The European Securities and Markets Authority recently warned that valuation risks are on the rise on key markets. Some of the reasoning of the report must be giving Austrian economists, those much-despised Cassandras of central-bank-inspired bubbles, a sense of vindication.

The European Securities and Markets Authority recently warned that valuation risks are on the rise on key markets. Some of the reasoning of the report must be giving Austrian economists, those much-despised Cassandras of central-bank-inspired bubbles, a sense of vindication.

The good news is that in the first half of 2014, EU securities markets have witnessed “significant gains amid low volatility and notwithstanding a challenging economic and political environment.”

The corollary is: low interest rates force a hunt for yield that has expanded across risk and asset classes. The problem, says ESMA, is that this hunt for yield in turn raises “valuation concerns,” that is, the danger that some of these asset classes are experiencing their bubble moment rather than real strength.

Directions of Change

The yield-hunting has created a receptive environment for initial public offerings. The report tells us that the number and value of IPOs increased in the first half of 2014 relative to preceding periods: two hundred and thirteen issuances, compared to just 121 in the first quarter of 2013, with the overall value of the IPOs “significantly higher” in both quarters involved, “than the five-year quarterly average.”

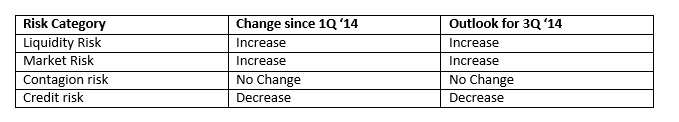

The below graph, adapted from a graph in ESMA’s repot, indicates that that ESMA doesn’t expect any change in the direction of change. The risks with regard to liquidity and markets have risen and will continue rising, credit risk will continue to lessen. That’s amounts to a gradual descent from some very great altitudes, though, credit risk “still remained very high” as of the second quarter.

Signs that credit risks are descending from their Alpine heights include “the establishment of the banking union, accelerated repayments of [Long-term refinancing operation] LTRO balances, and the return of several sovereigns to capital markets.”

It was late in the second quarter of this year that the European Central Bank introduced a variation on the now familiar LTRO theme, creating the T-LTRO, where the T stands for “targeted.” The T-LTRO operations are designed to allow banks to borrow up to 7% of their outstanding loans to the euro area non-financial private sector.

As to market risk, ESMA is concerned in particular that investors may be guilty of “over-reliance on continued policy support.” I gather that means that investors continue to believe that central bankers and governments will play the role of Santa Claus, and this is of course risky because [make sure the children are out of the room here] there is no Santa Claus.

From Trading Venues to Bond Funds

ESMA regards developments in the trading venues as worrisome. Infrastructural and technological innovations have increased the complexity of the trading world, and this has increased operational risk. Low latency trading (the report’s preferred term for HFT) “increases the potential for misconduct and market abuse.”

The report observes with a sigh of relief that during “the current quarter” at least “no major events threatening operational stability were observed.” But a potential interest-rate snapback could result in “liquidity constraints and collateral scarcity.”

There are also “financial stability risks” associated with the increasing reliance of markets upon non-bank lenders.

But to return to valuation: The danger ESMA has especially in mind isn’t simply of bubbles here and there, but of their correlation. The correlated blowing-up of bubbles suggests the prospect of a correlated popping. Or, in the more decorous language of the report, ”[A]sset prices are at highs, even in historical terms, across markets that would typically move in opposing directions, such as equity, and bond markets.”[Emphasis added.]

Where it will all end … consult the Austrians.

ESMA also observes that equity trading continues to be transacted chiefly through electronic order books, though the overall share of EOB dropped a bit. Trading through dark pools remains limited, less than 2% of the whole.

The fund industry in Europe has continued its growth. Assets under management in the industry grew by about 6.7% in the first half of this year due to capital inflows, focused mostly on bond funds.

It isn’t surprising that bond funds should be the recipients of capital, because bonds have “followed a quasi0-linear ascending trend” in recent months. In the first half of 2014, corporate bond prices gained 4.9% and Europe’s sovereigns increased 7%.

But investors pouring into bond funds aren’t getting immediate gratification. Bond fund returns – indeed fund returns in general in Europe – remained modest in the first half.

Relatedly, ESMA has released its Risk Deal Dashboard for 3Q 2014.