Twentieth-First Century Fox Inc. has two classes of common stock, non-voting and voting. Normally, if there were no other significant difference between the two classes, (such as, say, priority in the event of liquidation), a naïve observer would probably expect the voting shares to have greater value than the non-voting common shares. The ability to vote should have some positive value, even if it is only a small one.

Twentieth-First Century Fox Inc. has two classes of common stock, non-voting and voting. Normally, if there were no other significant difference between the two classes, (such as, say, priority in the event of liquidation), a naïve observer would probably expect the voting shares to have greater value than the non-voting common shares. The ability to vote should have some positive value, even if it is only a small one.

Until May 2014, this expectation would have been accurate. The voting shares traded at an average 6.2% premium to the non-voting shares. In May, though, the company delisted in Australia, and since then the prices have flipped.

To review: the reason for dual share structure is that Rupert Murdoch and his family wants to maintain control, yet they don't want to have to own as large an equity share as they would need in order to do so otherwise. As of the end of January 2015 there were only 0.8 billion shares of voting (or Class B) stock outstanding. Murdoch and kin control 39.7% of that. There are also 1.3 billion non-voting or Class A shares.

One of the major non-Murdoch investors is ValueAct Capital; a San Francisco based hedge fund managed by Jeffrey Ubben.

People familiar with the matter

Reuters is now reporting (and I am taking them at their word for purposes of discussion) that major investors – they don’t say which -- are demanding the opportunity to convert their voting shares into non-voting shares, as a simple arbitrage play in the face of the discrepancy. Reuters reporter cited unnamed "people familiar with the matter" who say that certain investors, including representatives of "major hedge funds," have met with Fox management in recent years to discuss convertibility. In effect, they are trying to convince Murdoch to accept an even larger share of the voting rights than he already has.

Why would voting rights have sunk to the discount price against the non-voting shares that this suggests?

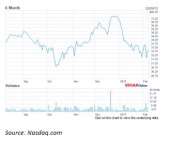

Near the end of last year the nonvoting shares (NASDAQ: FOXA) reached $39, they’ve fallen steadily since, and closed on February 6th at $33.58. Meanwhile the voting shares (FOX) reached $37.25 at the peak, last year, and have fallen in parallel to the FOXA fall since, closing on February 6th at $32.565.

There are several reasons for the discrepancy as it turns out. Two will suffice. First, investors who hold any shares to Twenty-First Century, with or without voting rights, generally accept the fact that they are along for the ride; that the Murdoch clan will remain in charge for the foreseeable future. That fact along may explain by the former premium may have sunk, perhaps to zero, even though it doesn’t by itself explain a discount.

Solving the Mystery

Second, then, the discount has come about because the company delisted from the Australian Stock Exchange, consolidating its trading on NASDAQ. This has made Twenty-First a foreign-listed company for Australian institutions, many of which are not allowed to own such things. They’ve been unwinding their positions, and this unwinding has disproportionately hit the voting shares.

Mystery solved. Indeed, the discount may be a very transient one. Dow Jones plans to index the voting shares later this year. That will raise their value for some institutions, and may well restore the premium, in a victory for the original naïve expectations.

In the meantime, will the arb play work out? Will the holders of voting shares get convertibility? My guess, probably not. The mere possibility of convertibility creates the threat of dilution for the non-voting class, and that in turn may constitute a drag on its price. The Murdoch interest likely wants to avoid that drag more than it wants to expand its own percentage of the voting class.