrier, and putting together a full package to send out for bids. Melville then creates an auction amongst investors and act as a fiduciary of the seller in the marketplace. When everything is said and done, our goal is to drive up the price and make the seller and their advisor happy. Andrew: Let’s say I'm a senior citizen. There are a lot of fears that could come up when looking at something like this. What are the risks involved that I should consider when selling my policy? Adam: Like with any other financial decision or product, you should consider who is on the other side of the transaction, who is representing you and make sure that you're comfortable with all of them. I think that goes whether it’s a real estate transaction, an insurance transaction, or a financial advisory type of relationship. The life settlement industry is regulated on the state level by each state’s department of insurance. The regulations have increased over the past years, mainly focused on consumer protection and rights. Additionally, transparency has become more prevalent, with complete disclosures and the use of 3rd party escrow to handle the funds and assets during the closing process. Andrew: So you’re saying that, like a real estate deal there is some sort of escrow process that protects everyone during the ownership and beneficiary transfer process? Doug: That’s exactly right. Companies like Wells Fargo and Wilmington Trust are two of the bigger escrow agents. They monitor each and every transaction that they are involved with to make sure that the buyer and the seller do what they are supposed to and also make sure everything is being done in a compliant manner. Andrew: You've touched on the fact that you help investment advisors and their clients. So what does a life settlement broker do? Doug: I joke with a lot of people, telling them that I'm actually in the educational business not the life settlement business because much of what we do is teaching people about the market. Similar to many businesses, it's fairly easy to understand the life settlement business at a high level, but it's much more difficult once you get in the trenches and have to figure out all the specific nuances to it. We represent and advise the client, making sure that we are all compliant and that their policy is being marketed as widely and aggressively as possible. Advisors need an expert who is focused on, and really knows the life settlement market, and who can represent their clients properly. We’ve been focused on life settlements for almost 12 years and understand what to look for and how to navigate those waters - which ultimately make advisors look good. When everything is said and done, we are adding additional dollars to their side of the ledger by helping them monetize an asset that they may have totally overlooked or didn’t even consider as an asset while they were still alive and kicking. Andrew: Doug & Adam, I truly appreciate your time! Thank you so much for educating myself, and our readers on this very intriguing market that seems to offer sellers and investors of life settlements a great opportunity. In conclusion, the life settlement industry is well-established, with some of the largest financial firms in the world involved in buying, selling, and servicing the trading and selling of life insurance policies in the secondary market. If you are an investment advisor, helping your clients monetize an asset they didn’t even know they had could lead to additional AUM, increased goodwill, new client referrals, and the ability to better serve your client’s needs. If you are a policy holder, you can avoid continuing to pay expensive premiums for a policy you may no longer need and generate a large cash sum to help you buy that vacation home, pay for long term care, fund your grandchild’s education fund, etc. If you are an investor, you can purchase policies that generate high returns that are uncorrelated to stocks, bonds, and other traditional forms of investment. And if you are any of the three - advisor, policy holder, or investor - speaking to an expert in the life settlement industry is the best way to start learning more about the business. The views and opinions expressed herein are those of the individuals and do not represent those of Vida Capital or its affiliates. The opinions expressed herein are for informational purposes only and should not be construed as a solicitation, recommendation, or offer to buy or sell any securities. Investing in life settlements involves risks other than those described herein, and you should consult a financial professional prior to making an investment decision. Doug Himmel, a licensed Life Settlement Broker, is a Co-Founder and Managing Director of Melville Capital. After earning his B.A. from the University of Arizona, he has been involved in financial services, lending and life insurance for more than 20 years. He lives in Venice Beach, CA with his two Rhodesian Ridgebacks and his wife. Adam Meltzer is a Senior Portfolio Manager at Vida Capital, a Vice President at Magna Life Settlements and previously managed acquisition and portfolio management process for D3G Asset Management. Andrew N. Smith, CAIA is a Co-Founder and Chief Product Strategist for OWLshares and serves as the chairperson of the Steering Committee for the Los Angeles Chapter of the CAIA Association.

