By Baird’s Asset Manager Research

Exploring the costs and benefits of two alternative investment approaches

Synopsis

Proponents of active and passive investment management styles have made exhaustive and valid arguments for and against both approaches. Each has its merits and inherent drawbacks, and this paper will not endorse one style over the other. Rather, our goal is to define the characteristics of each approach in an effort to help you determine which best suits your needs and preferences.

Investors encounter different opportunities and challenges at different times, which can help determine the investment management approach that is the best for them. On one hand, we believe active management can add value when coupled with strict due diligence services. On the other hand, when limited investment options are available or the best you can do is “average” performance, passive investment options may make more sense due to fees and other considerations. Regardless, a clearer understanding of how to balance and leverage both active and passive management is crucial to realizing your investment objectives.

The Basics of Active and Passive Management

The proliferation of passive management strategies in recent years is well documented and evidenced by the exponential growth of the Exchange Traded Fund (ETF) marketplace. Currently there are more than 1,000 ETFs available; many of these employ passive strategies and range from those replicating the widely recognized S&P 500 Index to more niche indexes such as the S&P Global Water Index. Passive management has proven a viable strategy and is challenging the more traditional portfolio construction practice of investing strictly in active managers.

Several factors should be considered when deciding between active and passive management. These factors vary greatly from one client to another and the solutions can be just as unique, ranging from a purely passive to purely active approach or some combination of both. The correct use of these strategies can help build a portfolio better suited to your specific needs.

Active vs. Passive Management Defined

The difference between active and passive investment management lies primarily in the stated goal and the approach used to reach it. Active management is overseen by investment professionals striving to outperform specific benchmarks. Passive management (i.e., index ETFs, index funds) attempts to replicate the return pattern of a specific benchmark. With active management, investment experts are hired based on the perceived value they can add above and beyond the benchmark. Passive management often stresses low costs, tax efficiency and the concept of market efficiency.

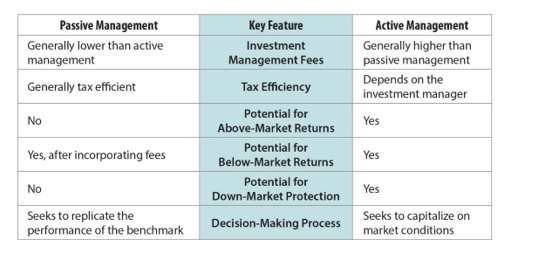

As Table 1 shows, there are trade-offs between the costs and potential benefits of the two approaches. Passive management will maintain exposure to the market, but not offer any potential for above-benchmark returns (or down-market protection). Active management offers the potential for above-market returns, but comes with the chance that the manager won’t beat the stated benchmark. Also, neither approach can completely shelter you from the possibility of below-market returns. These variables and the nuances of your specific situation make this a decision best made with the assistance of your Financial Advisor. The remainder of this paper should help guide you through that decision-making process by offering examples of when, where and how Baird believes active or passive strategies should be used.

Implementation of Active and Passive Strategies

Proceeding from the conclusion that both active and passive management are valid strategies, the question becomes where and when is one more appropriate than the other? The following pages will outline several common considerations.

The Truth of Market Efficiency

Market efficiency is the degree to which stock prices reflect all available information. In a perfectly efficient market, all stocks are precisely valued and no active manager has the ability to outperform the market. If the market were completely inefficient, nearly all active managers would be able to succeed. The truth lies somewhere in the middle.

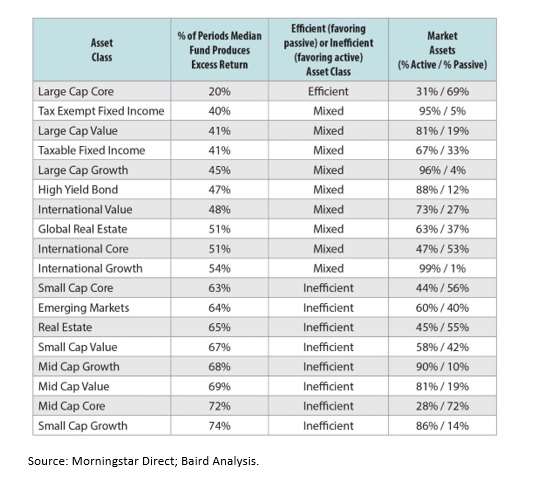

For the purposes of this study, several major asset classes were examined to identify the less efficient asset classes that are conducive to active management and the more efficient asset classes that are best suited for passive management (Table 2). Baird measured the frequency that the median, or average, mutual fund in a given asset class was able to provide excess return above its benchmark (second column below).

