By Peter Gaffney - Head of Research at Security Token Advisors.

Tokenized Product Distribution through Institutional Client Bases

One of the weak points in the tokenization industry to date is actual product distribution and capital syndication. Institutions are beginning to move beyond just tokenizing assets for operational uses and savings (repo, collateral management) and are now placing tokenized products with their own client bases as buyers. Citi is one name leading the charge here, offering digital corporate bonds through Singapore’s BondbloX to its Southeast Asia private banking and wealth management clients. UBS built upon its previous $400+ million digital bond issue to high-net-worth clients with an Ethereum-based money market fund, also in Singapore. As blue-chips like JP Morgan and Goldman Sachs continue to develop their digital suites, expect their private banking, wealth & asset management, and alternatives teams to act as distribution channels unlocking serious capital that retail broker-dealers struggle to access.

Blockchain Savings and Bottom-Line Improvements

The greatest efficiencies will come through end-to-end digital systems - meaning an on-chain lifecycle - in the form of tangible dollar savings or manual labor time relative to traditional process counterparts. Platforms are taking steps towards this reality in addressable market sizes in the billions and trillions of dollars ranges. A snapshot of savings through trials are as follows:

- Goldman Sachs Digital Asset Platform (GS DAP) - digital bond origination saved and passed 15 basis points onto Union Investment (€150K on €100M bond) as the buyer

- J.P. Morgan’s Onyx Digital Assets (ODA) - projecting $20 million in savings on expected $1 trillion in tokenized repo and TCN transactions by end of 2023

- Broadridge Distributed Ledger Repo (DLR) - saving sell-side clients like Societe Generale $1 million per 100,000 transactions

- Equilend - launched 1Source to save the securities lending industry an estimated $100 million in costs

- Intain - reporting 100 basis points in savings reducing SME loan lifecycle fees from 150 bps to 50 bps

- Vanguard - leveraging Grow Inc. to achieve straight-through processing savings 100 hours a week in labor

- Liquid Mortgage - reducing Mortgage-Backed Securities reporting from 55 days to 30 minutes

