Savills, a global real estate services provider listed on the London Stock Exchange, has released its annual report on the role that real property plays in the investment world. Here are some of its key points:

- Real estate assets constitute 60% of the value of all assets worldwide;

- Residential real estate constitutes 75% of the value of the world’s real estate – the remainder is about evenly split between commercial and agricultural uses;

- Of the world’s high-quality commercial real estate, 45% is in North America;

- Cross-border activity in real estate has grown since the global financial crisis of 2008 – in this connection the author of the report, Yolande Barnes, says, “Money is becoming not only footloose but also more adventurous”;

- The last three years have seen a steady growth in the volume of trade in real estate.

To expand on that last point a bit, the report says that volume has grown by 62% in North America during this period and by 65% in EMEA; the rate of growth in Asia Pacific has been somewhat more subdued, at 18%.

Population versus Value

The value of all developed real estate in the world, by Savills’ count, in U.S. dollars, is $217 trillion. This is 2.7 times the world’s gross domestic product.

Perhaps counter to Malthusian intuitions, there is no very close relationship between the percentage of the globe’s total human population to be found in a given region and the percentage of total residential real estate value there. Asia and the Pacific have 37% of the former but only 20% of the latter. There is another such disparity from the other side in North America, which represents only 5% of the globe’s population, but lives in 21% of its residential rea estate by value (and shops/works etc. within 45% of the world’s commercial real estate by value as noted above.)

In Europe, too, there is a big gap between the population numbers and the value numbers. It represents 11% of the world’s population, 24% of residential value, 28% of commercial value.

Let us assume (as seems reasonable) that this will change, that the less-developed parts of the world will develop, and this development will follow a path that reduces some of that disparity. What, more specifically, can we say about that path?

Barnes writes that China and other parts of Asia have shown that it is possible to proceed by demolishing existing structures, making way for large-scale developments that look a lot like those of North America and Europe. This can involve what she calls “landmark, world-class ‘trophy’ projects often involving named ‘starchitects’” which are “beloved by politicians and planners alike” and which get priority over smaller scale neighborhood developments that might integrate existing structures.

As the language might subtly suggest, though, Barnes isn’t enamored of the demolition-heavy, trophy project path as the way forward. It involves a lot of big-box, energy-hungry office buildings and shopping malls: these, she says with some understatement, will not be “universally preferred” as the 21st century proceeds.

Monetary Conditions

Indeed, loose monetary conditions made that path sustainable over the last few years and those are about to change: tighter monetary conditions are near at hand. In the post-2008 world, where central banks have worked to ensure low interest rates, Barnes observes that “equity has been searching for a home and asset price inflation has been inevitable.”

Even as the Savills report appeared, though, the U.S. Federal Reserve spooked markets by surprisingly hawkish language about interest rates, and in general the world seems headed toward a more normal interest-rate environment. Nobody will be throwing money at projects out of any absence of any clue as to what else to do with it.

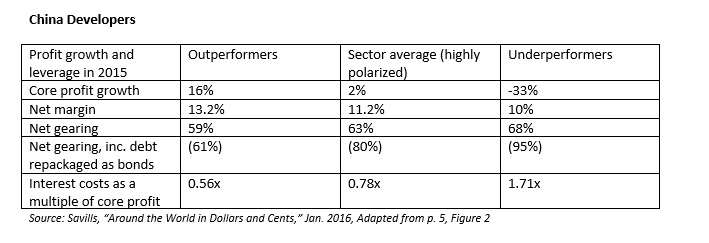

Or, in Barnes’ more decorous language, highly leveraged investors will find it “increasingly difficult to compete unless there is a clear value-add component to their purchase.”