Various one-year, three-year and five-year periods were examined over the past 15 years, giving us a total of 147 distinct observations per asset class. For example, the median Small Value fund was able to outperform its benchmark 67% of these periods, making it a relatively inefficient asset class. Alternatively, the median Large-Cap Core fund outperformed only 20% of the time, making it a fairly efficient asset class.

Asset classes that tend to be more efficient include large cap equities and fixed income. Small- and mid-cap styles tend to be less efficient. Other asset classes are mixed, requiring a judgment call as to whether active or passive management would be most appropriate. It is worth noting that while fixed income is toward the efficient end of the scale, in our opinion there are few passive options that merit investment. Many of these options have exhibited higher-than-anticipated tracking error. Tracking error is the degree to which returns vary from the actual benchmarks, something that passive investments strive to minimize. Another potential concern is that most popular bond indices are market-weighted, so passive strategies are often biased toward issuers with the most outstanding debt. For this reason, passive fixed income strategies typically have heavy exposure to U.S. treasuries and other government securities. Our study causes us to question whether the marketplace recognizes that some asset classes are more efficient than others and, therefore, have a distinct bias toward active or passive management. The best way to measure this is to determine what percentage of assets in an asset class are invested in active or passive managers (fourth column in Table 2). Large Growth is dominated by active management (96%), and it is a fairly efficient asset class. On the other hand, some inefficient asset classes, such as Small-Cap Core and Mid-Cap Core, have a high percentage of passive managers (both above 50%). This is counterintuitive and leads us to the conclusion that some investment portfolios are not optimally constructed.

All else being equal, it is our opinion that active management be used where it has the best chance of success, and passive management be used to round out the asset allocation. This may lead to an optimal portfolio that plays into the strengths of the different investment options.

What Is Average?

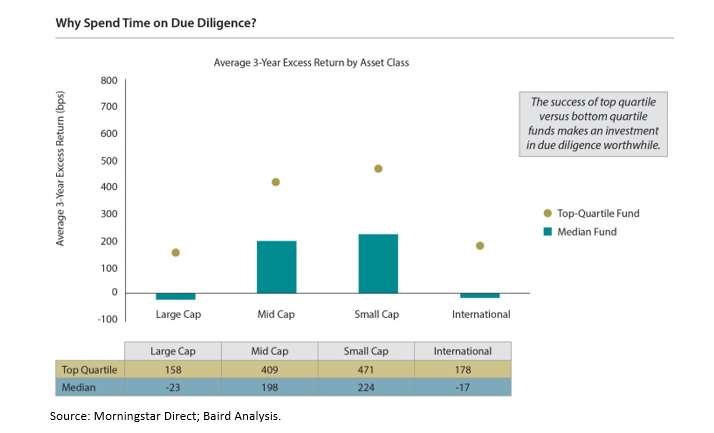

In the previous section on market efficiency, we focused on the performance of the median mutual fund. Since no investor strives to invest with an “average” manager, we examined how the outcome would change for those invested with a top-quartile manager (i.e., performance that ranks in the top 25th percentile of the peer group universe). For example, the median mid-cap manager outperformed the benchmark by 198 bps, on average, for three-year periods included in the study, while top-quartile managers added 409 bps of excess return during those periods. (1 basis point = .01%)

Clearly, there is a great difference between average and above-average managers, and this directly influences a client’s ability to meet or exceed performance expectations. While there is no certain way to identify and invest strictly in top-quartile managers, the success rates of average versus above-average managers makes a strong case for trying to identify superior options. Also, it is increasingly difficult for a manager to constantly remain a top-quartile performer over many periods. However, Baird believes that by conducting thorough research and due diligence on investment managers, it becomes easier to identify which of them exhibit the characteristics associated with consistent, long-term success.

