Late last year a California state court found that the plaintiffs in a class action suit stated a cause of action when they alleged that the defendant, iShares Trust, had failed to disclose the material risk of using market or stop loss orders in connection with ETFs.

This spring the same court also said that the plaintiffs have stated factual claims that could allow them to overcome their statute-of-limitations problem.

The plaintiff class consists of those who bought shares of BlackRock iShares ETFs between June 2013 and August 2015, in time to be hurt by the “flash crash” in that latter month. The complaint (in the court’s paraphrase) “alleges pertinent offering documents did not contain sufficient warnings including those on the peculiar susceptibility of ETFs to flash crashes.”

The statute of limitations issue arose because the defendants plausibly claimed that the very large drop in ETF trading prices in 2010 should have provided a “storm warning” to any diligent investor that ETFs are subject to such risks. The plaintiffs were then on constructive notice of their claims more than one year before their filing: thus the bar.

In the end, the Hon. Curtis E.A. Karnow of the Superior Court decided that the claims are not time barred, because the plaintiffs have alleged actions by the defendants obfuscating the cautionary nature of the 2010 event, an obfuscation that if it happened as alleged might well have confused a reasonable investor.

This litigation may have a long and winding road ahead of it, but the fact that the plaintiffs have gotten as far as they have should give the managers of ETFs pause. It isn’t just a matter of re-working the offering documentation. Managers must work harder than they sometimes have to be sure that what they provide to investors by way of information is in line with what investors want and need from them.

This, as it happens, was the subject of an important EDHEC document from last August, one dealing with a particular piece of the ETF market, the smart beta indexed ETFs. Is management giving investors what they want and need in that space?

Deemed to Be Important

The document is based upon EDHEC’s 9th annual survey of European investment professionals on the question of how they perceive the role of exchange traded funds in their portfolio management. It was the third year in a row that EDHEC had dedicated a portion of the survey to the use of products that track smart beta indexes.

These “smart beta” index ETFs have seen “tremendous growth recently, in terms of both assets under management and new products, as illustrated by global figures provided by ETFGI,” a consultancy headquartered in London.

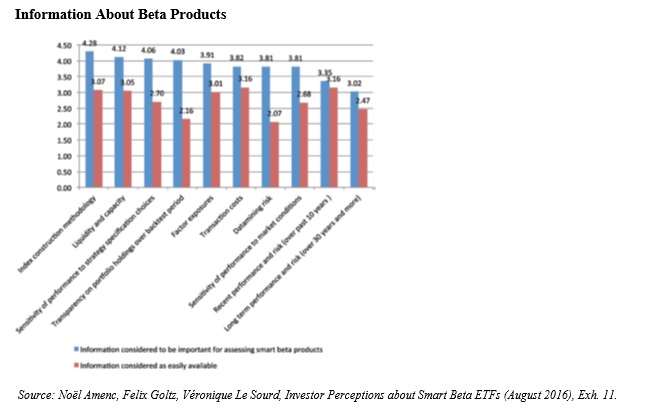

One problem, though, that may slow growth going forward is that there is a gap between information about these products that is “deemed to be important” by actual or potential investors, and information that is readily available.

For example, on a scale of 0 to 5 (where 0 represents information of no value whatsoever – 5 represents information of metaphysical or eschatological significance) investors rate information about the index construction methodology very high: 4.28. On the same 0 – 5 scale for ease of access, though, investors rate this point at 3.07.

On another issue that was important to the plaintiffs in the iShares Trust case, that of liquidity/capacity, the importance number is 4.2, the ease of access number is 3.05.

Information About Beta Products

Source: Noël Amenc, Felix Goltz, Véronique Le Sourd, Investor Perceptions about Smart Beta ETFs (August 2016), Exh. 11.

The mean score for importance is 3.82. The mean for access is 2.75. These results, say EDHEC’s authors, “suggest that investors do not believe that information considered important for assessing smart beta strategies is made available to them with sufficient ease.”

The Authors

Noël Amenc, first-named author of the study, is a professor of finance at EDHEC-Risk Institute and the CEO of ERI Scientific Beta. He’s also a member of the Monetary Authority of Singapore Finance Research Council.

Felix Goltz is the head of applied research at EDHEC-Risk Institute.

Véronique Le Sourd has a Master’s Degree in applied mathematics from Curie University in Paris, and is at present a senior research engineer at EDHEC-Risk.