By Nick Niziolek, CFA

In a recent post titled The Convertible Bond Trifecta, my colleague Scott Henderson outlined several market factors that appear supportive of convertible bonds after the volatility that started 2016. This post addresses a different role for convertibles: their use as a risk management tool within portfolios of more traditional asset classes. Convertibles offer the potential for downside protection while preserving upside potential—including in emerging markets funds, where many investors are often the most skittish.

For background, we launched our Evolving World Growth Fund in 2008 and this was Calamos’ first dedicated emerging markets product. We had invested in emerging markets for decades in our global/ international products, but we hadn’t yet launched a dedicated emerging market product. And one of the reasons is that emerging markets are often used as more of a tactical allocation by clients. We didn’t want to have a product where we were concerned that at the times we‘d want to be reallocating capital in emerging markets, we’d have clients pulling money and having to deal with the tactical in-and-out nature of many EM investors.

So, we sought to create a solution to that problem for investors who couldn’t handle the volatility in emerging markets, but knew it was a place they needed to be because there is a lot of growth in emerging markets and there’s a lot of opportunity, too—specifically, within the emerging market consumer. Given the expertise that we have in convertibles and the fundamental research we do that is always focused on understanding economic exposures and where assets and revenues are located, we sought to create a product where the core of the product is emerging markets equities, but we have the flexibility to add a couple of different elements to the portfolio that we believe provide a better outcome and better exposure to emerging markets.

One flexibility involves the ability to invest in developed market positions that have significant exposure to emerging markets. This isn’t a significant portion of the portfolio. It’s about 20%, 25% right now. And the other being the use of convertibles in our product.

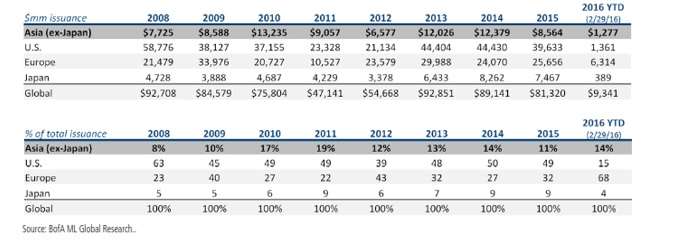

When we launched this product back in 2008, emerging market issuance in the convertible universe was still relatively low but it was increasing. We saw signs that we thought it would increase further (see Figure).

Ultimately as these emerging markets developed, the financial systems developed and these companies needed access to capital. Being able to do so in a convertible structure which requires less cash yield— typically you can get a lower interest rate when you issue your convertible—is a favorable outcome for a lot of these companies that need growth capital.

We allow ourselves to own roughly 20% of the portfolio in convertibles. We’ve found a lot more attractive emerging markets convertibles in recent years as more consumer and technology companies are coming to the market and giving us opportunities. How does this help the portfolio? A convertible has a bond floor. Ultimately in these very volatile times when you have these large drawdowns, equity trades down. That bond floor limits the downside of our participation so it helps our portfolio hold up better on the downside, but then ultimately when we do get these volatile breakouts, we have the ability to participate through that call option.

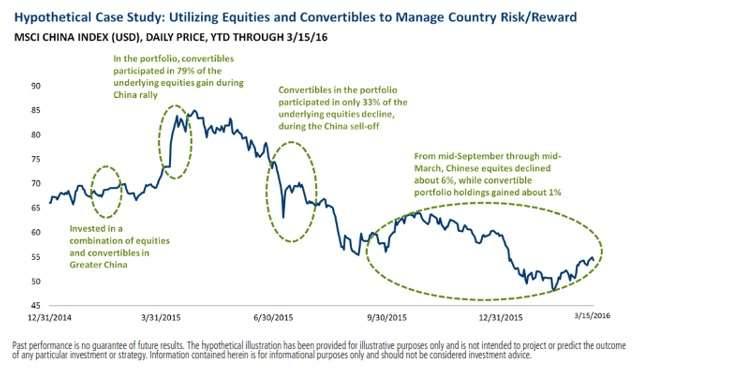

An example of that is what happened in China last year. The chart below is an illustration of how we had that significant breakout in China equities.

During that time period, our convertibles in China were able to participate in almost 80% of that upside move. We captured a lot of that upside move for our clients. But through adjusting our risk reward and rotating into different convertibles, in the subsequent correction we participated in only 33% of that downside. We were able to hold up much better for our clients and protect their capital. And then in the ensuing, period we’ve actually had a positive return in some of our China equities relative to the decline seen in the overall market during that time period.

Convertibles are just another tool that we have to help gain access to the emerging market opportunity, but to do so in a way where we can minimize that downside participation and manage that volatility for our clients and provide a better longer-term outcome.

--

The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Information contained herein is for informational purposes only and should not be considered investment advice.

The information in this report should not be considered a recommendation to purchase or sell any particular security.

Convertible securities entail default risk and interest rate risk. Investments in high-yield securities include interest rate risk and credit risk.

Nick Niziolek is Co-CIO, Head of International and Global Strategies, and Senior Co-Portfolio Manager at Calamos Investments.