By Nicolas Rabener of FactorResearch @FactorResearch

INTRODUCTION

Investors seeking exposure to global equities with a low carbon footprint could consider the iShares MSCI ACWI Low Carbon ETF (CRBN) or SPDR MSCI ACWI Low Carbon ETF (LOWC). CRBN has $500 million of assets under management, compared with $90 million for LOWC. Both charge a management fee of 0.20% per annum.

However, investors might be surprised to learn that both have a 3.5% allocation to the energy sector and include companies like Schlumberger, Valero Energy, and Halliburton. The ETFs are not defined as fossil-fuel-free products, but the exposure to companies that have oil and gas as their core business activities might disappoint some investors that do not spend time thoroughly analyzing the portfolios.

The portfolio construction of the ETFs can be explained by these companies featuring a low-carbon footprint, the focus of ETF issuers on minimizing a tracking error to a benchmark, or a combination of both.

Not all energy companies should be considered as bad corporates from a carbon perspective as they can offset carbon emissions. Although treated with some scepticism, the oil giant BP recently announced to become a carbon-neutral company by 2050.

Doing good while investing appeals to almost all investors, but large tracking errors do not, which has led some data providers to evaluate the carbon footprint of companies on a relative basis within sectors. Given this, a low-carbon product can hold companies that might be considered as truly evil by environmentalists, but will not deviate significantly from a benchmark index.

Low-carbon investing should be simple, but is unfortunately complicated. ESG investing is even more complicated as there are additional criteria that need to be considered in the stock selection process.

In this short research note, we will contrast ESG and low-carbon investing from a portfolio perspective.

GLOBAL ESG VS LOW-CARBON ETFS

We focus on equity ETFs that can be categorized into either ESG, low carbon, or ESG + low carbon. There are only a few ETFs available for each category and all three only for global, US, and European stock markets.

Investors are most likely intrigued by how ESG and low-carbon products have performed against benchmarks, but most of these ETFs have only been launched in recent years and therefore do not provide sufficient data history for a meaningful comparison.

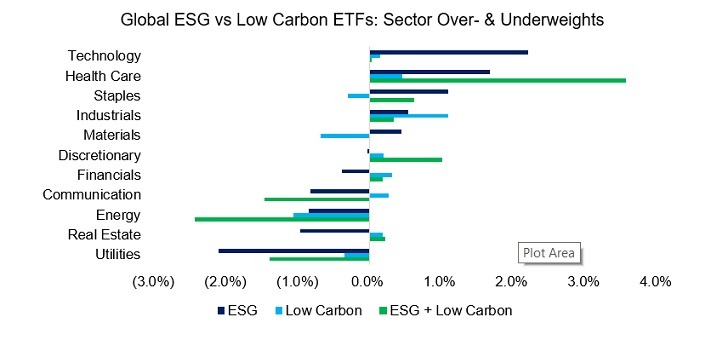

Analyzing the portfolios of global ESG and low-carbon ETFs highlights sector biases compared to their benchmark, which is the MSCI ACWI index. The portfolios share some similarities, e.g. an overweight toward healthcare and industrials as well as underweights to energy and utility stocks. However, there are also meaningful differences. For example, ESG ETFs have their largest overweight in the technology sector, which is neutral from a carbon perspective.

Source: FactorResearch

It is somewhat unusual to observe that ESG + low carbon has sector biases substantially different from ESG or low carbon on a stand-alone basis. There is a meaningful overweight towards consumer discretionary stocks, but we observe none from an ESG or low carbon perspective. Given that ESG + low-carbon stocks need to rank high on both criteria, this should not be possible. The likely explanation is that the index providers use different data sources, which frequently feature different ratings for the same stocks.

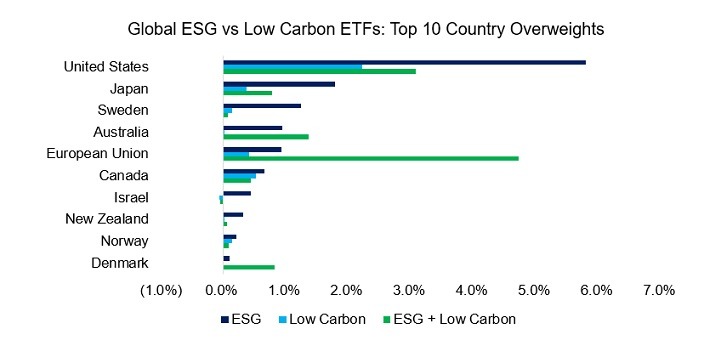

Next, we switch the perspective from sectors to countries and calculate the top 10 overweights for global ESG ETFs. The analysis highlights that countries like the US, Japan, European Union, and Canada receive larger weights in ESG and low carbon products than in the benchmark index, while other countries like Sweden or Israel seem more attractive on ESG than low-carbon metrics.

