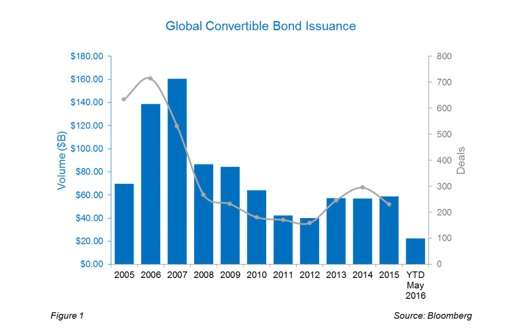

A moderate increase in the issuance of convertible bonds globally over the last three years came about only after a long post-crisis decline. At the convert market’s peak, in 2007, issuers placed $160 billion of these instruments. The placement for 2008 was only half that. By 2012 the market was down to only one-quarter its size at peak, as indicated in the graph below.

The bars in this graph measure activity by dollar volume. The grey line, though, measures volume by the number of issuances. They both tell by-and-large the same story.

Source: M. Baradas, “Convertibles are Back in Style,” Bloomberg Tradebook.

The size of this market recovered some of the lost ground in 2013, and then held that ground in each of the following two years. Over the three year period beginning in 2013, issuances averaged 250 a year: volumes $57 billion a year.

Not surprisingly, the taxing authority looks to rewrite regulations to benefit from this growth. More of that anon.

Why the Growth?

One key fact through the period 2013-15 may explain the growth: The Federal Reserve seemed throughout that period to be always on the verge of a substantial tightening of credit in the U.S. The issuance of converts may have become attractive as a way of getting the benefit of low rates while they lasted.

The financial sector has consistently led other sectors in issuance, though there has been a great deal of variance. Back in 2007, financials accounted for 40% of the market. In 2014 and 2015, the corresponding number was less than half of that.

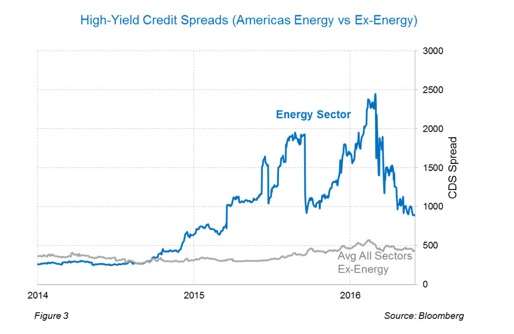

Meanwhile, the energy industry accounts for a growing share of the converts market. Energy is an industry where high-yield credit spreads have been both high and volatile since 2015. See the chart below, where the blue line passed the grey in late 2014, and where the divergence between the two became very marked in mid 2015 and then again early in 2016.

Source, M. Baradas, “Convertibles are Back in Style,” Bloomberg Tradebook.

These spreads rose as the price of crude oil declined in the period 2014-15. The fact and the unexpected size of that decline obviously increased the risks of investment in any firm that sold crude oil, or sought out new reserves of it, or sold oilfield equipment, etc. and it had other sometimes less obvious ramifications throughout the energy industry. Arguably, these developments drove the energy industries into the “hybrid zone” where the convertible call option strategy is most attractive to investors.

Faraday and a Probably-Apocryphal Story

There is a story about Michael Faraday, the great scientist who discovered electro-magnetic induction. The story goes that one day the prime minister visited Faraday’s lab, looked on as an early generator was demonstrated, and said, “Of what use is all this?”

Faraday replied, “Well, sir, some day you can tax it.”

The story is apocryphal, but it makes a valid point.

Convertibles may prove useful to politicians in roughly the same way as electric generators. They are taxable, and the ways in which they can get taxed can involve some ingenuity.

For example: one of the side effects of the existence of these instruments is that issuers make adjustments over the life of a bond that compensate bond holders for actions that dilute the value of the underlying shares. The idea is that a change in dividend policy for example may hurt the value of the underlying stock, in turn harming the value of the call option, and it is fair to compensate the holders for that. The legal query is: does somebody get taxable income there?

In April 2016 the US Treasury Department issued a proposed rule to enforce its view that these adjustments are taxable income, both enforceable going forward and enforceable retroactively over the last two years. The 90 day comment period on this proposal ended on Tuesday, July 12.

The proposal would result in what the Treasury Department itself calls “counterintuitive” consequences. Many taxpayers will surely use harsher and shorter words. Obviously, if a conversion adjustment is based on the restoration of a conversion’s value, the holders will see it as a move to make them whole, to protect them from an injury, which is historically quite different from “income.” Indeed, if another driver dents my car and the other driver’s insurer sends me a check I use to make my car as good as new again: is that income? Of course not: that’s indemnification.

Where exactly does the analogy fail?