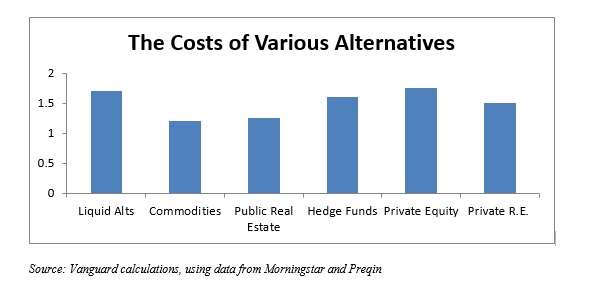

Vanguard, the manager of about 370 low cost traditional funds and ETFs, and an institution famously associated with low cost retail investing, has made public a new paper on the inclusion of alternative investments in target date funds. It isn’t enamored of the idea. Target date funds (TDFs), otherwise known as life cycle or age-based funds, are those designed to shift to a more conservative portfolio allocation as they age, usually as someone’s retirement date nears. These are less formally but more poetically known as “glide-path” funds, with a well-endowed retirement serving as the metaphorical safe landing. The authors of the new Vanguard paper on this subject are: Chris Tidmore, Scott J. Donaldson, Daniel B. Berkowitz, and Daren R. Roberts. They use the word “alternatives” broadly here to include any “investments or strategies typically not available and/or included in the retirement portfolios of individual investors.” That breaks down into six broad categories, as we shall see. First Part: A Filter The authors offer what they call a two-part framework for determining whether the inclusion of any of the six categories of alternative investments in a TDF portfolio is appropriate. The first part of the framework involves traditional investment standards and the second one involves more specific portfolio allocation ideas. The first part filters out “hedge funds, private equity, and private real estate” due to their “notably higher costs … increased complexity, lack of transparency, and limited liquidity….” The alternatives that pass through this filter are: commodities, overweight to REITs, and liquid alternatives. After very little further consideration, Tidmore et al. also exclude liquid alternatives, if not from all possible glide paths, at least from “further analysis in this commentary.” Liquid alts “represent a diverse category” that is highly dependent on the skill of the (active) managers. Thus a TDF plan sponsor would have to be very good at consistent selection of the top managers in the field to make it work. So from the six categories we have just two left: overweight to REITs and commodities. The authors use the phrase ‘overweight to REITs’ because they understand that REITs are typically used in life cycle products “as a public proxy for a direct allocation to private real estate,” so they are only “alternative” to traditional allocations to the extent a particular portfolio’s allocation is in excess of “what the market consensus believes is their market value.” The Filter’s Survivors The second part of the framework ends up pointing participants and sponsors away from the use of even the survivors of that first filter, though with language not quite so decisive. With regard to Vanguard’s own practice, the paper observes that it doesn’t employ either of these alternatives in its TDF portfolios. The allocation achieved for REITs through “an equity market capitalization-weighting scheme provides sufficient exposure.” As to commodities, Vanguard respects the benefits: inflation sensitivity and diversification. But it also finds that increased costs, the uncertainties surrounding systemic risk, and increased portfolio complexity outweigh the benefits. Tidmore et al go further than this though. They argue that “even if alternatives can be used at a low cost and with limited administrative complexity (and participant confusion), these strategies are likely to deliver modest benefits at best.” In an appendix Tidmore et al compare the cost of the six alternatives they have considered. “Cost” in this context is the median net expense ratio. The resulting graph (an adaptation of the paper’s Figure B-1 is below) shows PE as the most costly alternative, just edging out the liquids in this respect. Commodities and public real estate are the least costly.  Academic Research In another appendix, the authors offer some “further commentary” on the criteria they used in the ‘second part’ of the above two part framework. The first part (the filter) was based on general investment considerations, but the second part was based on portfolio construction criteria such as diversification benefit and improved wealth outcomes. The authors refer in this context to some of the academic research into what drives expected returns from the commodity futures portion of a portfolio. Some theorists think that it is a convenience yield or a diversification return. Others, though, think the return comes from the value of the insurance provided to commodity providers, as wheat farmers receive protection from an overly abundant harvest and the sudden drop in market wheat prices that would cause. The authors in this context refer us to a 2006 paper by Claude Erb and Campbell Harvey, “The Tactical and Strategic Value of Commodity Futures,” in the Financial Analysts Journal.

Academic Research In another appendix, the authors offer some “further commentary” on the criteria they used in the ‘second part’ of the above two part framework. The first part (the filter) was based on general investment considerations, but the second part was based on portfolio construction criteria such as diversification benefit and improved wealth outcomes. The authors refer in this context to some of the academic research into what drives expected returns from the commodity futures portion of a portfolio. Some theorists think that it is a convenience yield or a diversification return. Others, though, think the return comes from the value of the insurance provided to commodity providers, as wheat farmers receive protection from an overly abundant harvest and the sudden drop in market wheat prices that would cause. The authors in this context refer us to a 2006 paper by Claude Erb and Campbell Harvey, “The Tactical and Strategic Value of Commodity Futures,” in the Financial Analysts Journal.

- Programs

- Events and Webcasts

- Resources

- About

- Official Merchandise

Search

Search Close

Close