A new survey sponsored by Northern Trust suggests that asset managers need to capture more value from available data, and that in order to do so they need both a more flexible strategy and stronger leadership than many now have.

The surveyors talked to more than 200 executives in insurance companies and asset managers, in both the United States and Europe. About half of the respondents were based in the United States, about 15 percent in the United Kingdom. Slicing it differently, about half of them work for firms with assets under management of more than $5 billion.

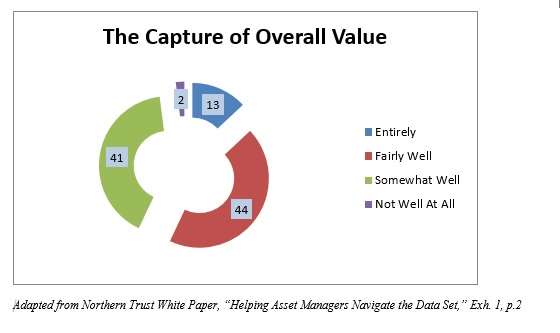

Only 13 percent of their respondents thought that they do successfully capture the full value of their data.

“Whether they are looking for ways to manage their investment decisions, monitor their risks, or improve their reporting, they need to extract more value from their data to gain actionable insights,” said Pete Cherecwich, Americas head of Corporate and Institutional Services, at Northern Trust, said in a statement accompanying release of the survey.

The white paper attributes one trenchant summary of the field to Ugo Catterina, senior vice president and head of U.S. internal audit at Allianz Asset Management, “If you don’t have a solid strategy and you consider everything at the same level, there is no prioritization, and the ensuing mayhem makes it exceedingly difficult to find direction in this ocean of data.”

Droughts and Floods are Both Bad

The sheer volume of data now available has exploded, especially in the last five years. Data about individual securities performance, for example, or the trading patterns of investment professionals, has been tracked much more effectively in recent years than ever before. This explosion requires that prioritization Catterina referenced. Priorities in turn follow from a strategy. Such a strategy may incorporate several goals, among them: improving investment decisions; managing risks; modelling or otherwise assessing risks; improving internal reporting; managing cost; improving external reporting. In order to execute strategy and achieve such goals, the data handlers of the investing institution require effective leadership.

A majority of the respondents to the survey expect to be spending more money and time on data three years from now than they are at present. Fortunately, a majority believe that their return on investment in this area will increase over those three years. In the words of Dan Shoenholz, managing director of Parthenon-EY Strategy Services, Ernst & Young LLP, “We’ve seen a lot of investment in the last few years in costly infrastructure to enable data analytics … and we’re on the cusp of seeing more activity in the integration and utilization of this information.”

Does one hand know what the other hand knows? This is one problem discussed in the white paper: an organization receives data from a lot of different directions, into a number of different internal organs, with different formats, collected for different purposes.

The Greatest Difficulties

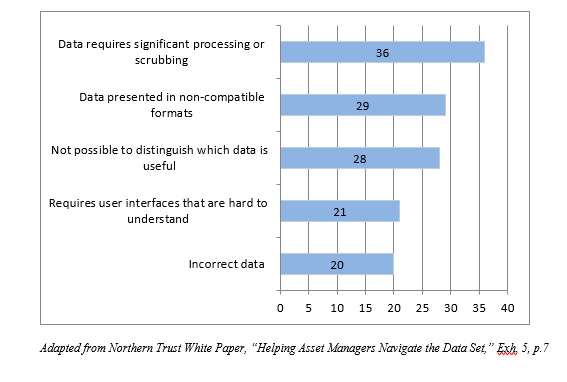

Surveyors asked the asset managers what they thought were the three greatest difficulties on getting and sharing data. The graph below shows the percentage of respondents who listed each of the listed problems as one of those top three.

Where there is a problem, there is a market. The white paper quotes Neal Pawar, principal and chief technology officer at AQR Capital Management, thus: “The way we scrub data is not proprietary – the secret sauce is in the models, not in our ability to parse Bloomberg data feeds. So the idea of a custodian or transfer agent or some independent third party providing this as a service resonates tremendously with most of us in the industry.”

Still, a firm cannot contract out its core responsibilities. The question remains: who within the firm provides the necessary leadership? The survey displays a “dispersion of responsibility,” a confusion on this point. Companies that do have strong leadership on the issue of data, then, have an important competitive advantage. Those that don’t have such leadership: have a problem.