By Nicolas Rabener, CAIA, Factor Research Summary:

- Common equity factors generated attractive risk-adjusted returns in the Chinese stock market

- Factor performance in China often mirrors global factor performance

- Indicates common factor drivers that permeate even emerging and isolated markets

INTRODUCTION Economic news like changes in GDP growth are frequently used by financial commentators to explain the daily ups and downs of the stock market. However, research by Dimson et al. (2002) revealed that there is a modest negative correlation between long-run equity returns and economic growth by analyzing multiple countries over a century. China is a prime example of this unusual relationship as the economy has been growing at a steady 7% per annum in recent years while its stock market had anything but a steady performance. Until recently investors were fortunate enough to be able to ignore Chinese stocks as these had a low weight in global benchmarks. However, in 2018 MSCI increased the number of Chinese A shares in its global emerging market index, which is followed by $1.6 trillion of assets. Although Chinese stocks still have a relatively low weight in global benchmarks, emerging market investors are forced to spend more time analysing these stocks and contemplate what kind of strategies work in the Chinese stock market. In this short research note, we will investigate applying classic factor investing strategies to Chinese stocks.

METHODOLOGY We focus on all A shares traded in Chinese stock markets in the period from 2008 to 2018. The factor performance is calculated by constructing long-short beta-neutral portfolios of the top and bottom 10% of stocks ranked by the factor definitions. Only stocks with a minimum market capitalization of $1 billion are included. Portfolios are rebalanced monthly and each transaction incurs costs of 10 basis points. It is worth noting that there are few data points available for historical transaction costs for Chinese stocks.

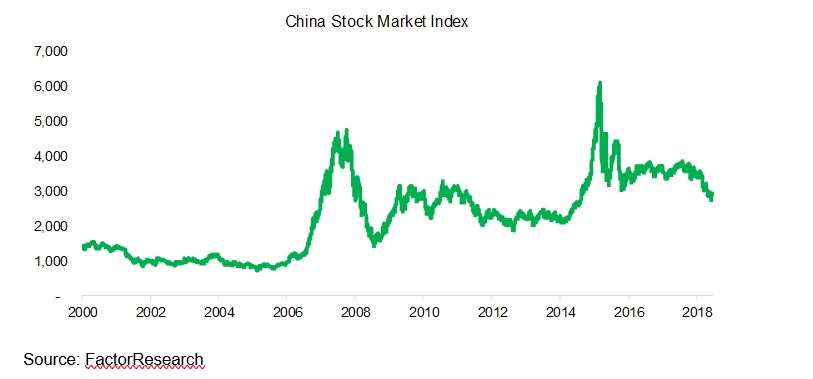

THE NON-PERFORMING CHINESE STOCK MARKET The Chinese stock market comprised of A shares, which are companies from mainland China that are traded in Shanghai and Shenzen, has not been attractive for investors in the last two decades. There have been two major boom and bust cycles since 2000, which featured drawdowns of larger than 70%. The Chinese government tried to control the last crash in 2016 by forcing state-related entities to buy declining stocks and introducing maximum daily price changes, but unsurprisingly these measures failed to stop the stampede of exiting investors. The poor performance of the Chinese stock market is frequently explained by that the composition does not reflect the dynamic nature of the economy appropriately. Many of the largest A shares companies are state-owned entities that are managed inefficiently, while most of the highly successful Chinese companies like Alibaba are listed in Hong Kong, London or New York.

FACTOR INVESTING IN CHINESE STOCKS We focus on three factors namely Value, Momentum and Quality. It is worth noting that shorting Chinese stocks has historically been prohibited or exceedingly difficult, therefore we show factor performance for portfolios that short stocks as well as short the index, which is somewhat easier. In addition, we contrast the performance of factors in Chinese stocks to the global factor performance. Chinese stock markets are dominated by retail investors, which are less analytical than institutional investors. Therefore we would expect a Value strategy that requires investors to analyse fundamentals to perform less well. We define the Value factor by a combination of price-to-book and price-to-earnings multiples. In contrast to our expectations, the long-short Value factor in Chinese stocks generated positive excess returns since 2008, albeit with little consistency. Comparing Chinese to global factor performance does not indicate a strong relationship.  Retail investors tend to chase performance. Investors might therefore expect the Momentum factor, which is defined as buying winners and shorting losers as measured over the stock performance of the last 12 months, excluding the most recent month, to perform strongly. However, the Momentum factor in China generated relatively flat returns since 2008. More interesting and contrasting to Value, comparing the Chinese and global Momentum factor shows shared trends. We observe that the Momentum crash of 2009 is clearly visible in the Chinese stock market, which would indicate that Chinese investors behave similarly to global investors. However, the analysis also highlights that between 2013 and 2015 the Momentum performance in Chinese stocks was significantly different to the global factor performance.

