Are companies leveling with their shareholders and stakeholders in reporting data pertinent to their environmental and social impacts and their governance issues?

Whether they are or aren’t levelling: how important is that as part of their relationship with their investors?

For Ernst & Young, these questions have become more pressing since the eruption of the Volkswagen emissions scandal in September 2015, when the Environmental Protection Agency in the US said that VW had been rigging its cars so that they can score unrealistically well on emissions tests. That happened on a Friday. The following Monday, the first trading day after news broke, the value of VW shares fell by more than 24%.

As E&Y says in a new report, that scandal was one of a number of recent events that together have “propelled ESG to the top of the global agenda.”

E&Y latest survey of investor sentiment on such matters is at the heart of a new report, “Is Your nonfinancial performance revealing the true value of your business to investors? 2017”. The bottom line: 60% of the respondents, asked if companies adequately disclose their ESG risks, answered “no.” This is a considerable increase from the answer to the same question a year before.

Mathew Nelson, E&Y’s global leader for climate change and sustainabiity services, in a preface to the new report, says that, with that large level of disappoiintment as a backdrop, it is re-assuring that new reporting practices are getting themselves adopted “across industries and geographies.” He refers for example to the Financial Stability Board’s Task Force on Climate-related financial disclosures as one of the initiatives that is “establishing crucial benchmarks and standards designed to better define what’s effective, credible and comparable.”

An Investors’ PoV

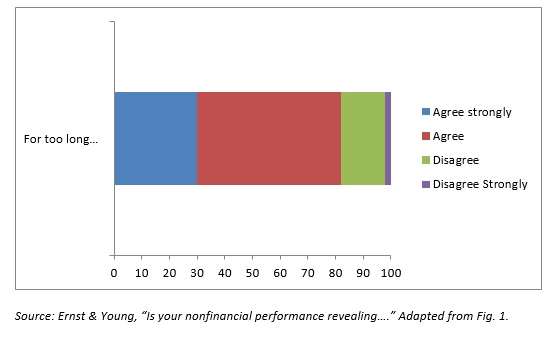

But to begin with the basics: what percentage of investors believe that it is none of their concern what a company is doing on ESG matters? A very small one. Asked whether “over the long term ESG issues … have real and quantifiable impacts,” 42% believe “strongly” that they do. Another 50% said yes, they do have such impacts, though without characterizing their belief as strong. Simple noncontroversial arithmetic tells us that the total “yes’ answer, then, is 92%. Only 2% disagree “strongly,” and only another 6% disagree not-so-strongly.

When investors were asked to agree or disagree with the view that “for too long, companies have not considered” environmental and social concerns “core to their business,” the break down was as follows: 82% agreed (with one of the two offered degrees of intensity), only 18% disagreed.

The chief investment officer of the New Zealand Superannuation [Old Age] Fund, Matt Whineray, referenced two meta-studies that support a bottom-line case for ESG awareness. The more recent of these was a 2015 study by Oxford University with Arabesque Asset Management, taking account of more than 200 academic studies. It found that 88% of the research under review supported solid ESG practices.

Investors want disclosure in these fields because, as the E & Y report puts it, they want “an additional lens for reviewing and evaluating companies and assets, not just for equity performance, but for factors that affect bond pricing and real estate valuations.”

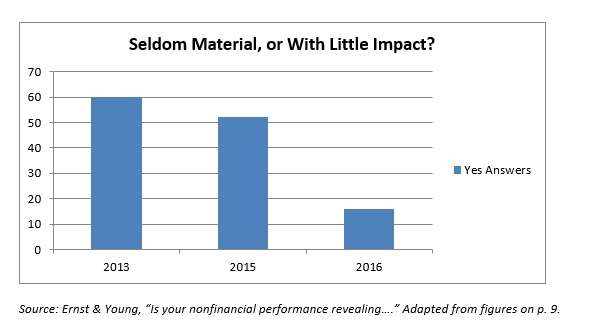

Attitudes have changed over time. In a 2013 survey, 60% of respondents said that “nonfinancial disclosures are seldom material or have financial impact.” That number has since fallen to just 16%.

An Issuers’ PoV

Ernst & Young also looks at the whole matter of ESG reporting from the point of view of issuers, and it asks about their motivations in disclosure. Apparently, the biggest single motivating factor is the need to build and maintain credibility/corporate reputation with investors. That is followed by the need to comply with regulatory requirements. Other factors exist (such as response to competitive pressures, or a demonstration of return on cost savings) but they lag far behind the top two: reputation and regulation.

Jacky Prudhomme, the head of ESG integration and social business investments at BNP Paribas, in Paris, says “companies now are clearly aware that talking about corporate social responsibility is really part of their reputation … the way they convince people that there is good management of their business.”