A new CFA Institute report, working from a survey of 1,145 leaders in the contemporary global investment industry, discusses the mega-trends at work, including: technological advance, shifting client preferences, new macroeconomic conditions, changing regulatory regimes amidst geopolitical novelties, and new demographics.

The report, entitled “Future State of the Investment Profession: Pursuing Better Outcomes – for the End Investor, the Industry, and Society,” emphasizes that technological advance can empower both individuals and organizations. In either capacity, it may well generate fintech disruption, challenging the existing business models, for example, and requiring a rework of the regulatory infrastructure. In one possible future, traditional active management will shrink under such pressures, replaced by alternatives, smart betas, and outcome-oriented solutions.

Another possibility is that changing demographics (specifically, the aging of the population in many countries) may well combine with technological empowerment, macro-economic facts, and resource management issues, to produce what the report calls the “lower for longer” scenario. This is an unappetizing possible future in which natural interest rates stay low, in defiance of central bankers’ hopes for “normalization.” In this “new normal,” China and the emerging nations in particular will see a lot of hoarding of cash. Disappointment with outcomes could increase a broad public distrust of asset management. Other bad outcomes lie down that road.

Purposeful Capitalism

More optimistically, the report maps out a future the CFA Institute calls “purposeful capitalism.” This could arise as a consequence of and response to all of the above listed mega-trends. This involves making markets for publicly listed equity and private equity alike deeper, more fair, and more efficient. On the part of asset managers, it requires that they increase their attention to fiduciary responsibility and the alignment of their own incentives with those of their investors.

Specifically on the subject of pensions, the report observes that private pension markets are barbelled, that is, on the one hand they adapt to mature markets and on the other hand they are developing the mature markets. It adds that the whole field is “ripe for disruption:” needing new models, and more efficient use of existing technology.

Some Numbers

Some quick numbers illustrate the direction in which these mega-trends are moving the industry. Of the CFA charter holders surveyed, 52% expect either substantial or moderate contraction of the profit margins for asset management firms; 57% think institutions will be looking to insource more of their investment management activities to save on their costs; 70% expect that investors will up their allocation to passive investment vehicles; and more than four fifths, a whopping 84%, expect consolidation in the investment industry.

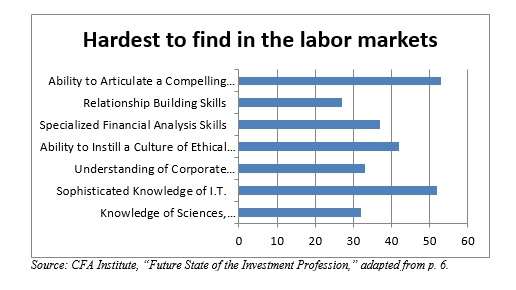

Those surveyed also answered questions about what skills they expect will be most highly valued in years to come. This big question in turn has four parts: most highly valued for CIOs and portfolio managers?; for the CEOs of asset managers?; for the CEOs of asset owners?: or simply those skills hardest to find in the labor market.

The general consensus was that the two skills that will be hardest to find in the labor market will be (1) an ability to articulate a compelling vision for the institution; and (2) a sophisticated knowledge of information technology. Further information one may find in the graph below.

A Few Words on Trust

Trust is good. When distrust toward key social institutions becomes the norm, those institutions falter, related institution change for the worse, and misconceived substitutes can come into being.

Investment managers must preserve or improve trust from investors and other stakeholders through communication “early, fully, and often.” It will also help if they “show some societal responsibility.”

The CFA Institute says that it “will be conducting further engagement on how organizations should be dealing with fiduciary responsibility and other issues where legal and regulatory frameworks are at a potential conflict with the ambiguities and uncertainties endemic to the investment field.”