Money Markets and Treasuries as the Low-Hanging Fruit

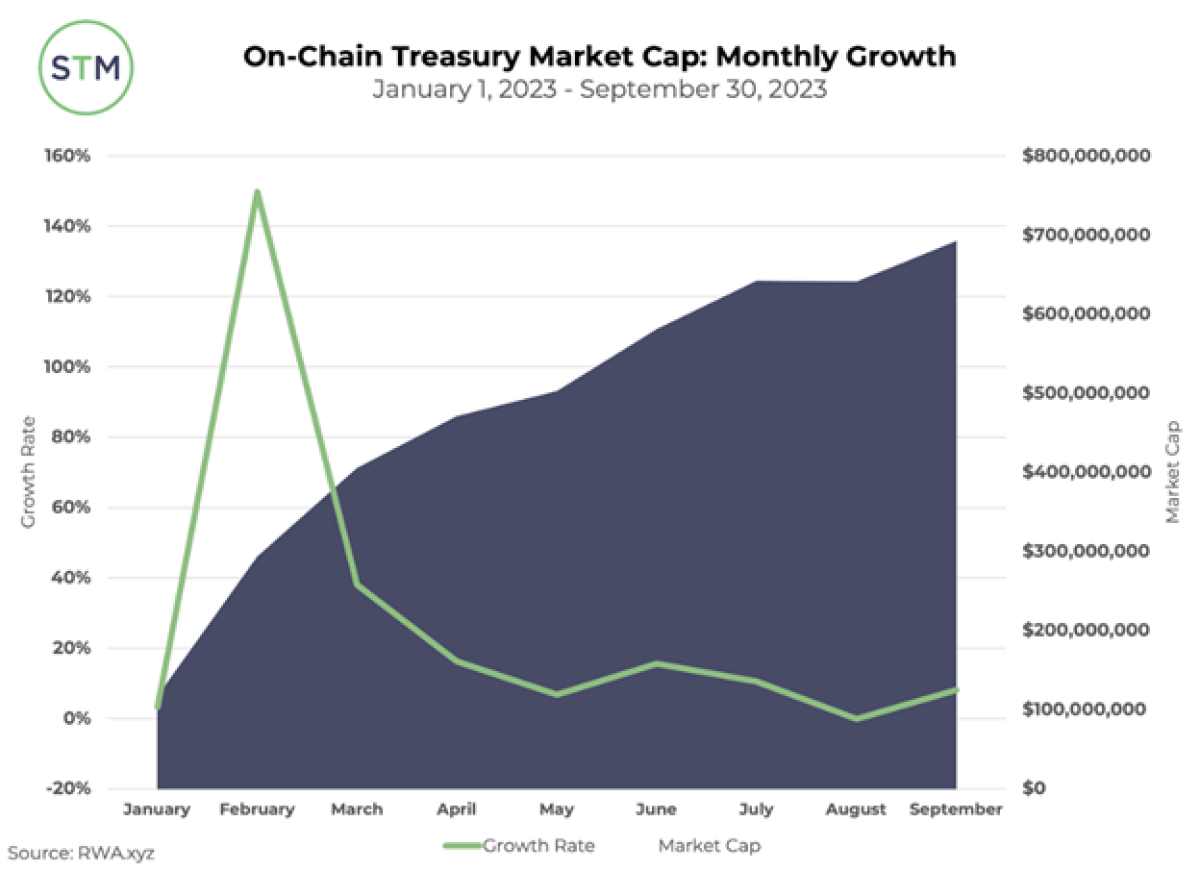

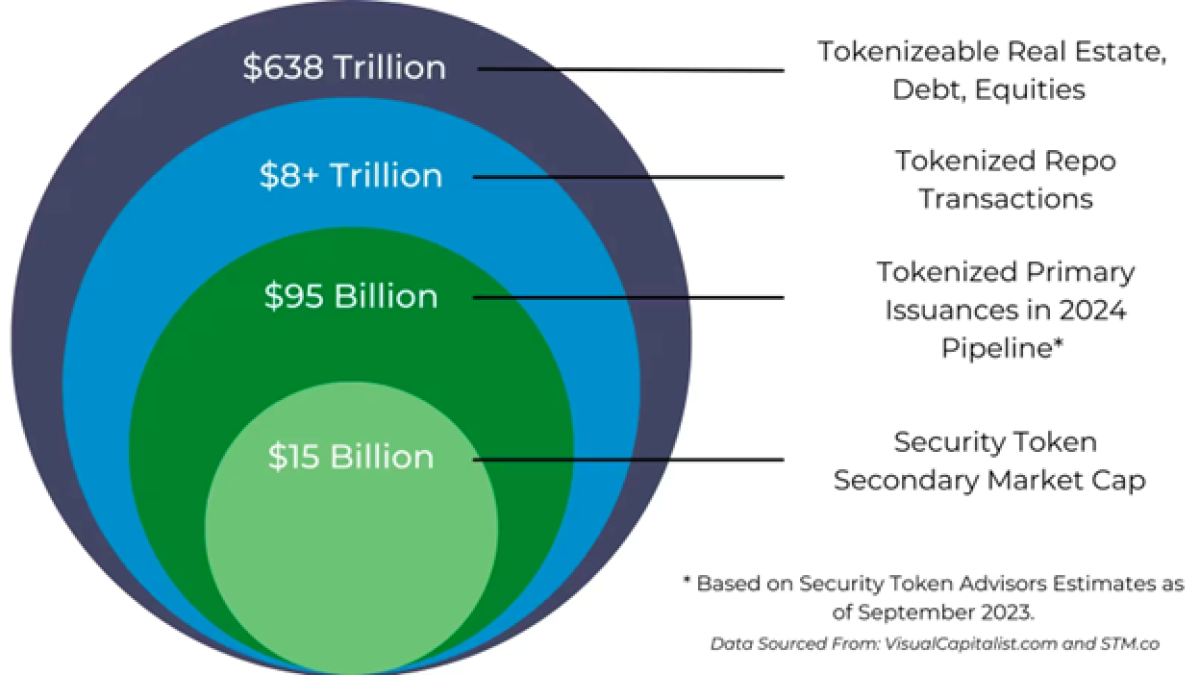

On the product side, this industry has seen swings in its most popular asset class from real estate to pre-IPO shares to private equity and now to… money markets and treasuries. While not the most glamorous asset type, and even one that has people scratching their heads as to why, tokenized money market funds and tokenized treasury products will play a key role in the developing ecosystem - probably more than the other alternative classes could have on their own. While the capital markets push towards a fully digital future, the inhibitor sometimes lies in the actual transfer and settlement mechanism. Stablecoins, Central Bank Digital Currency (CBDC), and tokenized deposits may all be viable options, but they are difficult to make use of at scale when money markets and treasuries are generating ~5% annually in low risk segments. This asset class has accumulated almost $700 million in assets by the end of Q3 2023, up almost 520% YTD. It presents asset managers with ideal test products to familiarize themselves with tokenization workflows and processes while generating yield that gets passed onto clients as additional strategies come to formation.

