The long declivity of the commodities sector has had repercussions for the world of dry bulk shipping – that is, for the maritime bulk shipping of such commodities as coal or iron ore. This creates a good opportunity for a warning against the impulse to “catch a falling knife.” As that wonderful slang term suggests, a bloody hand is always the most likely result.

The Baltic Exchange indicates that the rates for ships that carry dry bulk are now at record low levels. They are now only 1/20th what they were at the peak in 2008. “Oh, that was a world-historical bubble, an outlier,” you say. Yes, but more proximately, the same index was above 2300 as recently as December 2014. It is now roughly 1/5th of that. So the fall however measured is impressive and recent. How knife-like is it?

In a somewhat counter-intuitive development, rates for tankers that transport crude oil are moving in the opposite direction. Reuters has attributed this to aggressive action by the firms that own the tankers, who have been scrapping them precisely to head off the sort of capacity surplus seen in the dry bulk market.

Consider Caspian

The stereotypical knife chaser will think, ”ah, it is a good time to buy into the market [buying dry bulk capacity in one form or another, perhaps via ownership of the equity in one of the firms involved] in order to get the bargain before the rebound.”

Some alpha seekers are in fact engaging in such a play. Consider Caspian Capital Partners as an example. I don’t mean to suggest that Caspian’s analysis is as simplistic as that suggested in the above paragraph. It comes to mind simply because it filed its 13Q before year’s end 2015, showing that had significant long exposure to Star Bulk Carriers Corp, at 7.35% of its portfolio. Star Bulk is an Athens headquartered dry bulk shipping concern that trades on the Nasdaq Global Select Market (SBLK).

The problem with a Star Bulk play or with analogous plays is that the bottom of this bargain basement may not yet have been found. Fitch only recently downgraded the sector from stable to negative.

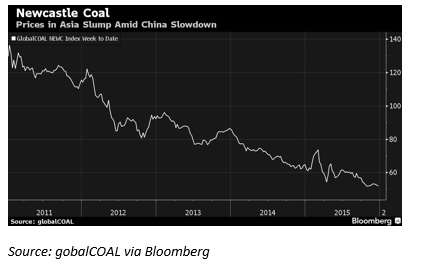

The problem behind the problem, as so often in markets of late, is China. Specifically, it is in the way in which China has fallen out of love with coal. China’s importation of the dry black carbon-based stuff dropped dramatically in 2014 and more so in 2015. Largely as a consequence of China’s slump, global consumption of coal fell in 2014 for the first time in the 21st century. The main pricing benchmark in Asia, one which bears the charming name “Newcastle Coal,” fell to about $52 a ton over the course of 2015, a fifth year of decline.

The executive director of the International Energy Agency, Fatih Birol, said in December 2015 that the IEA expects coal prices to “remain under pressure” for four to five years.

Firms continue to exit the industry. In September, after two years of massive bleeding, Global Maritime Investment Cyprus Ltd filed for bankruptcy protection in the U.S., carrying $169 million in debt, most of it unsecured. Daiichi Chuo Kisen Kaisha took the analogous step under the laws of Japan the same month.

Six Brave Hedge Funds

The aforementioned Star Bulk may be seeking to reduce its own carrying capacity. On December 8 it announced the sale of four of its vessels to unnamed buyers.

SBLK’s equity has been taking a beating. It lost almost 90% of its value last year. It was selling for about $6 when 2015 began. This was down to $3 at midyear and to $0.61 as the year ended.

There are six hedge funds with long positions on SBLK, and their positions total roughly $298 million. So some alpha seekers have the stomach for these waters, but seasickness seems the least of the hazards.