By Diane Harrison

By Diane Harrison

While reading "Swimming to Antarctica," the autobiography of Lynne Cox, a a long-distance swimmer who successfully navigated some of the world’s most challenging deep sea passages utilizing nothing more than a standard swimsuit, goggles and lanolin oil, I learned about the gravitational effect of tides, which in turn sparked a connection to the market forces that often dictate the global market movements. The physics of tidal pulls present an interesting parallel to some of the market cycles the asset management world has found difficult to navigate over the recent past. Perhaps taking a closer look at the two forces—tides and money flows—might offer some insight into what lies ahead for investment managers and investors.

GOING SOLAR

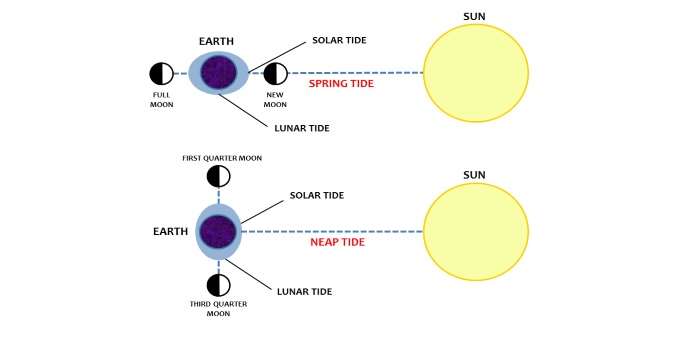

First, let’s refresh our science background with a brief lesson on tides, courtesy of The Farmer’s Almanac’s website. Tidal flows are the result of the gravitational pull on the earth of the moon and the sun. Surprisingly, the sun has less of an impact on the earth’s oceans than does the moon, based primarily on the relative distances each occupy from the earth. The sun exerts only 46% of the pull that the moon does on the earth’s tides. Higher tides occur during these moon phases.

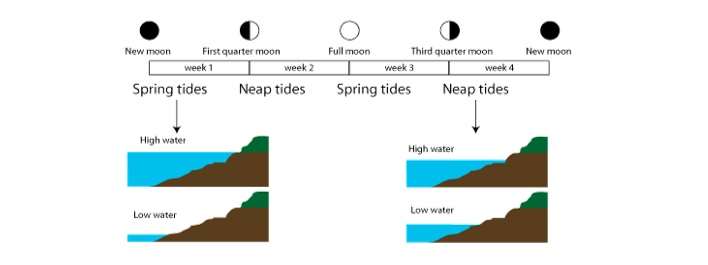

When the gravitational effects of the sun and the moon combine, we get spring tides, which have nothing to do with the season of spring. The term refers to the action of the seas springing out and then springing back. These are times of ‘higher high tides’ and ‘lower low tides.’

A week later, during either of the two quarter moon phases, when the sun and moon are at right angles to each other and their tidal influences partially cancel each other out, neap tides occur, and the tidal range is minimal. In fact, because the oceans take a bit of time to catch up to the geometry of the moon, spring and neap tides usually occur about a day after the respective lunar cycles.

So we now understand more about how the gravitational forces of our solar neighbors exert their impact on the ocean tides over the course of each month. What can this teach us about how our global markets respond to their respective gravitational pulls of economics and monetary policies?

Again, a visual might prove useful here. As the figure below shows, when the moon is in the quarter phases and counteracting some of the sun’s force, the neap tides (as reflected in the light blue band) present less extremes during high and low tides.

ECONOMIC VERSUS FISCAL FACTORS

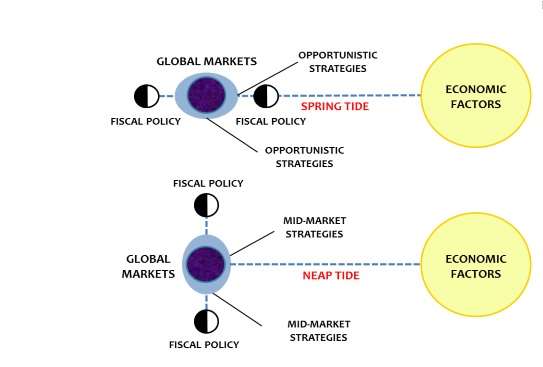

So what does the tidal lesson suggest to us? Investment strategies that rely on the classic market forces of supply and demand and the factors that influence their interplay have been stymied in recent years by the opposing forces of fiscal policy action, most notably quantitative easing and central bank actions, which have exerted their own influence on the markets to buoy prices and prevent an economic stalling.

These managers who employ strategies that seek to take advantage of traditional fundamental price action have been frustrated by the mitigating factors governmental actions have caused in the global markets. However, managers who have developed strategies that respond to incremental, short-term market movements and strategies that are market agnostic have found many opportunities to realize their objectives in recent years. Both strategic approaches have had opportunities to profit episodically, yet neither has found the global markets to offer sustained long-term opportunities for any singular approach.

BUILDING AN ALL-WEATHER PORTFOLIO

To bring home the analogy between this and the tidal forces, opportunistic strategies perform better during spring tide cycles in the markets, while mid-market strategies succeed best during the neap tide cycles in the markets. Investors who recognize the need to incorporate both opportunistic and middle market movement managers in their portfolios can position themselves for a true “all-weather” portfolio construction.

If we redraw the solar graphic to reflect the impact of economic supply and demand factors and governmental monetary policy by substituting economic factors with the sun and the often-greater force of fiscal policy action with the moon, the same graphic might look like the image that follows:

VARIETY IS THE BELLWETHER APPROACH

While nothing about the prior discussion is ground-breaking or new, it bears repeating that the best investment strategy for most investors is to embrace variety, where strategies and market exposures work together to deliver an overall target objective. This is the bellwether approach most wealth managers try to construct for their clients, while institutional asset managers do the same for their long-term objectives.

Investors owe it to themselves to learn more about the variety of market strategies that can perform in diverse market cycles and phases. The more flexible investors can be in constructing their portfolio with an advisor, the greater the likelihood that they will successfully navigate today’s markets to their long-term investment goals.

Diane Harrison is principal and owner of Panegyric Marketing, a strategic marketing communications firm founded in 2002 and specializing in a wide range of writing services within the alternative assets sector. She has over 20 years’ of expertise in hedge fund marketing, investor relations, sales collateral, and a variety of thought leadership deliverables. Panegyric Marketing received consecutive year awards in 2013-14 as IHFA’s Innovative Marketing Firm of the Year and AI’s Marketing Communications Firm of the Year- US. A published author and speaker, Ms. Harrison’s work has appeared in many industry publications, both in print and on-line.

Contact: dharrison@panegyricmarketing.com or visit www.panegyricmarketing.com.