By: Bill Kelly, CEO, CAIA Association

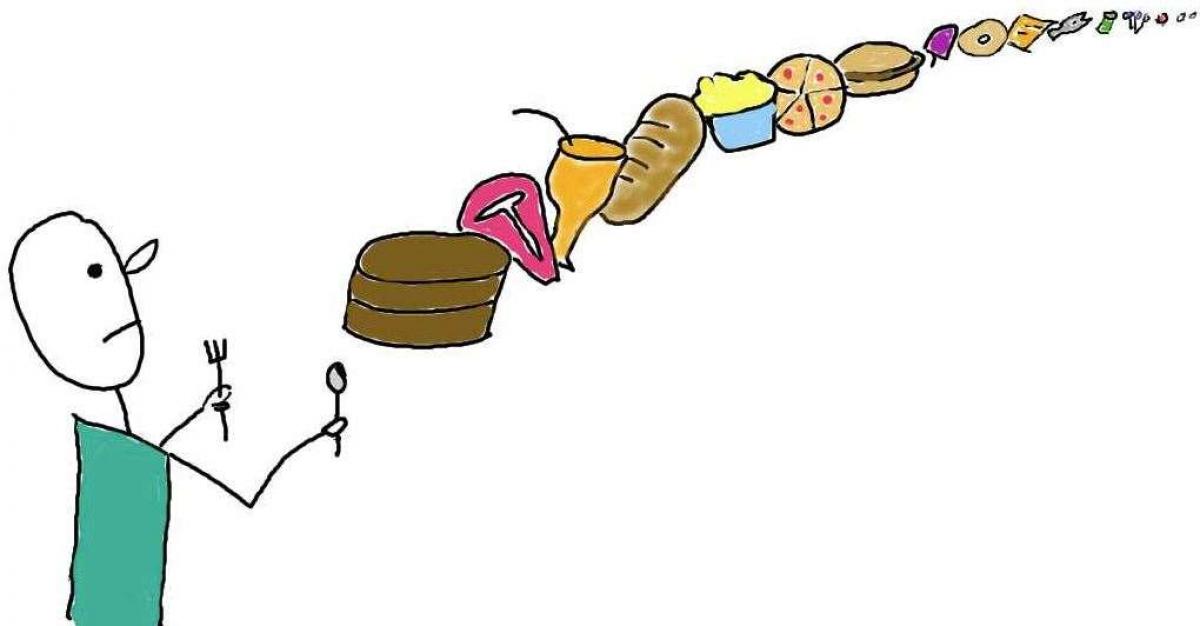

We have all seen it. The Sunday brunch, the Caribbean vacation, or the cruise to nowhere or everywhere that touts the all-inclusive offer when it comes to food and drink. The behavioral aspects of these arrangements are common and predictable. More choice often yields to poor choice as the longer lines form around the dessert table, the red meat, or the Bloody Mary station. You likely will never see a nutritionist or a cardiologist next to your hostess to help guide your selections as they would ruin the fun and slow the access to the desired end product.

This horn of plenty is everywhere and our industry is certainly no exception. The station that is serving up financial product is prolific, magnetic, and more accessible to anyone who wants to pick up a plate and head over. Index replication products have been the recent rage in this risk-on world in which we now live as fees have (rightfully) been put under the white-hot lights. While the S&P 500 index has grabbed the lion’s share of assets and headlines, there is a field of mushrooms standing beside it. Jack Bogle, clearly the face of this part of the market, gets most of the deserved credit for what he invented a little over forty years ago. Jack turned a young 89 years old last week, and you must wonder if he could have imagined the choice available to today’s index-minded investor. Remarkably, we now have over 5,000 investable indexes and 6,000 ETF’s to choose from in a world where we have seen the number of stocks listed on the US exchanges shrink to 3,500, down almost 50% from its peak in 1996.

If all of that is not enough to sate your appetite, not to worry. Just last week one of the leading global financial services firms lowered the minimum investment level for access to their most sophisticated alternative product offerings from the rarified air of $10 million, to the more pedestrian entry point of just $100,000. There will likely be some accredited investor gates here to spoil some of the fun but to give a minimum investment level a 99% haircut with one stroke of the pen sounds an awful lot like unfettered access to more product. More choice has never been the challenge with traditional investments and now the same seems to hold true for alternatives. This ease of access is often accompanied by even less advice, but then again, just like that disparaging glare from the nutritionist as you approach the dessert station for seconds, who needs that?! As it turns out, most of us do.

Instant gratification is part of human nature, but where is the headline that talks about the democratization of risk management, education, or literacy? Some of these tools are hiding in plain sight, and many of these product providers, including the ones referenced here, have meaningful solutions to be accessed and used, but they are never blockers to the investor who wants to simply take the leap.

The all-inclusive cruise is typically over in about a week and that boozy brunch lasts just a few hours, followed by some level of regret resulting in moderation of behavior back to better habits. Investing does not have that natural segue point and by the time the investor realizes what has been consumed, it may be too late for meaningful intervention or repair. Democratization of product is a good thing for the end investor of any size, but a base level of financial literacy and risk management must be consumed first, or at least in equal proportions.

Seek diversification, education and know your risk tolerance. Investing is for the long term.

Bill Kelly has been the CEO of CAIA Association since January, 2014.