Custodians as the Base Layer to Unlock Scale

Digital asset custody acquisitions have been on the up and up all year, from both the FinTech and traditional sides. Organizations like Ripple and Fireblocks have been competing on tokenization positioning with acquisitions of Metaco and Blockfold, respectively, while incumbents like Citi and Northern Trust have formed their own integrations and upgraded capabilities. The key here is recognizing that custody is the base layer of tokenized assets, much like in the traditional capital markets. Citi is able to distribute digital bonds to clients near-seamlessly because it controls that base layer. Service providers like tokenization engines and broker-dealers will need to properly integrate with the big players like BNY Mellon, State Street, Citi, Northern Trust, Standard Chartered, BNP Paribas, and even Coinbase as an emerging player to achieve the desired product distribution and placement services on behalf of client issuers.

Notable Tokenized Products

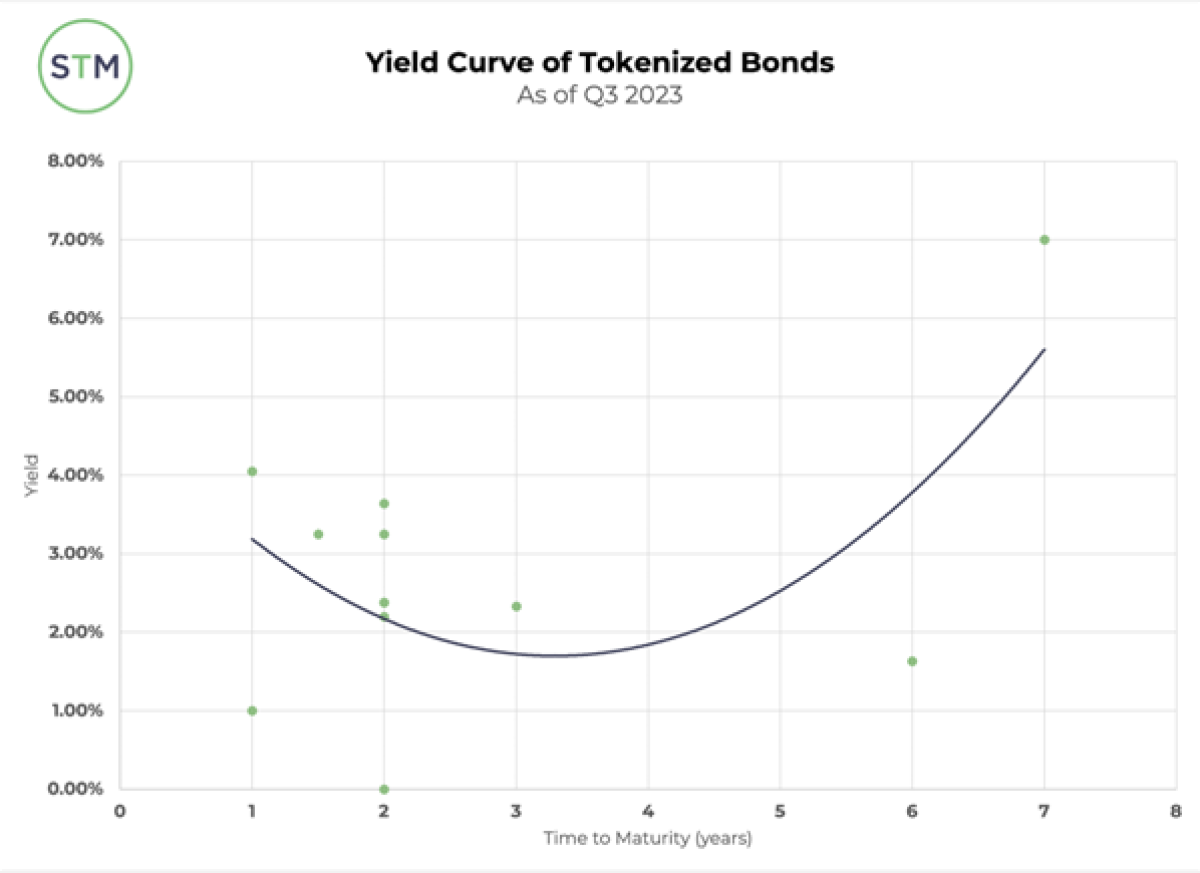

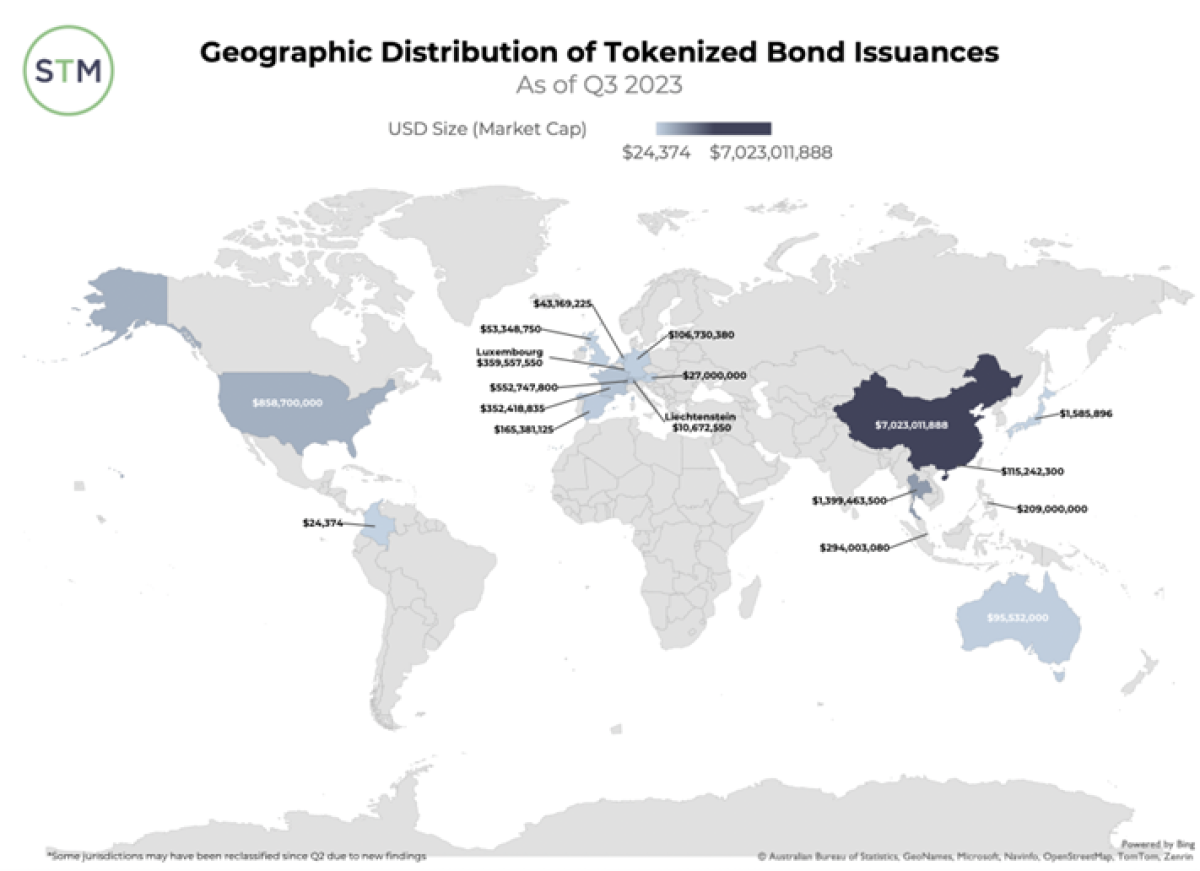

A number of digital bonds have been issued over the past 4 years through investment banking platforms for firms like European Investment Bank (EIB), Santander, Societe Generale, and UBS, as well as government agencies and central banks like the Hong Kong Monetary Authority (HMKA). Many, if not all, of these digital bonds were issued in the primary markets to single-bank buyers or to a few select allocators as opposed to widespread distribution channels. Most of them are still performing as investors collect yield and hold to maturity with little to no plans of secondary trading. Nonetheless, given that this segment is one of the stronger institutional plays given the aforementioned names that are involved, the vertical deserves attention. The visuals