Citi Global Perspectives and Solutions (Citi GPS) has published a new white paper on the global need for infrastructure spending.

The authors are: Jason Channell, head of EMEA Infrastructure Research; Elizabeth Curmi, Global Thematic Analyst; and David Lubin, head of Emerging Markets Economics.

Channell et al contend that “now could be the time for a global infrastructure push,” to the tune of $58.6 trillion over the next 15 years, and that “the most exciting opportunities are by region and industry.” They discuss what both governments and private stakeholders have to do to get this push underway.

Long Date Liabilities ISO Long-Horizon Assets

Some of the players in the financial orchestra are “perfectly suited to infrastructure finance.” Pension funds and insurance companies, for example, both have long-dated liabilities, and want to link them to long-horizon assets. Infrastructure projects can offer such institutions a stable and secure revenue stream for a long period.

But the global financial crisis has had an unfortunate impact on some of these institutions’ ability to play in this orchestra. Monoline insurers, for example, have largely disappeared, while other insurers are constrained because infrastructure assets don’t count within their Solvency II limits. Meanwhile “banks find themselves held back by Basel III implications.”

Some assets lend themselves better than others to private financing. Among these: highways, broadband networks, mass-transit systems, energy networks. In each of these cases, consumers pay as they use, and the revenue stream is desirable.

Those assets that perform a “social good” rather than an economic good are trickier as subjects for private financing, and here creative thinking comes in handy. The government of Hong Kong wanted to keep the costs of using its Metro low, so it didn’t want to allow a private developer simply to charge what the traffic would bear. Instead, it granted the developer property rights around the stations. As the stations came into use and traffic increased (thanks to those low fares) the real estate in closest proximity to the stations increased in value.

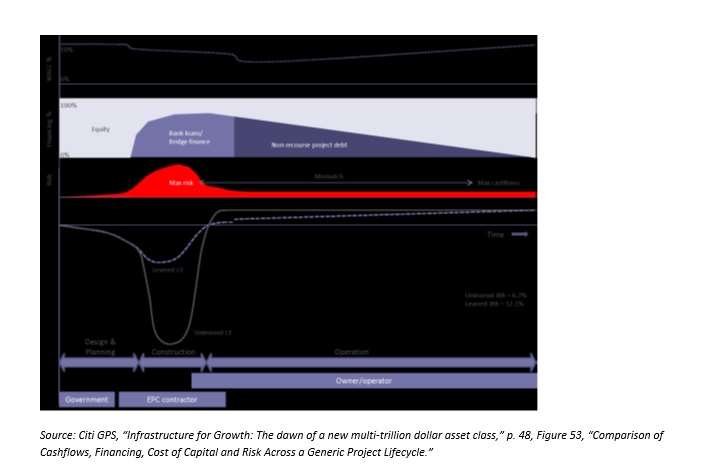

Speaking more generally, Citi GPS breaks a project down into three stages: design and planning; construction; and operation. Each has a different profile re: capital needs and risk.

Design and planning requires relatively little in terms of capital, although there are of course corporate and staff costs, asa well as outlays for site testing and surveying. The chief risk involved for an investor involved in a consortium funding this is that these costs will have to be written off as lost if another bidder gets the contract in question.

Risks Do Not Correlate With Cash Flow

Risks are considerably higher during the construction phase, which often sees delays and cost overruns, design and specification changes, late deliveries of critical inputs, and so forth. These risks, Citi tells us, “are exacerbated by the often enormous scale of the projects, sometimes multi-billion in dollar terms.” At this stage, work is still in part equity financed, but there are also a lot of bank loans and bridge financing, and some drawdown of project bonds.

Finally, there is operation. The road opens for traffic, the electrical plant starts selling its wattage, the new pipes play host to running water, etc. Once a project has established an EBITDA track record, it is fairly straightforward for the project managers to arrange long-term debt finance at a much lower rate than they were able to get during construction, and they gradually retrire the non-recourse project debt. Further, there is a “remaining equity buffer [which] shields debt investors from operating fluctuations as well as providing a safety net on the capital value should the asset ‘fail’ and have to be sold as a distressed asset.”

Scary but Doable

In the schematic above, the design & planning phase is represented as roughly one-sixth of the whole, the construction phase another one-sixth, and the operation of the asset as the remaining two thirds. The cash flow is very heavily negative during that second sixth, when risks are highest.

It sounds scary. Still, in contrast to lackluster market returns in many other asset classes at present, infrastructure investing looks attractive, and the risks look like something to be managed rather than something that should cause the eligible institutions to run for the hills.