How many ways are there to list expenses? And how many different sorts of possible expenses could fund advisors in principle charge to their investors? How forthcoming about these possibilities are registered investment advisors at present, given the brochures on file with the Securities and Exchange Commission?

How many ways are there to list expenses? And how many different sorts of possible expenses could fund advisors in principle charge to their investors? How forthcoming about these possibilities are registered investment advisors at present, given the brochures on file with the Securities and Exchange Commission?

A Connecticut based data analytic company has issued a new White Paper on the fund expense practices of alternative asset managers that addresses these points. It finds … practice is all over the proverbial map. Although it may seem likely a priori that over time some settled conventions will develop, they haven’t yet.

As the white paper, from Convergence, observes, this is an issue on which the SEC has focused a good deal of its recent energies. It requires RIAs to disclose in their ADV “any other types of fees or expenses clients may pay in connection with their advisory services.”

Convergence concludes from its research into industry practices that there is a lot of variance in the “depth, breadth, and quality of expense disclosure practices” across fund types and strategies.

It reached this conclusion on the basis of 2,600 Form ADVs, nearly half of them (1,288) from hedge funds. The rest came from VC, PE, and real estate funds.

What is intriguing about the study is what Convergence did with that data base. It created a ”dynamic dictionary” or “term objects” – words and phrase used in expense disclosures. A quick quantitative statement of semantic inconsistency is this: Convergence’s algorithms discovered that more than 1,800 “term objects” were employed to describe what were only a little more than 200 distinct expense categories. Even more briefly put: Convergence discovered a lot of divergence. One advisor will write of “fees paid to providers who may produce, maintain, and monitor the books and records of the fund that are not affiliated with the Advisor.” Another, using more concision, may write, “third party fund accounting & administration.”

The disclosures were distributed among peer groups. For example, hedge funds with a primary debt-distress strategy constitute one peer group. For less granular purposes, “hedge funds” as a whole constituted a single peer group.

How Many Expense Groups

One central question for the study was: how many distinct expense groups do funds, in their various peer groups, disclose? Among hedge fund advisors in particular, the mode was for disclosure of between 16 and 20 expense bundles. Almost as many (28%) disclose between 11 and 15. A few hedge funds (8%) disclose a very wide bundle of possible expenses, between 26 and 33.

For purposes of contrast, consider the Private Equity peer group. Here the 16-20 expense-group bundle was a much larger part of the whole than it was for hedge funds. Forty two percent of the PE funds fell into that range. The second-largest bundle, for PEs, (21%) consisted of those who reported between 21 and 25 expense groups.

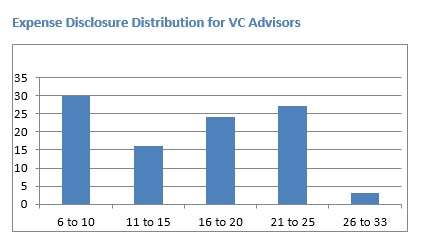

VC advisors displayed a pattern that wasn’t even remotely bell-like. Indeed, if the highest range of expenses disclosed, the 26 -33 range, were to be excluded from this graph, this would be a bowl rather than a bell.

Expense Disclosure Distribution for VC Advisors

For the purpose of showing the disparities among the peer groups, below is the expense disclosure distribution for PE Advisors.

This one does look a little bit like a bell. At least the mode is in the center. But there is a sharp skew, with 33 observations to the left of the mode and only 24 to the right.

Final Thoughts

A broad conclusion of the numbers crunching is that no peer group concentration exists, that is, no peer group dominates any of the expense group size bands.

What is the significance of the data? In the words of John Phinney, co-president of Convergence, “It is important that Advisors and Investors have empirical market-based data on what expense practices are on and off market when they discuss fees.” It is possible, moreover, that by tabulating this data Convergence has taken part in the development of a more predictable set of disclosure practices.

Hedge fund advisors as a group tend to disclose with greater consistency than the other peer groups, while real estate advisors are the least consistent of the peer groups.