By Nicolas Rabener of FactorResearch (@FactorResearch)

ESG INVESTING – SIMPLE OR COMPLEX?

Investing is complicated as it is simple and complex at the same time. Common advice for new investors is to pursue a buy-and-hold approach for long-term wealth creation. Although this strategy has worked out great in the U.S. stock market, it has been far less attractive for Japanese or Chinese investors, casting doubt on this simple recommendation.

Millennials are especially interested in investment products that feature high environmental, social, and governance (ESG) standards. It should be simple to distinguish between good and bad companies. Investors might assume that oil stocks like BP rank low on ESG metrics while electric car makers like Tesla rank high, until they learn that electric batteries require cobalt, which is mainly mined in the Democratic Republic of Congo, a country where children are frequently employed. ESG investing is more complex than it might seem.

Investors considering ESG strategies should also question if there is a price to pay for investing in stocks with high ESG scores as there are very few free lunches in finance. Companies that rank high on ESG metrics need to be good corporate citizens in their local communities, treat their employees well, not pollute the environment, and show sound governance standards. Not all of this might be in the interests of shareholders, which mostly care about profits, dividends, and share buybacks.

In this short research note, we will analyze the performance of ESG investing in the U.S. stock market. Specifically, we focus on the pure ESG factor where we reduce the exposure to sectors and other common equity factors in order to highlight the residual returns from ESG investing.

GOOD VS. BAD CORPORATES

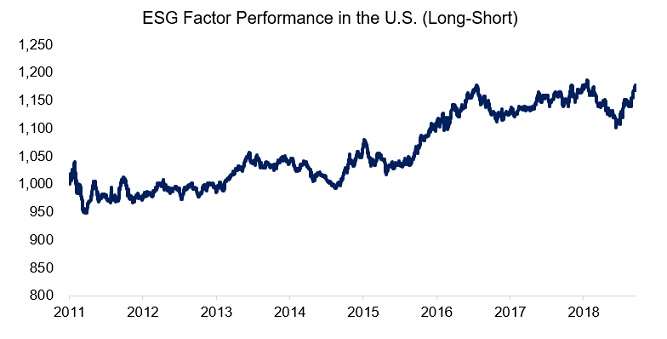

We utilize data from a U.S. provider that aggregates ESG scores from multiple other providers, which results in a comprehensive data set that covers most of the stocks listed in the U.S. stock market. We create a beta-neutral long-short portfolio composed of the top and bottom 10% of U.S. stocks sorted by ESG metrics, which comprise four major categories: citizenship, employees, environment, and governance. We only included companies with market capitalizations in excess of $1 billion. The resulting portfolio is rebalanced monthly and includes 10 basis points of cost per transaction.

The ESG factor in the U.S. stock market shows a positive performance since 2011, essentially implying that investors were rewarded by investing in good corporates and avoiding bad corporates. The returns are not particular volatile and relatively consistent, making the strategy highly attractive.

Source: FactorResearch

ANALYSING THE ESG FACTOR PORTFOLIO

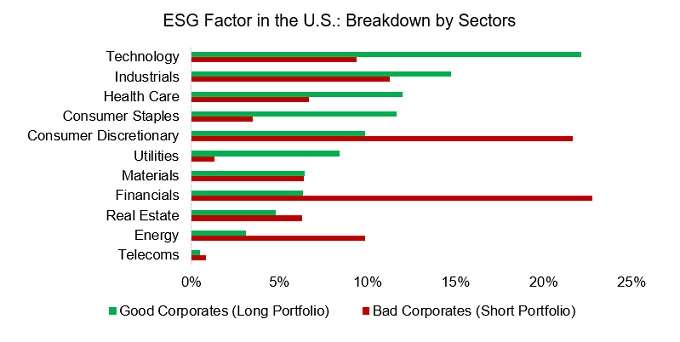

Investors might be intrigued by what kind of stocks are ranked high and low by ESG metrics. A breakdown by sectors reveals that a large proportion of stocks with high ESG scores are from the technology sector. Tech firms have to fight fiercely for employees by offering attractive perks and often run asset-light business models that create few conflicts with the environment. They also tend to be highly profitable companies, which provides the necessary resources for achieving high ESG scores.

In contrast, consumer discretionary stocks like car companies exhibit low ESG metrics that can be explained by asset-heavy, low-margin business models. Some sectors like energy are pre-destined to feature low ESG scores due to the nature of their industries, which creates structural sector biases in the ESG factor.

Source: FactorResearch

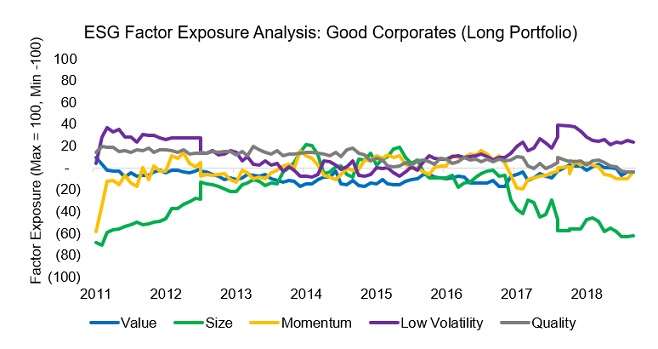

FACTOR EXPOSURE ANALYSIS OF THE ESG FACTOR

To further our understanding of what is driving the ESG factor performance, we run a factor exposure analysis that reveals exposures to common equity factors. Stocks with high ESG scores exhibited positive exposure to the low volatility and quality factors and negative exposure to the value and size factors.

