Hedge funds have now seen three consecutive months in which redemptions have exceeded new investment, for a net outflow.

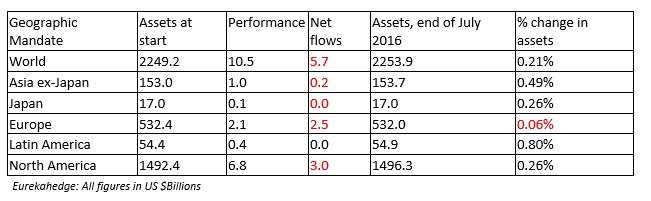

The net outflow for July alone was $5.7 billion. Fortunately, July also saw performance based gains of $10.5 billion, so the total assets under management grew slightly.

The table below adapted from Table 1 of the July Eurekahedge report, breaks down the asset flow and performance figures by the geographic mandate of the funds involved.

Geographic Mandates

Two points are worth noting on the face of this table: only in Europe was the overall percentage change in assets down; only in Latin America was the net flow not down.

On a year-to-date view, European mandated hedge funds have sustained performance-based losses of $6.1 billion, and have a net inflow of less than half of that.

Also looking at YTD, Latin America has a performance gain of $1 billion, with a net outflow of $0.4 billion.

News from Central Banks

There were some perturbing developments in July, as the report observes. For example, the European Central Bank met only to leave current measures unchanged. The market took this to mean that there will be further stimulus measures in the months to come.

Similarly, the Bank of Japan continued its policy of expansion, and the government there continued its policy of stimulus in July. Japanese stock markets ended the month in positive territory.

In the United States, though the Federal Reserve left rates unchanged at its latest gathering, Eurekahedge understands the market sentiment as expectant of a rate hike soon, given “incoming macro data.”

Referencing the news from all of these central banks together, Eurekahedge says that confidence “in the power of fiat currency” could be failing, and that in turn may cause “a drive toward real assets.”

Looking at Strategies and Sizes

Let’s look now at the strategies rather than regions of hedge fund mandates. In terms of percentage change in assets over the month, including both performance and investment flow, relative value hedge funds ‘won’ the month of July, increasing their assets by 0.98%. Arbitrage funds placed second, with a gain of 0.67%.

Long/short equity funds saw the deepest decline in net flows. This is the third consecutive month of outflow for long/short. Over those months, redemptions for L/S have equaled $18.4 billion.

Looking at the performance number alone, every strategy was in the positive numbers for July. L/S equity was the clear winner here, gaining $6.1 billion. It is followed by CTA/managed futures and multi-strategy funds, which earned gains of $1.5 billion and $0.9 billion respectively.

There is no clear pattern in July relating results to the size of the funds. But the largest category, the funds with more than $1 billion in assets under management each, gained $6.6 billion via performance, and lost a little more than that, $7 billion, in net outflows.

The smallest group, funds with less than $20 million each, were flat on performance for the month, and just a little better than flat on investment flow, with a net of $0.1 billion coming in.

Commodities

In a commentary on commodities, Eurekahedge observes that there continues to be anemia in the demand for the energy commodities. Unless OPEC can reach an agreement on the reduction of inventories, this slacking of demand will keep the prices trending down. That could cause the prices of agricultural commodities to head downward too, since they are very energy-sensitive.

The outlook for metals prices also looks bearish, especially given the slowdown in China’s

property market.

Considering commodity hedge funds in 2016 year to date, Eurekahedge is impressed with how well they have played these currents. They are up 9.19% There are lots of commodity-oriented hedge funds that offer daily liquidity, and they could be an attractive investment option “for investors seeking liquidity as well as uncorrelated returns to the overall market.”