below depict 1) the existing yield curve of these digital bonds and 2) geographical breakdown of digital bonds that have been issued through both private blockchain and public blockchain solutions over roughly the last four years. Please keep in mind that while some of the earlier bonds were issued in 2019, the volume of issuances saw a noticeable upswing in 2022, with stagnant activity throughout 2020 and 2021.

Beyond investment banking platforms and bond issuances, much of the capital markets industry is keeping tabs on tokenization trends with regards to money market funds, treasury funds, private equity, private credit, and others. Many of the alternative investment products are still in the primary capital raise phase and offer limited associated data (i.e. how much capital was raised, average ticket size, buyer demographics), although it’s useful to see how holistic the future tokenization markets will look as these types of feeder funds, digital share classes, and carve outs find their ways into meaningful portfolios.

The table below is a non-exhaustive aggregation of notable products within these classes for simple reference.

About the Authors:

Peter Gaffney is the Head of Research at Security Token Advisors, an advisory group that constructs tokenization strategies for clients ranging from global asset managers to real estate investment groups to mortgage servicing platforms to private equity & venture capital firms and pre-IPO shares. He leverages experiences at Global X ETFs and boutique private equity firms to bring the public and private markets under one roof via tokenization. Peter is the author of 'Blockchain Explained: Your Ultimate Guide to the Tokenization of Finance' and the 'State of Security Tokens' series.

LinkedIn: https://www.linkedin.com/in/peter-gaffney/

Twitter: https://twitter.com/pgaff_digital