Two Maryland-based scholars have reviewed the evidence of the performance of gold mining stocks. The title of their article, which appears in the Alternative Investment Analyst Review, November 2016, puts the central question bluntly: are such stocks “more like gold or like stocks”?

Let’s get the answer to that query out of the way first. The authors determine that the returns of these stocks “behave far more like gold returns than like stock returns.”

Conclusion first, now some evidence.

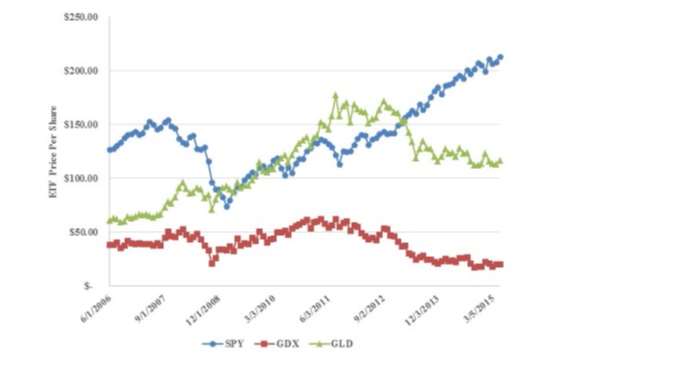

The graph below, reproduced from the Johnson-Lamdin article, shows the development of the price per share of three relevant ETFs during a period of close to nine years (from June 2006 until March 2015.) The blue line represents the underlying equity market, that is, the SPDR S&P 500 ETF Trust (SPY). The green line represents gold as a commodity, traced by the ETF appropriately known as GLD. Finally, the red line represents the Market Vectors Gold Miners ETF (GDX).

Both the gold and the gold miners’ equity rose in value early in this period, peaked early in 2008, and dropped through the remainder of that year. Both of those lines, the green and the red, recovered beginning in early 2009 and engineered another rise, until 2011. Both of those lines stayed in the same neighborhood through much of 2011 and much of 2012 as well, but headed down late in the latter year. Each of those lines seems to have settled onto a floor since.

There are differences. In particular, but the green and red lines below seem to be trying to tell much the same story.

The blue line, though, has a very different tale on its mind. It is rising out of the gate, more sharply than the others, but reaching a top earlier and falling much more dramatically than either. Equity hits bottom a little later than either of the two gold-based ETFs, but it has since then enjoyed an almost uninterrupted upward move.

What are the implications?

So the miners’ ETF acts a lot like the commodity ETF. What are the implications of that fact for portfolio management?

One might naively take the implication to be: investors can appropriately substitute one asset for the other, an equivalent dollar amount of gold miners’ stock for actual gold, in a portfolio. But the most intriguing thing about this report, by Mark A. Johnson, Sellinger School of Business and Management, Loyola University Maryland and Douglas J. Lamdin, Department of Economics, University of Maryland, is that these authors not only don’t draw that inference, they warn against it.

For gold mining stocks are more closely correlated with (other) equities than is gold itself, and this is an important difference for an investor in search of diversification. Suppose an investor has a portfolio consisting entirely of equity, and that these equities are all in companies that do something – anything – other than mining for gold. The investor naturally wants to diversify. Should he be indifferent as between gold and gold mining stocks?

Despite the similarity in performance between those two assets, the answer here is “no.” The investor should prefer owning the actual metal over owning the miner.

Looking at older literature, which often used data from the 1970s and 1980s, the two scholars find that earlier studies have been very unclear “on whether investors are better served by adding gold or adding gold mining stocks to an existing portfolio. The results are sensitive to the sample period used.”

So they improve upon the existing situation by using 21st century data. They believe they also improve upon the older data in another respect, too: their use of ETFs. Earlier studies had to make do by creating “portfolios to mimic what the returns to investors might have been.” But ETF aren’t constructs. They are empirically observable portfolios, which “precisely represent relevant returns.”

In Other Gold ETF News

As a coda it may be worth noting that the final quarter of 2016 was a rather bad time for gold related asset classes. GDX took a nose dive after Donald Trump’s election, moving quickly from above $24.30 a share to below $21. Thereafter it bounced around for a while, then took another nose dive in mid-December, getting as low as $18.99.

In all this, it was confirming one of the Maryland scholars’ points. It was indeed acting a lot more like the shiny commodity than like the broader equities class.