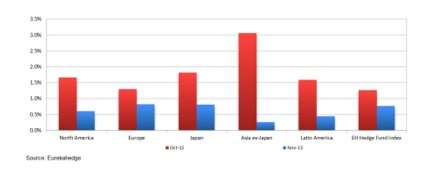

News from Venezuela and Argentina at last is such as to inspire more laughter than tears among investors. But in general, as a new report from Eurekahedge says, hedge funds with mandates in all the regions of the globe showed gains in both October and November 2015. Less happily, gains were less in November than they had been in October, again without exception across regions.

Europe and Japan mandated funds led the tables, gaining 0.82% each. In the case of the Japanese funds, Eurekahedge attributes the size of the gain to positive Q3 numbers in that country and a commitment from the Bank of Japan to meet its inflation target. Both of these events have cheered investors, pulling up the equity markets in general. The Nikkei 225 was up 3.48% for the month and the Tokyo Topix was up 1.42%.

In Europe, the positive performance in November also seems derived from a reading of the intentions of central bankers, in this case of course those of the ECB. Many hedge funds with European mandates have taken positions on the EUR/USD pair.

In Europe, again akin to the situation in Japan, there is positive news from the equity markets. DAX is up 4.9% for the month, the CAC is up 1.22%.

In North America, too, everybody spent a fair amount of mental effort in November focusing on the intentions of central bankers, in this case those of the Federal Reserve, and what it was going to do (has since done) in December. North American managers came in third in November, as you can see from the height of the first blue bar on the above chart.

Cheerful Political News

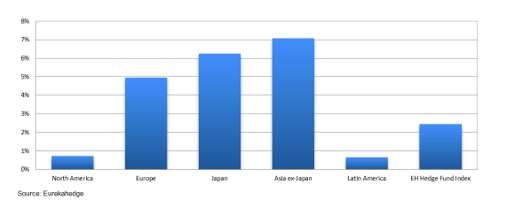

But to return to Latin America, politics provided cheerful news for investors in November and heading into December. Mauricio Macri, the mayor of Buenos Aires, won an upset victory over Daniel Scioli of the Front for Victory (FPV). MERVAL reflected the investor optimism that Macri inspires, and hedge fund managers have benefitted from that wind at their backs.

Meanwhile, in Venezuela, the political winds in November were evidently turning against the anti-investment legacy of the late Hugo Chavez, and so of his successor Nicolas Maduro. The parliamentary elections of December 6th in Venezuela confirmed November’s sense of hope. The Democratic Unity Roundtable, the anti-Chavez party, won a super majority.

Things did not go swimmingly for managers of hedge funds with mandates for Asia ex-Japan in November, though. Their numbers only barely managed to stay in the positive, after having outperformed everybody in October. As with the other regions mentioned above, the news from the hedge fund world in Asia ex-Japan reflects the news from equity markets there. The Hang Seng Index fell 2.84% in November.

Asia ex-Japan managers still lead the other regions on a year-to-date basis. North America is doing only a little better than Latin America, YTD, as the graph below indicates:

Short Volatility

The Eurekahedge report also updates its recipients on the CBOE Eurekahedge Volatility Indexes, that is, on a group of four equally weighted volatility indices - long volatility, short volatility, relative value and tail risk.

This grouping is designed to track performance of fund managers who take specific views of implied volatility toward the goal of positive absolute return. As the names imply, the CBOE Eurekahedge Short Volatility Index tracks the performance consequences of a net short view on implied volatility.

The short volatility index was the stand-out performer of the four in November, with a gain of 1.1%, followed by relative value volatility with 0.52%. Year to date, though, it is relative value that stands out at 5.49%, and short volatility that comes in a somewhat distant second, at 2.69%.

The tail-risk (i.e. the “black swan”) index is in the fourth position both by month and year to date. Although most quants will agree in general with the proposition that an old-fashioned Gaussian understanding of risk understates actual risk, that tails are wider than they ‘should’ be: the ability to harness that consensus view to actually make some money seems a lot trickier, a lot more rare, than the ability to write fascinating articles about how well a black swan approach should work.

By strategy, November was a very bad month for both event driven funds and those who seek to make alpha from distressed debt.