A paper by Helmut Gründl and two associates, discussed at the June 2016 meeting of the Organization for Economic Cooperation and Development, and published “on the responsibility of the Secretary-General” thereof, proposes that the regulators of insurers active in the various member countries should see their role not as the promotion of long-term investment as such, nor as the hindering of such investment. They should see their role as the promotion of mechanisms that allow for an accurate understanding of the insurers’ risk exposures.

The OECD report begins with an assessment of what has happened to the insurance industry worldwide in the near-decade that has passed since the global financial crisis. The component entities’ risk appetites have gone in different directions, some opting for “re-risking” strategies by investing in emerging markets and/or in alternative assets. Others have gone for de-risking, “investing in shorter term assets so as to cope with changing regulation,” and sticking with fixed income investments.

The problem with de-risking

The problem with de-risking, for insurance companies as for pension funds, is of course the danger that the resulting income stream will be inadequate “to cover investment guarantees that often constitute an important product feature” of the contracts at the base of the institution.

The risk management strategy varies with the type of institution. Life insurers use economic scenario generators for their utility in valuation. Property and casualty insurers generally employ stochastic models to cope with their liquidity risk: dynamic financial analysis is an example.

In plain English that means that the actuarial math of accidents and liabilities is inherently less precise than the math for human life expectancies, so insuring against the former is trickier than ensuring against the latter, which is why “property and casualty insurers are usually not able to invest a large part of their portfolio in illiquid, long-term investment projects.” This is the market-based reality and not something regulators should try to fix.

In many countries a risk-based solvency regime is either already in place or is under consideration. If a regulatory regime employs short-term horizons than it tilts the considerations of the affected insurers in favor of short-term assets. Gründl et al take a dim view of such tilting.

They also consider take the hypothesis that small and medium sized investors in particular may have difficulty investing in long-term assets, and that in order to allow them to do so, “risk mitigation by the public sector may assist.” They are no big fans of that, though: any mitigation measure should be “justified by a clear and strong public interest,” as in the case of easing investment in an important public-private infrastructure project.

Four Sorts of Excessive Risk

Speaking broadly, there are four developments that may lead an insurer into a situation of excessive risk, and this paper briefly recounts them.

First, an insurer could be charging insufficient premiums or, in hopes of expanding its business volume, it might have adopted an imprudent underwriting policy.

Second, though, an insurer could change its asset allocation toward a riskier portfolio, one not supported by the premiums it has been collecting, producing the same effect from the opposite direction.

Third, the management can reduce the company’s equity capital endowment (insofar as regulators will require in their jurisdiction) increasing the probability of insolvency.

Finally, the managers may simply fail to make the proper reinsurance contracts necessary to manage risks.

Large Insurer Survey and Derivatives

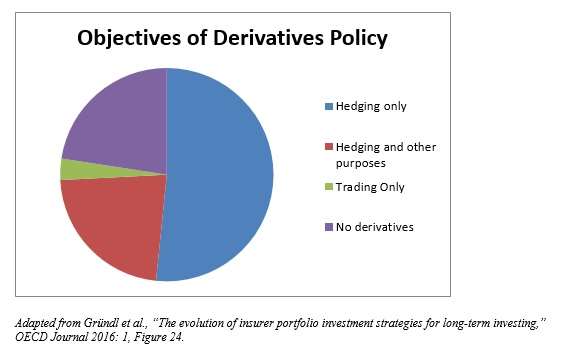

As the paper observes, the OECD’s large insurer survey asked participants to describe the chief objectives of their use of derivatives. The survey received only thirty-one “valid responses” to this, which sounds like a small survey. Still, more than half (16) said they use derivatives for hedging purposes only. Only one respondent (3%, if you prefer) said that it uses derivatives only for its trading portfolio. That left two equal sized groups of 7 insurers each, saying they don’t use derivatives on the one hand, or that their use of derivatives is for both for hedging and for “other purposes” on the other. The pie looks thus:

The authors of this paper are affiliated with the International Center for Insurance Regulation and Goethe University, in Frankfurt, Germany.