A new study by the EDHEC-Risk Institute has found that those who have invested in smart beta exchange traded funds are on the whole, pleased with the results.

A new study by the EDHEC-Risk Institute has found that those who have invested in smart beta exchange traded funds are on the whole, pleased with the results.

That is a statement that demands a bit of definition. Although the familiar sort of ETF is a passive instrument designed to track the performance of a financial index, often through the use of a capitalization/weighting scheme, the “smart beta” ETFs adopt a variety of alternative approaches to weighting, seeking to fill specific niches in an investors’ portfolio.

Among the non-cap-weighting schemes listed by the authors of the new study, Felix Goltz and Véronique le Sourd, are equal weighting; minimum variance; and characteristics-weighted ETFs. Generically they are called “smart beta” ETFs and there has been “tremendous growth” in their segment of the ETF market, both in terms of new product development and assets under management. These authors cite the independent research shop ETFGI for the proposition that as of the end of August 2014, 15% of the assets in any ETF or ETF-like products were in smart beta indexes.

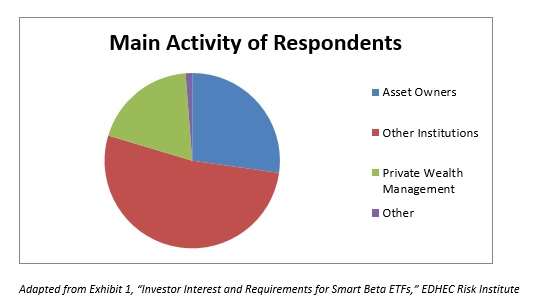

Let us also define the data base a bit. EDHEC received 222 replies to its questions about the perceptions and practices of European invests in the ETF space. The respondents broke down into these groups: asset owners (i.e. pension funds or insurance companies); other institutional IMs; private wealth management; other. This breakdown is an excuse for the ever popular pie chart.

The two groups of institutional investors concerned account for 78% of respondents. By country: 27 European countries were represented among the respondents. Switzerland, the United Kingdom, and France were all quite well represented. Those three countries account for 47% of the whole.

But of the 222 replies to the questionnaire, only 25% reported actually using, or being affiliated with an institution that uses, such products at present. Another 40% are with organizations that are “considering investment in such products in the near future.” For the purpose of measuring satisfaction, of course, the focus has to be on those respondents who actually have made use of smart beta.

Satisfaction Achieved

The definitional task complete, we should return to the original statement. The study has found that those who have invested in smart beta exchange traded funds are on the whole, pleased with the results.

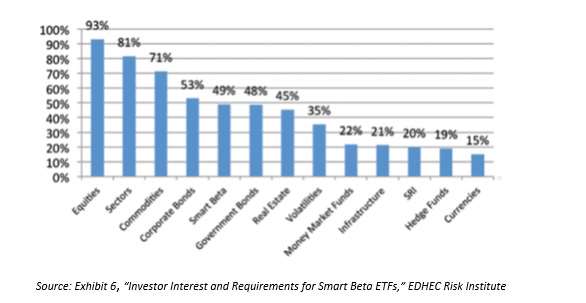

The exhibit below gives an idea of the range of ETF and ETF-like products employed by this group.

About three quarters (74%) of smart beta ETF users say that they are satisfied with them. Further, when the survey asks in a more open ended way what are a respondent’s top priorities for future product development in the ETF space, smart beta dominates the list that results,

The authors observe that among the six biggest priorities listed by investors is response to that open-ended question, four concern smart beta approaches.

But … satisfaction is not bliss. Investors do have some concerns about smart alpha. Most important, the alleged smartness shouldn’t become an excuse for opacity. Eighty-eight percent of respondents said that smart beta indexes require full transparency on methodology and risk analytics. This transparency “is not only the best protection against the risks arising from conflicts of interests, but it is also instrumental to improving the informational efficiency of the indexing industry.”

The Two Authors

Felix Goltz is EDHEC-Risk’s head of applied research. He has a Ph.D. in finance from the University of Nice Sophia-Antipolis. He also studied economics and business administration at the University of Bayreuth and EDHEC Business School.

Véronique le Sourd has a Master’s in applied mathematics from Pierre and Marie Curie University, Paris. She is a senior research engineer at EDHEC-Risk.