Some of these exposures are quite intuitive: small and cheap companies tend to be companies in trouble and have other priorities than ESG, which consumes precious resources like capital and management time.

Source: FactorResearch

PURE ESG FACTOR

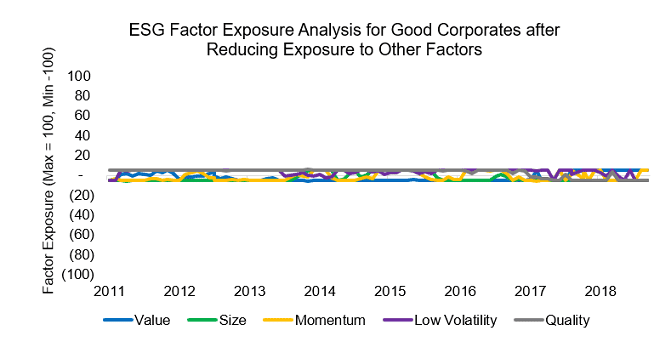

Given the exposure to common equity factors like Quality, investors might question if ESG can be viewed as a factor in its own right or is more akin to a multi-factor portfolio with structural factor tilts.

Although we cannot answer this question definitely, we can reduce the exposure to other factors via an optimization process. This process maximizes the exposure to the ESG factor and minimizes the exposure to other factors by changing the weights of the stocks in the portfolio at each monthly rebalancing date.

Source: FactorResearch

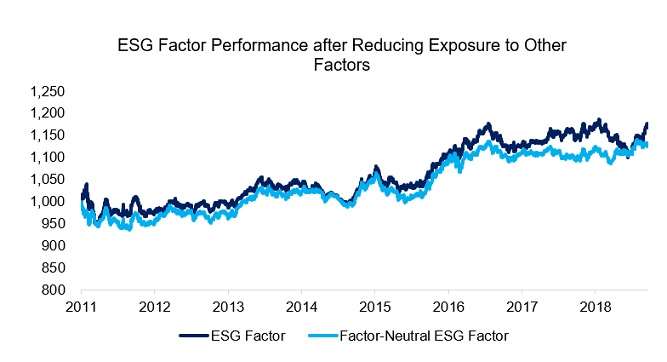

Interestingly, the performance of the factor-neutral ESG portfolio does not differ much for the original ESG portfolio. Although we highlighted exposure to other factors, the levels were not particularly extreme, which likely explains the relatively comparable returns.

Source: FactorResearch

Investors focused on ESG can view these results favorably as it highlights that ESG investing generated positive excess returns since 2011, independent of other factors. The factor-neutral ESG returns were 1.59% per annum, which are attractive, depending on the fees charged for accessing the strategy.

However, the factor-neutral ESG factor will still exhibit sector biases like an overweight to technology and underweight to energy stocks as noted earlier. A skeptical investor might argue that the positive performance of the ESG factor can simply be explained by the strong performance of technology stocks like the FAANGs over the last few years.

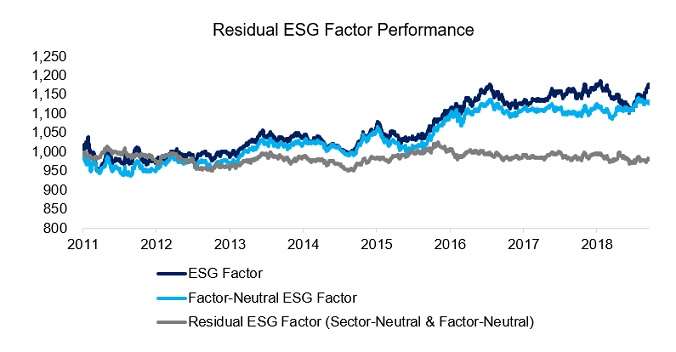

Finally, we therefore create a sector-neutral and factor-neutral ESG portfolio that highlights the residual returns from ESG investing. The resulting portfolio generated essentially zero returns since 2011, implying that the strong performance of the ESG factor is indeed explained by sector biases.

Source: FactorResearch

Investors allocating to ESG strategies might be uncomfortable with this conclusion as there is the risk of sector rotation, which occur frequently. The Technology sector generated the highest returns of all sectors since 2011 and Tech stocks are trading at high valuation multiples. Comparisons to the Tech bubble of 2000 have been made.

FURTHER THOUGHTS

This short research note highlights positive excess returns from ESG investing, although a deeper look reveals that the abnormal returns are mainly explained by sector biases.

Ranking high on ESG metrics requires companies to satisfy multiple stakeholders, not only shareholders, which requires precious resources. Investors should therefore not view ESG as a potential source of additional returns, but more as an approach to investing based on personal preferences. There might be a cost to investing in good corporates, but not every investor is interested in solely maximizing their return.