Ten years ago, thus before the global financial crisis, the Uniform Law Commission promulgated the Uniform Prudent Management of Institutional Funds Act (UPMIFA), a successor to an earlier uniform act, the UMIFA.

One of the big changes from UMIFA to UPMIFA was the elimination of the concept of “historic dollar value” that had played a big part in the former. The older act had refused to allow covered endowments to do any spending once their funds were “underwater,” that is, once they were valued at a figure less than that historic value. Thus, nonprofit firms that relied upon the money from such endowments were ordered to use other sources of funding to keep operations going during such a down time.

In 2008, states began to adopt the newer more flexible model act. By 2012 it was the law in 49 states as well as the District of Columbia.

Alpha pursuers will want to be aware of this situation to the extent that they market their own products to endowed institutions.

Two Recent Publications

Two quite recent publications discuss the consequences of the change from the older less flexible model to the new. Brian D. Galle, of Georgetown University Law Center, has posted a paper on the determinants of compliance. He finds that the “lifting of firm spending restrictions indeed [increased] firm spending,” as one would expect.

Separately, Cambridge Associates has issued a new paper on the subject, “Keeping Underwater Endowments Afloat (and the Programs They Support).”

One intriguing observation inference Galle draws is that nonprofit firms generally follow the law even when there is no significant enforcement activity. They follow laws, that is, even without a gun to their head. How do we know this? Because there was no significant enforcement activity for the UMIFA rules in place before the advent of UPMIFA. If firms had been taking advantage of that fact, if they hadn’t been in compliance with UMIFA based state laws, then as he says “there would have been little reason for the loosening of legal restrictions to change their behavior.”

Cambridge Associates’ Survey

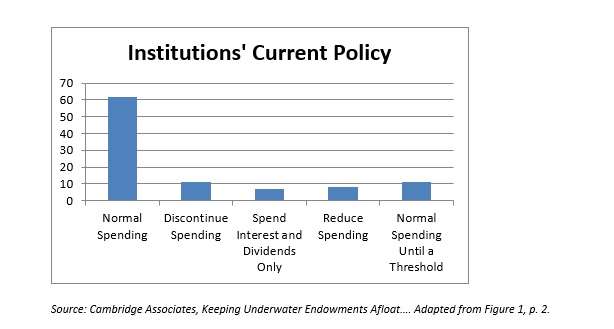

That isn’t CA’s concern, though. In January 2016, a CA survey asked nonprofit institution respondents, “What is your current policy/practice for spending from ‘underwater’ endowments?” The effect represents between 4% and 4.8% of spending.

Forty-four out of the 71 respondents said that they spend using the normal rate and rule even when underwater. Only 11% followed the old UMIFA rule. See the graph below.

Source: Cambridge Associates, Keeping Underwater Endowments Afloat…. Adapted from Figure 1, p. 2.

For those who continue spending normally until a threshold … what is the threshold? How far underwater do they let themselves go until they do something else? The most common answer is: 80% of original gift value.

No Right Answer

CA says there is no single right answer to the question how institutions ought to use the discretion that UPMIFA has given them in such matters. One point to keep in mind: going underwater is by no means an unusual development. “Our models,” the report says, “suggest that the probability of a market value decline of more than 20% (after spending) at any point over a ten-year period is 38%,” or close to two fifths.

In a lengthy footnote, the authors expand on that number. Their modeling is based on a portfolio that consists of 22% of US equities, 16% international equity, 7% emerging markets equity, 11% bonds, 20% hedge funds, 8% PC and VC, 9% real assets and inflation-linked bonds. That leaves 7% to fit into the residual category of “other,” including cash.

One way that a nonprofit can choose to lessen the risk of going underwater is to extend the period between an endowment and the start of spending, using that period to build the numbers up above the waterline. Another approach is to change spending policies once underwater. Of course those two possibilities are not mutually exclusive.

Open Questions

One must understand that endowment distribution may represent only a modest portion of the operating revenues of a particular nonprofit.

Still, that distribution may support important commitments. This is presumably one of the considerations behind the change from the old model law to the new.

A non-profit concern reviewing its policy should, CA suggests, ask itself these questions:

- How well can its enterprises absorb a disruption in spending policy?

- How reliant is its mission on distribution from endowments that are, or that are approaching, the water line?

- Would the institution be willing or able to suspend programs that an underwater endowment supports?

- What percentage of the overall endowment is underwater?

- What are the other significant sources of funding, which might fill the spending gaps?