A recent working paper from the European Corporate Governance Institute discusses direct investment by sovereign wealth funds in private equity transactions – that is, it discusses an ongoing shift from investing in PE funds to co-investing with PE funds.

The paper describes this as a trend especially viable in the years since the global financial crisis, a decade during which many SWFs have opted to invest in real estate or in illiquid infrastructure projects. This trend, moreover, serves valuable systemic purposes, for example by “making risk capital available to SMEs and young firms in emerging and developing countries.”

Tabulating a Tilt

The paper cites a 2015 study by BlackRock that surveyed over 100 investors with a total of $6 trillion assets under management, finding that nearly half (49%) expected to increase their allocations to real estate. Investments in real estate are compelling because central banks have kept interest rates so low for so long, and because rents tend to rise with real earning.

Unfortunately, the move toward alternative investments by SWFs also has systemic costs, for example it “can create hidden risks and overvaluation of illiquid asset classes.”

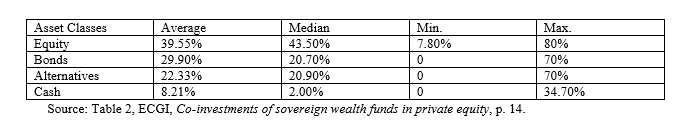

Early on, the paper tabulates the “alternative tilt of SWF in their strategic asset allocations.” The table comes out as follows:

For purposes of this paper, an SWF is a member of the International Forum of Sovereign Wealth Funds so long as its figures are available. Some funds are more transparent than others, but this data on the four main asset categories is generally out there.

These figures already make clear the great variance in the extent to which SWFs use alternatives, which can range up to as much as 70% of their portfolios, or down to 0%. But the high average and median figures also lend plausibility to the common suggestion that the price of some asset classes may be affected by SWF activity.

PE Firms

But (one might ask) why involve PE firms/funds at all? Why could an SWF not simply invest in infrastructure or real estate directly and solo?

Part of the answer is that involving a PE firm ties the hands of the SWF managers in valuable ways. It removes what may otherwise be a strong temptation to invest in projects that are politically rather than commercially viable.

SWFs could tie their hands in this desirable manner by simply investing as an LP with a PE that operates in the infrastructure or real estate space as general partner, and letting the GP make all the specific investment decisions.

But they calculate that they might change the nature of the LP/GP direction in their favor by adopting the co-investment model, investing some money in the PE fund, but simultaneously investing directly in certain of the target firms in the PE fund’s portfolio.

Among the PE firms that find themselves engaged in co-investments with SWFs, the report names two: Apis Growth Fund I (of the United Kingdom) and McRock Capital (of Canada). Apis has $157 million in AUM, McRock has $65 million. Apis’ investors include the Swedish government’s development financier, Swedfund, and the European Investment Bank. McRock’s investors include Alberta Enterprise and Export Development Canada.

Two Final Points

The study also looked into a contention “common … in the literature,” that government involvement in private equity plays a role in increase the level of research and development. It found “only limited support” for that hypothesis in its own data. SWFs typically want to invest in projects that are “in a mature phase of development,” not in potentially cutting edge start-ups.

Finally, on a geographical question: the SWFs investing in Europe are very likely to be looking to participate in the financial or information technology sectors. Those investing in Africa or the Middle East are more likely to be interested in the energy sector.