By Diane Harrison

As 2016 winds down, U.S. investors and voters alike have embraced the concept of change. While we may not know how this will manifest in 2017, the twin fates of government and investment are moving into this unknown together, although perhaps not unafraid.

Lethargy, exhaustion, languor, fatigue…all these describe the 2016 effectiveness of both the U.S. government in total and the performance measures of the financial funds that investors look to for future growth. With a Supreme Court deadlocked since January following the death of Justice Antonin Scalia, and a slugfest of a presidential campaign that dominated the US political discourse through November, nothing of import has come out of Congress in months. And while the stock market may be on a tear since the November 9 election result announcement, it does not necessarily translate on a fund basis to more than a mix of so-so growth that leaves investors yawning.

With The Barclay Hedge Fund Index showing a 2016 YTD return of 5.45% through November, and this following last year’s flat line performance of under 0.5%, the industry as a whole has been less than exciting for investors. Of course, there were pockets and individual performers within the space that achieved or exceeded expectations, but by and large, funds struggled to post substantial results in 2016.

“One half of the world fears stagnation, and the other half change.”--Marty Rubin

Some of the causes for this stagnation include bloated costs, diminished competition, and strangling regulations all working against the current model in both government operations and investment management.

Investors and fund managers are agreed in this area: costs, in the form of fees and operational expenses, are always in the forefront of their desire for change. Investors want to see reduced management fees and incentive fees that closely align with performance benchmarks and shared interests. Managers want to know that their business expenses, including the retention of quality service providers, experienced staff, and marketing efforts that deliver new business, are adequately covered by their fund’s revenues and planned growth.

A shrinking pool of investor capital that is willing to put money to work in many of these funds, and expanding regulatory requirements most funds need to comply with gobbling up an increasing share of the expense pie allocated to legal, compliance, and related record-keeping functions have been working against these desires. Investors are simply unwilling to take on the additional risk of undercapitalized businesses that cannot project the desired bench strength of resources in all of these areas, so managers are growing more reliant on securing an equity partner or early stage seeder who can bolster the capital requirements needed to grow.

But managers and investors can expect 2017 to be different. Change, while perhaps not clearly outlined at present, is certainly going to be a major force in the coming year. The markets have already embraced this inevitability, as prices surged immediately following the election results outcome, and set record gains into December.

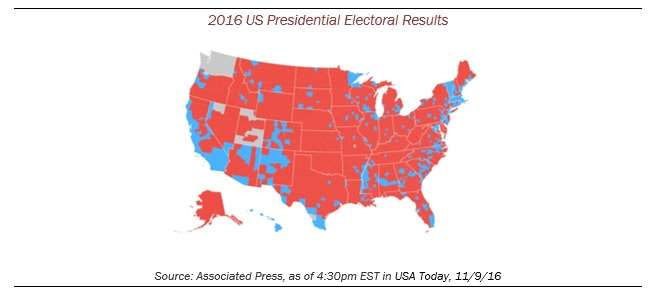

Investors anticipate a slate of reforms and economic undertakings that will shake up the market’s ennui of old. Some of the likely change elements include income tax simplification, infrastructure project undertakings, and a rollback of regulations in financial markets. Much like the electoral map below, which reflected a nation’s widespread desire to reject the status quo, 2017 will underwrite the next chapter in investment reform.

“Of the people, by the people, for the people” --Abraham Lincoln at Gettysburg

At Gettysburg in 1863, in one of the shortest yet most poignant speeches ever given in the US, Abraham Lincoln appealed to the nation to come together and move forward into the new landscape rent by the American Civil War. After years of bloody battles and a weary population wondering what exactly the nation actually won, Lincoln reminded them that the ability to self govern and work together towards change is the essence of what the nation was founded upon.

Flash forward 150 years and today’s investment community can learn from 2016’s election process divisiveness and focus a clear eye on some of the top challenges in the hedge fund industry:

- Need for streamlining: reflecting a populist desire for change—both in regulatory reform and in fee structures

- Increase attractiveness: acknowledging the rising cry for demonstrated value, perhaps easiest to recognize in the slackening of new hedge fund capital commitments in 2016

- Willingness to embrace flexibility: letting go of a nostalgic need to cling to what used to be versus what needs to be going forward.

Lead, follow, or get out of the way--Thomas Paine, General Patton, Mitt Romney

All of the above have been credited with some variation of the familiar saying. Regardless of who said it first, the sentiment is prophetic as we move into a new year. 2017’s hedge fund industry must to find a way to incorporate more choices for investors—in transparency, fee flexibility, and options in which to invest for performance gains.

The industry also would benefit from a rollback of the regulations currently choking the fund universe, robust and diversified competition among fund strategies offering real values for investors, and greater participation of both parties, who need each other in order to survive and thrive. To quote Bob Dylan, “I feel a change comin' on.” Let 2017 be a referendum for the change policy that is needed in both government and investment management.

Diane Harrison is principal and owner of Panegyric Marketing, a strategic marketing communications firm founded in 2002 specializing in alternative assets. She has over 25 years’ of expertise in hedge fund and private equity marketing, investor relations, articles, white papers, blog posts, and other thought leadership deliverables. In 2016, Panegyric Marketing has been shortlisted for Family Wealth Report’s Outstanding Contribution to Wealth Management Thought Leadership and received AI Hedge Fund's Outstanding Contribution to Wealth Management Thought Leadership, M&A's Excellence in Financial Services Marketing Communications – USA, AI’s Innovation in Alternatives 2016, Wealth & Finance International's Best In Funds 2016 – US and their Women in Wealth Awards Best Financial Services Marketing Company - New York, and Investor Review's 2016 Fund Elite Award's Most Innovative Financial Services Marketing Firm USA. A published author and speaker, Ms. Harrison’s work has appeared in many industry publications, both in print and on-line. To read more of her published work in alternatives, please visit www.scribd.com/dahhome. Contact: dharrison@panegyricmarketing.com or visit www.panegyricmarketing.com.