Andrew: Doug, earlier you mentioned that someone can sell their policy for greater than the cash value but less than the death benefit. Can you give me some examples? Doug: I'll give you two quick ones. The first one is really unique because there was a $15 million term policy on the owner of a company that was in trouble. The lender, who had been assigned the policy as part of their loan agreement had decided to cancel the policy because they didn’t want to continue making the premium payments – and since it was a term policy, it obviously had no cash value. However, after we looked closer at the policy, we recognized that the policy was still convertible – meaning that with minimal paperwork it could be converted into a Universal Life policy. At the end of the day, we ended up selling that policy for over $3 million dollars and the advisor who introduced us to the client looked like a hero by generating several million out of something the Lender was on the verge of canceling for nothing. Another example is a current case where the owner of a $4MM dollar policy that they don’t need any more but have been paying into for 10 years. In that case, the policy has approximately $150k in cash value and we have multiple offers on the table in excess of $750,000. Andrew: So let's take a closer look at that second example. Approximately how much premium was he paying on a yearly basis for those ten years? Doug: In regards to this specific policy, the client has been spending somewhere in the neighborhood of a hundred thirty thousand per year in premiums. Selling their policy for somewhere around $750,000 and reducing their yearly outflow by 130-140k…that's a very meaningful transaction regardless of how wealthy the client may be. So, in addition to bringing in a lot more cash than they were expecting, another huge benefit is that they no longer have the burden of making those ongoing premium payments. Andrew: This definitely makes so much sense for policy sellers. Why are hedge funds and institutional investors buying policies? Adam: In this market, investors are chasing yield… You hear that term all the time and here, these institutional investors are looking for that yield bump in an alternative asset class that is uncorrelated to stocks, bonds and currencies. It’s certainly not without risk, but the risk is not correlated to other markets. Doug: Agreed - This makes sense since an asset manager is essentially purchasing a double or triple A rated receivable from a huge insurance company like New York Life or John Hancock at an above market yield of approximately 14%. For pension funds, or those with any long dated risk, this is a way to hedge their longevity risk going out 10, 15 and 20 years. Andrew: What type of annual returns can investors expect when buying life settlements? Adam: Currently we see the market generally trading in the mid-teen IRR range (gross). The Net Death Benefit of the policy is a large driver of the type of IRR that a life settlement can be acquired for. For example, smaller life settlements (1.5m NDB or less) are trading a much lower IRR levels while larger policies are trading at higher IRR levels. This is mainly because there is an influx of smaller funds who realize that diversification is extremely important and are willing to pay-up for smaller face polices instead of getting a more limited number of large face policies at a higher IRR. Andrew: What are the main items investors should analyze when considering buying a life insurance policy in the secondary market? Adam: Longevity risk is a key issue when investing in life settlements that is not generally associated with other asset classes. Knowing how to analyze this risk on a per-policy and portfolio basis is key for an investor in building a portfolio. Using tools such as independent life expectancy reports, internal medical underwriting, and market specific software allows investors to evaluate this risk appropriately, in an effort to mitigate both extension risk and certain tail-risk factors that can be detrimental to a portfolio. Additionally, diversification is important to mitigate against other potential risks. Investors should look at diversifying many aspects of their portfolio, including carrier, insured age, primary impairment, and state. Andrew: What are the most prevalent structures through which investors can access life settlements? Doug: Over the years, we have heard of many different structures being used to buy policies including on and offshore vehicles, special purpose vehicles, and even funds. Often, because of taxation implications, these vehicles are held in places like Ireland or Luxembourg. Andrew: From everything I am hearing, it seems to me that a life settlement transaction is beneficial to all parties involved. The policy holder benefits by generating substantial capital and avoiding future costly premium payments, the investor benefits by earning high yields from an uncorrelated asset class, and the advisor benefits from the management of more capital and helping their clients. So what’s the catch? Is selling a policy an extremely difficult process? Doug: I wouldn't characterize it as a difficult process – but it is a process like selling any other major asset like a house or a business. It takes some time. There are key steps in the process including getting an application signed by the insured and policy owner, ordering medical records and life expectancy reports, obtaining policy illustrations