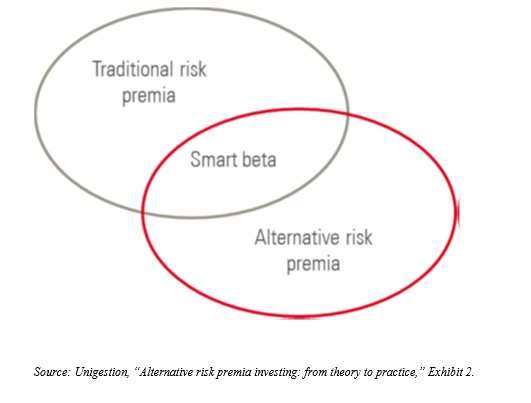

Unigestion has posted a research paper by Olivier Blin, Joan Lee, and Jérôme Teiletche, on “some of the practical considerations that should help investors get the most out of their allocation to” alternative risk premia (ARP) strategies. Unigestion is a boutique asset manager, and Blin is its head of cross asset systematic strategies. The idea behind “alternative risk premia” is straightforward. It has become apparent to many observers, traders, and investors that the traditional risk premia (term, credit, equity, illiquidity) are not the only games in town. There are other factors, and thus other premia to be had. There is, for example, the premium obtained by the foreign exchange carry strategy, i.e the strategy of going long on high yielding currencies and short low yielding currencies. These authors refer briefly to the academic literature on what exactly that premium is, that is, why the carry trade works. It may represent compensation for exposure to the economic growth risk, for example. But historic experience indicates that there is a premium there to be obtained. Another alternative risk premium is that obtained by the dividend carry. As a strategy, this can be implemented by going long on a synthetic constant maturity EuroStoxx 50 dividend future, while maintaining a short position on Eurostoxx 50 futures. A Venn Diagram Before getting to the practical issues, Blin et al take pains to distinguish such premia, as logical space, from smart beta. Smart beta strategies use alternative weighting schemes and receive in consequence “mixed exposure to both traditional and alternative risk alpha.” The relationship is indicated by the diagram below:  But, as noted above, the distinguishing feature of this paper is its discussion of how market participants might best put alternative risk premia into practice. The authors suggest, for example, that investors look for risk premia strategies that go beyond the status of a “:niche,” that are “implementable and scalable at a reasonable execution price.” Also, the underlying factor’s behavior should be explicable “in relation to the major economic and market regimes.” Allocating Among ARP Strategies Suppose an investor has decided on two or more premia/strategies in this space. How does it decide how to allocate among them? Unigestion suggests Equal Risk Contribution as a starting point. ERC assigns the same “volatility budget” to each component of the portfolio, thus appealing to investors who want a “no-choice” view. But ERC should only be a starting point, not the end of the consideration of allocation, these authors add. This is where we get to the necessity for an understanding of the prevailing economic and market regimes. In a recession, a cross-asset trend following strategy has an excess Sharpe ratio above 0.4, but carry strategies have a negative excess Sharpe ratio, -0.2. In an inflationary regime, that situation is nearly reversed. The cross-asset trend following number goes negative; the carry strategy number goes positive. In a market stress regime, the excess Sharpe ratio of carry strategy is not merely negative; it is close to -1.0. Such regimes, after all, may be considered the risk for which this premia, when it does work out, is the reward. These same three authors have another paper forthcoming which highlights the market regime issue for ARP strategies. Conclusion and Classification In conclusion, the authors deny the idea that ARP constitutes a “passing fad.” These premia constitute a real solution for investors. But those investors “should choose which strategy to invest in with considerable care: in particular, different strategies with the same name cane provide very different return streams.” Investors should also pay heed to how the ARP portion of their portfolio is “designed and implemented, as a simplistic approach may lead to unwelcome surprises.” The paper also contains a brief discussion of taxonomy. How should one go about classifying ARP strategies? One taxonomy is “academically driven,” and it distinguishes value, momentum, carry, etc. But the authors think this too rigid. There are some important premia that don’t fit into it very well. On the other hand, another strategy is driven by the practice of hedge funds working the field. It distinguishes by their styles: equity market neutral, macro, relative value. But the very fact that this is associated with hedge funds may deter investors. Accordingly, the Unigestion authors adopt what they call an “intermediary” terminology, classifying strategies in this space as members of one of three families: single-stock equity; macro directional; or yield capture.

But, as noted above, the distinguishing feature of this paper is its discussion of how market participants might best put alternative risk premia into practice. The authors suggest, for example, that investors look for risk premia strategies that go beyond the status of a “:niche,” that are “implementable and scalable at a reasonable execution price.” Also, the underlying factor’s behavior should be explicable “in relation to the major economic and market regimes.” Allocating Among ARP Strategies Suppose an investor has decided on two or more premia/strategies in this space. How does it decide how to allocate among them? Unigestion suggests Equal Risk Contribution as a starting point. ERC assigns the same “volatility budget” to each component of the portfolio, thus appealing to investors who want a “no-choice” view. But ERC should only be a starting point, not the end of the consideration of allocation, these authors add. This is where we get to the necessity for an understanding of the prevailing economic and market regimes. In a recession, a cross-asset trend following strategy has an excess Sharpe ratio above 0.4, but carry strategies have a negative excess Sharpe ratio, -0.2. In an inflationary regime, that situation is nearly reversed. The cross-asset trend following number goes negative; the carry strategy number goes positive. In a market stress regime, the excess Sharpe ratio of carry strategy is not merely negative; it is close to -1.0. Such regimes, after all, may be considered the risk for which this premia, when it does work out, is the reward. These same three authors have another paper forthcoming which highlights the market regime issue for ARP strategies. Conclusion and Classification In conclusion, the authors deny the idea that ARP constitutes a “passing fad.” These premia constitute a real solution for investors. But those investors “should choose which strategy to invest in with considerable care: in particular, different strategies with the same name cane provide very different return streams.” Investors should also pay heed to how the ARP portion of their portfolio is “designed and implemented, as a simplistic approach may lead to unwelcome surprises.” The paper also contains a brief discussion of taxonomy. How should one go about classifying ARP strategies? One taxonomy is “academically driven,” and it distinguishes value, momentum, carry, etc. But the authors think this too rigid. There are some important premia that don’t fit into it very well. On the other hand, another strategy is driven by the practice of hedge funds working the field. It distinguishes by their styles: equity market neutral, macro, relative value. But the very fact that this is associated with hedge funds may deter investors. Accordingly, the Unigestion authors adopt what they call an “intermediary” terminology, classifying strategies in this space as members of one of three families: single-stock equity; macro directional; or yield capture.

- Programs

- Events and Webcasts

- Resources

- About

- Official Merchandise

Search

Search Close

Close