A new paper by Giuseppe Risalvato, a Ph.D. candidate at Università Carlo Cattaneo, Italy, contends that there is no “ethical sacrifice” in investing. That is, there is no discount that investors who want to be socially responsible will have to pay for that choice.

Risalvato makes two chief theoretical arguments to this conclusion: first, any ethical sacrifice can be diversified away “based on the principles of classical finance.” Second, even at the level of the individual security (before diversification comes into play) ethical risk can be avoided trough sufficiently extensive and detailed research.

Empirically, Risalvato contends that “ethical funds have performed better than traditional funds during the period of crisis and post-crisis” that is, since 2007, and have assumed the role of insurance for investors.

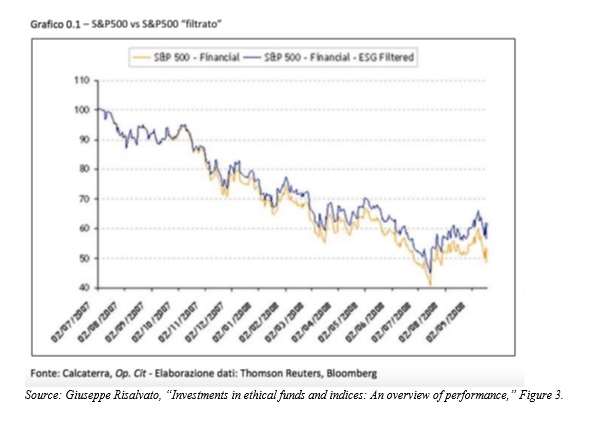

The graph below illustrates this point. The lighter line represents the movement of the S&P 500 from July 2007 to September 2008 – bringing us from an era when august figures were assuring us the “subprime” issues were safely “contained” right up to the eve of the Lehman bankruptcy.

July 2007, as it happens, was the month when Charles Prince, the CEO of Citigroup, memorably told a reporter for the Financial Times, “As long as the music is playing, you’ve got to get up and dance. We’re still dancing.”

Prince’s personal contribution on the dance floor came to an end that November, when the bank’s CDO- and MBS-related losses induced his retirement.

The lighter line represents the S&P, whereas the darker line represents the S&P in “filtered” form – that is, after the omission of issuers that do not meet certain environmental, social, or governance standards.

Diverging Lines

The two lines are identical through those final months of 2007. They start to diverge, in favor of the “filtered” form of the index, early in 2008, soon after Prince’s departure from Citigroup, as the discordant notes became obvious throughout the dance floor. The divergence between the two lines becomes larger as the crisis becomes more severe, and (though both lines are obviously headed down throughout this period) the discrepancy increasingly goes to the favor of the dark line, the filtered one.

As Risalvato observes, an industry devoted to doing that filtering, customizing the filtering in various ways, and packaging it for interested investors, has enjoyed considerable growth in the last ten years. Ethical indices “are now present in most of the world’s financial centers, each family of indices uses negative and positive screening criteria ….”

They are often defined by geography. The ECPI Group, in Milan, for example, has an ESG Index Series in China. It also collaborates with the FTSE Group on the Italy SRI Leaders, which in Risalvato’s words is “an equally weighted index made up of a selected basket of Italian companies that exhibit excellent characteristics in environmental, social and corporate governance.”

By December 2014, there were 1,874 socially responsible funds in Europe alone. Nearly a quarter of these (23%) invest only in Europe. Risalvato cites a KPMG paper in 2015 that said that 41% of the assets under management by such funds are in equity, 25% in bonds.

Who are the European issuers best represented in such portfolios? They include Sanofi, Vodafone, Total, Unilever Eni, and GlaxoSmithKline.

A Digression and a Conclusion

Allow this writer a brief digression on the last of those names. GlaxoSmithKline may seem to some an odd company to find on that list. It is a British pharmaceutical company headquartered in London – the outcome of a merger at the turn of the millennium between Glaxo Wellcome and SmithKline Beecham. It is routinely listed as part of “Big Pharma,” and of course Big Pharma comes under regulatory heat for practices the critics regard as flunking the “S” part of the ESG test.

For example, early last year the UK fined GSK more than GBP37 million for paying generic drug companies bribes through the period 2001-04 to get them to keep generic versions of Paroxetine (its anti-depressant) off the market, allowing it to continue charging a monopolistic price.

Still, GSK evidently gets through many filters, and the KPMG report on which Risalvato is relying came out prior to that UK enforcement action.

Risalvato’s bottom line is that “it would be a good result” if, in another 5 years, the percentage of the assets invested in ethical funds will have reached 10% of the number invested through al funds. He sees great promise for the industry.