from the carrier, and putting together a full package to send out for bids. Melville then creates an auction amongst investors and act as a fiduciary of the seller in the marketplace. When everything is said and done, our goal is to drive up the price and make the seller and their advisor happy. Andrew: Let’s say I'm a senior citizen. There are a lot of fears that could come up when looking at something like this. What are the risks involved that I should consider when selling my policy? Adam: Like with any other financial decision or product, you should consider who is on the other side of the transaction, who is representing you and make sure that you're comfortable with all of them. I think that goes whether it’s a real estate transaction, an insurance transaction, or a financial advisory type of relationship. The life settlement industry is regulated on the state level by each state’s department of insurance. The regulations have increased over the past years, mainly focused on consumer protection and rights. Additionally, transparency has become more prevalent, with complete disclosures and the use of 3rd party escrow to handle the funds and assets during the closing process. Andrew: So you’re saying that, like a real estate deal there is some sort of escrow process that protects everyone during the ownership and beneficiary transfer process? Doug: That’s exactly right. Companies like Wells Fargo and Wilmington Trust are two of the bigger escrow agents. They monitor each and every transaction that they are involved with to make sure that the buyer and the seller do what they are supposed to and also make sure everything is being done in a compliant manner. Andrew: You've touched on the fact that you help investment advisors and their clients. So what does a life settlement broker do? Doug: I joke with a lot of people, telling them that I'm actually in the educational business not the life settlement business because much of what we do is teaching people about the market. Similar to many businesses, it's fairly easy to understand the life settlement business at a high level, but it's much more difficult once you get in the trenches and have to figure out all the specific nuances to it. We represent and advise the client, making sure that we are all compliant and that their policy is being marketed as widely and aggressively as possible. Advisors need an expert who is focused on, and really knows the life settlement market, and who can represent their clients properly. We’ve been focused on life settlements for almost 12 years and understand what to look for and how to navigate those waters - which ultimately make advisors look good. When everything is said and done, we are adding additional dollars to their side of the ledger by helping them monetize an asset that they may have totally overlooked or didn’t even consider as an asset while they were still alive and kicking. Andrew: Doug & Adam, I truly appreciate your time! Thank you so much for educating myself, and our readers on this very intriguing market that seems to offer sellers and investors of life settlements a great opportunity. In conclusion, the life settlement industry is well-established, with some of the largest financial firms in the world involved in buying, selling, and servicing the trading and selling of life insurance policies in the secondary market. If you are an investment advisor, helping your clients monetize an asset they didn’t even know they had could lead to additional AUM, increased goodwill, new client referrals, and the ability to better serve your client’s needs. If you are a policy holder, you can avoid continuing to pay expensive premiums for a policy you may no longer need and generate a large cash sum to help you buy that vacation home, pay for long term care, fund your grandchild’s education fund, etc. If you are an investor, you can purchase policies that generate high returns that are uncorrelated to stocks, bonds, and other traditional forms of investment. And if you are any of the three - advisor, policy holder, or investor - speaking to an expert in the life settlement industry is the best way to start learning more about the business. The views and opinions expressed herein are those of the individuals and do not represent those of Vida Capital or its affiliates. The opinions expressed herein are for informational purposes only and should not be construed as a solicitation, recommendation, or offer to buy or sell any securities. Investing in life settlements involves risks other than those described herein, and you should consult a financial professional prior to making an investment decision. Doug Himmel, a licensed Life Settlement Broker, is a Co-Founder and Managing Director of Melville Capital. After earning his B.A. from the University of Arizona, he has been involved in financial services, lending and life insurance for more than 20 years. He lives in Venice Beach, CA with his two Rhodesian Ridgebacks and his wife. Adam Meltzer is a Senior Portfolio Manager at Vida Capital, a Vice President at Magna Life Settlements and previously managed acquisition and portfolio management process for D3G Asset Management. Andrew N. Smith, CAIA is a Co-Founder and Chief Product Strategist for OWLshares and serves as the chairperson of the Steering Committee for the Los Angeles Chapter of the CAIA Association.

- Programs

- Events and Webcasts

- Resources

- About

- Official Merchandise

Search

Search Close

Close