Context Summits has published a detailed report on the views of those who allocate money into hedge funds.

Almost everybody they talked to is in on the act. Ninety-six percent of investors expect to allocate to two or more hedge funds in 2016. A majority (57%) were prepared to invest in at least four hedge funds in 2016. But there may be some sample bias there, since the sample consisted of attendees at Context Summits Miami 2016, on February 3-5.

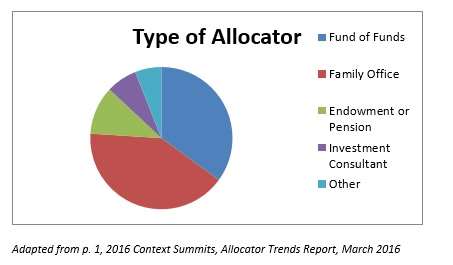

The graph below indicates the type of allocators involved in the survey. Most were working either for family offices or for funds of funds.

Some key points about the attitudes of the allocators are:

- Process trumps performance as the key appeal;

- Risk controls are more important than size (AUM);

- There is little or no consensus as to where the underlying markets are headed;

- There is a preference for emerging over established alternatives managers;

- The attitude toward coming Federal Reserve rate hikes is a compound of uncertainty and indifference.

Starting with the final of those points: the survey takers asked participants how many times the Federal Reserve would raise interest rates in 2016. The choices available were: zero, once, twice, three times, four times, five-or-more times. Nearly one third (33%) said there would be no raise at all. The same number said there will be two raises. A slightly smaller number (30%) said there will be one increase. This left 5% believing there will be three increases. Actually, that adds up to 101%, which presumably is an artifact of rounding. At any rate, nobody at all opted for a higher number than three.

The survey data was collected soon after the Fed’s late-January decision not to start the year off with a rate hike. The data may be considered a consensus that the Fed is roughly where it wants to be and/or where it is going to have to stay for some time. Still, the range from 0 to 3 hikes makes room for a wide range of uncertainty, and the nearly even split among three possibilities emphasizes that.

Yet 30% of the participants thought it an uncertainty that didn’t matter all that much, saying that a Fed rate hike wouldn’t change their own allocation scheme anyway.

That is difficult to read. What about a plunge into negative rates? Would that change the plans of anyone in that 30% group?

The authors of the report say that the 30% figure “echoes the growing sentiment among some that the Fed can do little to encourage consumption” precisely in the light of recent efforts both in Europe and in Japan “to move interest rates into negative territory.”

New Managers and Underlying Markets

Moving up the bullet list: participants were quite willing to consider new managers and investment strategies. They see the emerging managers as “more nimble, able to shift exposures in volatile markets, and [offering] more favorable fees and structures.” Only 32% are looking for managers with a track record of more than 5 years.

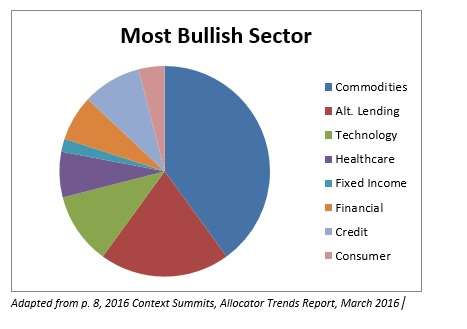

On underlying markets: 40% of participants say that commodities are the most bullish sector. Another 32% list commodities as their most bearish sector. Surely there’s no consensus there!

Intriguingly, too, very few participants saw the healthcare sector as superlative in either direction, remarkable though is the degree of attention it has drawn. Only 7% named it as most bullish and only 9% as most bearish.

The authors speculate that the reason for the sharp disagreement about commodities is “the difficulty in calling the bottom of the market.” Is crude oil, for example, which is at a historically low valuation, as low as it is going to get? And even if so, is it going to bounce back or stay in this valley for long enough to continue a shake-out among producers? Or, is it already on its way back up to three-digit prices on the barrel?

Risk Controls and Process

Consistent with the preference often expressed for newbies, the allocators in this survey are not impressed by size. AUM ranking is “among the least important factors when it comes to allocators deciding whether to allocate to a new or existing fund.” They are much more interested in strong risk controls and solid operations.

The authors regard this as a cautionary tale for managers, who “can’t just get by on their brands or previous success anymore.”

Unsurprisingly, performance remains an important driver for the allocators, but the would-be buyers are even more interested in whether the managers can show them a proven and reputable investment process. As the authors put it, “Potential investors want to feel confident that performance isn’t just a result of short-term luck.”

Context Summits plans to publish a more detailed analysis of its survey results next month.