By Brad Case, Ph.D., CFA, CAIA

By Brad Case, Ph.D., CFA, CAIA

On balance it’s probably positive, provided you’re in the market during enough good periods to offset the pernicious effects of leverage during bad periods. Unfortunately fund managers have managed leverage very badly.

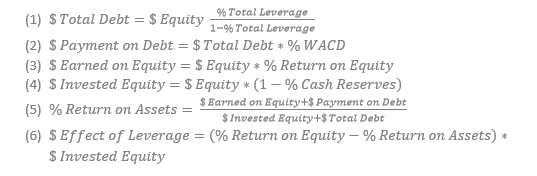

Here’s how to estimate the effect of leverage on the basis of typically available data:

Since 2000Q1 the National Council of Real Estate Investment Fiduciaries (NCREIF, as part of its ODCE data base) has published quarterly data on three of the four items necessary to estimate the effect of leverage on gross total returns of the average returns of core private real estate funds:

- Return on Equity (%)

- Total Leverage (%)

- Cash Reserves (%)

The fourth necessary data item is the weighted average cost of debt. While NCREIF does not publish WACD data, I estimated it in each quarter by averaging the three lowest WACD figures reported for the same quarter by listed property companies (mostly equity REITs).

As an example, assume you had invested $10 million in the average core fund during 2010Q3. The average total leverage in that quarter was 29.60%, so total debt was $4,204,092. (I’m rounding in my explanation, but not in the underlying data.) The three listed property companies reporting the lowest WACD during that quarter (Franklin Street Properties, UDR, and Government Properties Income Trust) had an average WACD of 3.76% on an annualized basis, so your payment on debt during 2010Q3 would be estimated at $4,204,092 * 3.76% / 4 = $39,557. Meanwhile, ODCE reported an average gross return on equity of 5.45%, so dollars earned on equity were $545,057. The average cash reserve was 6.21%, so invested equity was $9,378,813. Those figures imply that the return on assets was ($545,057 + $39,557) / ($9,378,813 + $4,204,092) = 4.30%. Finally, the effect of leverage then was 5.45% - 4.30% = 1.15%, or $107,531 based on your invested equity.

That’s an extreme example: the best quarter shown in the ODCE data base. How bad can it be in the bad times, even for a core fund? During 2009Q1 leverage averaged 29.55%, so total debt was $4,194,986. Imputed WACD was 3.57% (based on the figures reported by Ashford Hospitality Trust, Franklin Street Properties, and Kilroy Realty), so debt payments would be estimated at $37,471. Average gross return on equity was -13.69% (ugh!) or -$1,368,642. Average cash reserve was 2.70% (nothing like being fully invested at exactly the wrong time!), so invested equity was $9,729,526. Implied return on assets was (-$1,368,642 + $37,471) / ($9,729,526 + $4,194,986) = -9.56%. The effect of leverage, then, was -13.69% + 9.56% = -4.13% or $401,489 based on an investment of $10 million.

Leverage seems to have had a positive effect during 43 quarters available in the ODCE data base and a negative effect during the other 16 available quarters, with the leverage effect averaging +0.41% per good quarter and -0.98% per bad quarter. Fewer data points are available for the NCREIF/Townsend indices of value-added and opportunistic funds: the available data suggest that the effect of leverage for value-add funds has averaged +1.51% during 15 good quarters and -4.28% during nine bad quarters, while for opportunistic funds it seems to have averaged +1.97% during 15 good quarters and -4.80% during nine bad quarters.

The data suggest that an investor would have to be in core funds during 40 good quarters to erase the effects of the 16 bad quarters shown in the ODCE data base; value-add and opportunistic funds would require 26 and 22 good quarters, respectively, to erase the damage done during the bad quarters shown in the limited available historical data base.

Perhaps the most depressing finding is that fund managers seem to have done a really bad job of managing both leverage and cash reserves. The correlation between leverage and ROE is -0.46 for core funds, -0.41 for value-add funds, and -0.49 for opportunistic funds: that is, fund managers have tended to maximize leverage just when it would be most damaging, and minimized it just when it would be most beneficial. On the other hand, the correlation between cash reserves and ROE is +0.25 for core funds (data are not available for value-add or opportunistic funds): that is, fund managers have tended to be most fully invested just when it was most damaging, and be least invested just when returns were highest.

These results tend to mirror those reported by Shilling & Wurtzebach [2012], who asked whether anything other than differences in the use of leverage explain the returns of value-added and opportunistic real estate investments relative to core. The authors found that “value-added and opportunistic investing in times of rising property prices during expansionary periods leads to lower, not higher, returns, even though, ceteris paribus, the use of higher leverage by value-added and opportunistic fund managers should be associated with higher returns. Only one hypothesis explains this result: value-added and opportunistic fund managers generally use a high amount of debt to fund deals, regardless of market conditions. Hence, it is hard for them to scale up their returns to a level palatable to investors when property prices are high and expected returns are low. However, the use of leverage scales up the volatility of their returns, a fact that leads to being farther above or below the return to core investments.”

That’s poor investment management.

Brad Case is senior vice president, research & industry information for the National Association of Real Estate Investment Trusts (NAREIT). Dr. Case has researched residential and commercial real estate markets, domestically and globally, for more than 25 years. His research encompasses investment return characteristics including returns, volatilities, and correlations with other assets; measuring appreciation in property values; inflation protection; use of DCC-GARCH and Markov regime switching models to measure and predict investment characteristics; the length of the real estate market cycle; and the role of the investment horizon. He holds patents as the co-inventor of the FTSE NAREIT PureProperty(r) index methodology and the backward-forward trading contract. Dr. Case earned his Ph.D. in Economics at Yale University, where he worked with Robert Shiller and William Goetzmann, and holds the Certified Alternative Investment Analyst (CAIA) designation.