Alexandre Coupe, associate director, Pacific Alternative Asset Management Company, head of PAAMCO’s asset allocation research, and formerly of Green Street Advisors, has written a fascinating review of private equity funds. She looks at what proxies work (and which don’t work) in assisting portfolio managers who have to make asset allocation decisions, and in understanding the related risk drivers.

Coupe’s paper appears in the Alternative Investment Analyst Review, (3Q 2016). She focuses specifically on buyout funds. As she writes, their M.O. is the creation of value in the following three ways:

- Improving operations, through cost cutting, better management, or synergies, with the expectation that this will increase the asset value of the acquisition, lessening the leverage;

- Restructuring finance, through in particular the sale of assets, the paying down of debts, and distributions to limited partners;

- Profiting off long time horizon, acquiring companies expensively in times of market dislocation, then selling as the cycle turns and multiples improve.

A particular transaction can of course combine these sources of value in various ways.

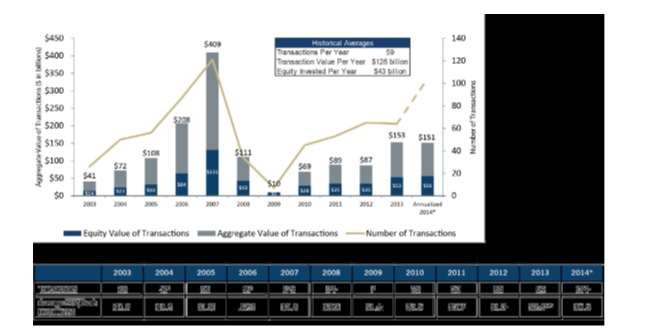

Source, Alexandre Coupe, “Assessing Risk of Private Equity: What’s the Proxy?” Alternative Investment Analyst Review, p. 40, Exh. 1, “Illustration of Private Equity Funding Timeline.”

The median buyout fund, Coupe tells us, is holding a dozen investments. Thus, it should benefit from diversification, with an “expected volatility … somewhere between that of an individual equity and a diversified index.”

Reliability of Data

Her paper treats, too, of the issue of the reliability of PE world data. One big difference between private and public equity, after all, is that the former is “liberated from the obligation to mark-to-market.”

Until recently, PE managers could hold their investments at cost, creating “a very smooth return series that far understated the risk.” Those halcyon days are gone given the implementation of ASC 820 in 2007, which requires fair value reporting.

Still, ASC hasn’t eliminated the public/private equity distinction. PE valuations are model based and so still tend to exhibit a very smooth pattern. “Since the model remains static [from quarter to quarter] except with timing moving forward one period, a high degree of autocorrelation that continues to understate volatility is created.”

The PE space is also importantly different from the hedge fund space in terms of valuation and volatility. For hedge fund managers an accurate metric of the monthly net asset value matters a good deal, because investors might want to invest or redeem at that value. In private equity, with its fixed life-cycle and locked-in investments, there is much less reason to scrutinize, and thus predictable much less actual scrutiny, of the NAV.

What does this have to do with the issue of finding a good proxy?

The connection of ideas here is direct. For the reasons just surveyed (and of course surveyed much more completely in the actual paper we’re summarizing) PE has a beta and volatility profile higher than what one might think were one to rely on the smoothed-out quarterly returns provided by the big benchmarkers in the field.

Can’t one simply take the official benchmark – say, from Cambridge Associates – and de-smooth the returns though statistical magic? Yes, one can. Among the approaches available in the literature on the subject, Coupe prefers a proposal by Philippe Jorion, a managing director and head of risk management at PAAMCO. Jorion’s approach uses the autocorrelation coefficient to construct adjusted return. This doesn’t give one a proxy, that is, it isn’t “helpful in conducting the forward-looking analysis needed” for asset allocation. But it is “helpful ex-post,” in that it gives one a standard against which possible proxies can be measured.

The bottom line of this paper is that industry and size ETF proxies work best to prove “a basic intuition for how private equities perform.” Look to the industries to which PE firms have allocated most of their investors’ money and use the S&P 400 Midcap Index sectors, and one gets a proxy that is “a good fit in approximating e risk profile of private equity positions.”

The industry index “obviously understates the risk at the level of the individual position,” she adds, “but we [at PAAMCO] believe this effect washes out at the portfolio level.”