Source: FactorResearch

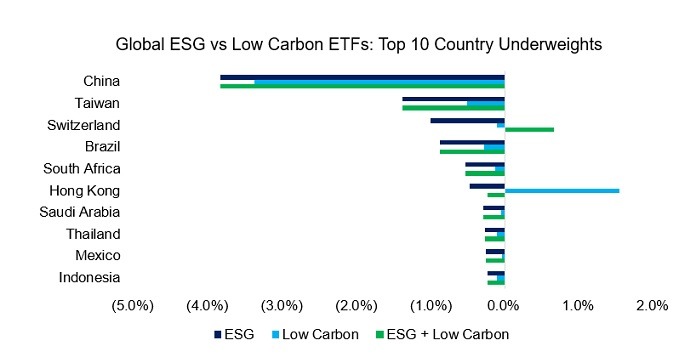

Analyzing which countries are most underweighted results in a relatively homogenous perspective. China is by far the largest underweight in global ESG and low-carbon ETFs, which is not unexpected given that the country has some of the most polluted cities globally due to weak environmental standards, ranks low on employee rights, and features many firms with poor corporate governance.

Source: FactorResearch

ESG VS LOW-CARBON ETFS IN THE US

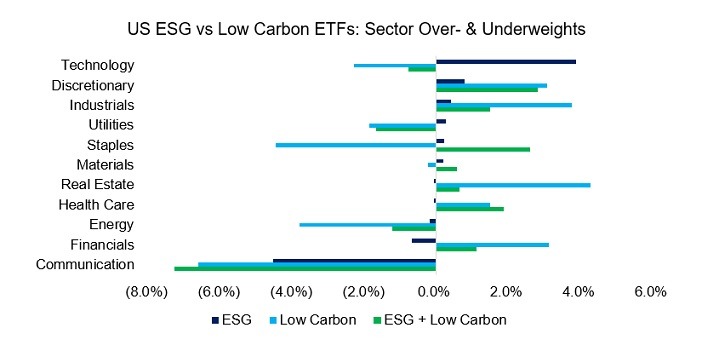

In contrast to the global ETFs, there is less overlap between ESG and low-carbon portfolios in the US from a sector perspective. Furthermore, low-carbon ETFs have more extreme over- and underweights than ESG products, which deviate minimally from the benchmark, except for being long technology and short communication stocks.

These results can be attributed to the index providers and their data sources. The global ETFs were all issued by the large ETF firms like iShares, StateStreet, and Invesco, which mainly use MSCI indices in their products. However, the low-carbon ETFs in the US are managed by niche providers that utilize different data sources and results in more differentiated portfolios.

Source: FactorResearch

EUROPEAN ESG VS LOW-CARBON ETFS

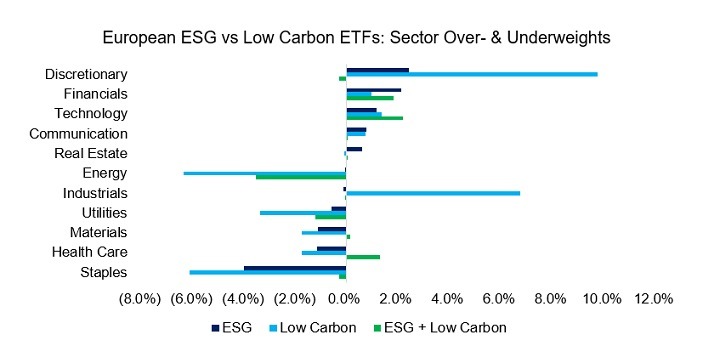

All ESG and low-carbon ETFs in Europe were launched by large ETF issuers, which explains the slightly more homogenous over- and underweights from a sector perspective compared to US products.

We observe again that low-carbon ETFs have more extreme sector biases than ESG products. Given the magnitude of the biases, e.g. a 10% overweight in consumer discretionary, investors should expect a significant tracking error from European low carbon ETFs.

Source: FactorResearch

FURTHER THOUGHTS

The key takeaway of this analysis is the complexity of ESG and low-carbon products, which is difficult to reduce and not a particularly attractive feature of investing in general. Other learnings are as follows:

- Low-carbon ETFs contain stocks from sectors like energy that are likely unexpected and undesirable by investors;

- ESG and low-carbon ETFs exhibit different sector and country biases;

- ESG leads to larger over- and underweights in global, but lower ones than low carbon in US and European products; and

- The extreme biases in US and European low-carbon ETFs will lead to significant track errors.

Ultimately, ESG and low-carbon investing requires investors to select one of the data providers like MSCI or FTSE, but given conflicting ratings on stocks like Tesla or Exxon Mobile this necessitates understanding their methodologies.

Unfortunately, the complexity is increasing as the standards for evaluating stocks on ESG and low carbon continue to evolve. Many tech stocks seem to be low-carbon emitters, until their supply chains are considered. The companies that investors consider good corporates today might be perceived far less positive in a few years given more advanced analytics.

RELATED RESEARCH