Retail investors tend to chase performance. Investors might therefore expect the Momentum factor, which is defined as buying winners and shorting losers as measured over the stock performance of the last 12 months, excluding the most recent month, to perform strongly. However, the Momentum factor in China generated relatively flat returns since 2008. More interesting and contrasting to Value, comparing the Chinese and global Momentum factor shows shared trends. We observe that the Momentum crash of 2009 is clearly visible in the Chinese stock market, which would indicate that Chinese investors behave similarly to global investors. However, the analysis also highlights that between 2013 and 2015 the Momentum performance in Chinese stocks was significantly different to the global factor performance.  Chinese stock markets feature a large number of companies where the government is the majority owner. These are typically diversified companies that exhibit low profit margins and high levels of debt. The Quality factor represents the strategy of shorting low-quality and buying high-quality stocks, which generated attractive returns in Chinese and global stock markets since 2008. Similar to the Momentum factor, there seem to be shared trends across markets, indicating common drivers of factor performance.

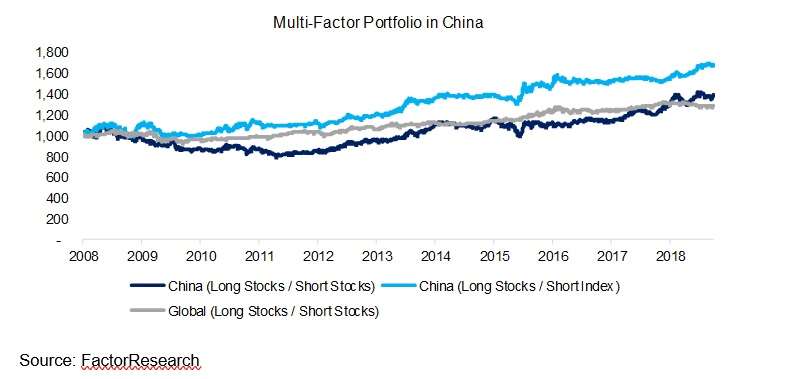

Chinese stock markets feature a large number of companies where the government is the majority owner. These are typically diversified companies that exhibit low profit margins and high levels of debt. The Quality factor represents the strategy of shorting low-quality and buying high-quality stocks, which generated attractive returns in Chinese and global stock markets since 2008. Similar to the Momentum factor, there seem to be shared trends across markets, indicating common drivers of factor performance.  Next, we create classic multi-factor portfolios by equally allocating to the Value, Momentum, and Quality factors. The performance is relatively consistent across time and therefore attractive for investors. The performance of the multi-factor portfolios in Chinese and global stock markets are comparable, which is to be expected given that the single factors share trends.

Next, we create classic multi-factor portfolios by equally allocating to the Value, Momentum, and Quality factors. The performance is relatively consistent across time and therefore attractive for investors. The performance of the multi-factor portfolios in Chinese and global stock markets are comparable, which is to be expected given that the single factors share trends.  Finally, we analyze the risk-return ratios of six common equity factors in the Chinese stock market. A few observations:

Finally, we analyze the risk-return ratios of six common equity factors in the Chinese stock market. A few observations:

- Factor investing in Chinese stocks generated attractive risk-adjusted returns

- Shorting the index was more attractive than shorting stocks

- Chinese factor performance mirrors approximately global factor performance

- Low Volatility and Quality were most while Size and Momentum factors were least attractive

FURTHER THOUGHTS The short research note highlights that factor investing in Chinese stocks was attractive, albeit mirrors global factor performance, which is somewhat surprising as investors might have expected completely alien factor performance. Given that trading Chinese stocks has been difficult for foreign investors, the factor performance is explained by the behaviour of local investors. It is another indication that factors have common drivers across sectors and markets, even if emerging and isolated.