For the 15-year period ending January 31, 2015, excess returns for individual mutual funds were collected by asset class. The excess returns were calculated based on rolling three-year periods (n=49).

All performance is gross of the funds’ management expense ratio.

Other Important Considerations

Below are the other most common factors that should weigh into your decision when choosing a money manager. These are important topics to discuss with your Financial Advisor.

Investment Time Horizon

How soon you need the proceeds from invested assets to reach specific goals determines that investment’s time horizon. Some assets are designated for long-term growth until retirement, while others may be invested in the stock market for the short-term, in lieu of CDs or savings accounts. In either case, the length of the anticipated holding period for those assets can help dictate which solution is most appropriate. Baird’s studies have shown that active managers have a higher probability of success if held for longer periods. For example, the frequency that a manager adds value increases from 59% to 73% by extending the holding period from one year to five years. Baird recommends allowing at least one full market cycle of three-to-five years for most active managers to realize the potential of their strategies. For holding periods of a year or less, passive management can be a quick and effective way to gain exposure to the market without high transaction costs.

Investment Management Fees

Management fees are an inescapable fact of investing. Passive management generally has lower fees relative to active management, but fees can vary greatly even for investments striving to replicate the same benchmark. The average ETF expense ratio as of December 2015 was 0.56%, which includes lower-priced ETFs that track major indices and higher-priced options that track specific sectors or industries. Given that ETFs and index funds have similar objectives, in most cases you would be generally best served by utilizing the lowest-priced option available to you.

Fees are equally as important when considering active management options, but the decision is a bit more complicated. First, fees vary more with active management, but so does manager quality. It is generally prudent to invest in lower-priced options because of the lower hurdle, especially in the fixed income arena, where the performance spreads are already narrow. However, final judgment must be made based on whether you and your Financial Advisor believe a money manager has the requisite talent to earn the fees by providing adequate excess return. This is where due diligence becomes critical.

Tax Sensitivity

Generally speaking, passive investments offer investors greater tax efficiency because they create fewer capital gains situations due to in-kind distribution. Also, because of the low turnover of the securities that comprise most of the indices such funds are modeled after, not a lot of trading is necessary. For active managers, however, buying and selling securities is one way they attempt to add value by capturing excess returns. This can come at the cost of increased capital gains exposure. For those clients who are very sensitive to taxes, ETFs can be a suitable option.

Market Conditions

Evidence suggests that certain market conditions favor active or passive management. Actively managed investments have historically performed better than passively managed investments when the markets are decidedly negative, or in flat to moderate markets. Conversely, passive investments have generally outperformed in swiftly rising markets. While there are exceptions to these dynamics, understanding when market conditions are favorable or unfavorable for an investment style is important in managing expectations.

Conclusion

There is no consensus regarding which approach provides superior results. With proper due diligence, active management has the potential to provide above-market returns. However, passive management creates a level of consistency, knowing that investment performance will not vary greatly from the benchmark. Before making a decision, it is important to consider your expected time horizon, tax sensitivity, ability to tolerate performance variation and other factors. Your Financial Advisor can help you weigh your objectives and concerns to determine which approach is most appropriate for you.

ETFs are subject to the same risks as their underlying securities and trade on an exchange throughout the day. Redemptions may be limited, and, if purchased outside of a fee-based portfolio, brokerage commissions are charged on each trade.

Past performance is not a guarantee of future results, and no investment, regardless of the length of time held, is guaranteed to be profitable. Indices are un-managed, and an investment cannot be made directly in one.

Investors should consider the investment objectives, risks, charges and expenses of any fund carefully before investing. This and other information is found in the prospectus. For a prospectus, contact your Baird Financial Advisor. Please read the prospectus carefully before investing.

©2016 Robert W. Baird & Co. rwbaird.com. 800-RW-BAIRD

MC-46563. First use: 3/2016.