A new Preqin paper presents the state of the alternatives investment industry in Australia and New Zealand.

Mark O’Hare, the CEO of Preqin, says in a Foreword that Preqin’s databases track 481 fund managers active in one or the other of those two countries, and 443 “significant institutional investors”

The report proper begins with an observation on the split of the alternatives industry in Australia and New Zealand as between private capital on the one hand and hedge funds on the other (with “private capital” understood to include PE, private debt funds, real estate, infrastructure, and natural resources funds). Two thirds of the assets managed in the alternatives sector are managed by private capital, the reminder by hedge funds. Looked at in terms of the broader region, the industry in these two countries represents 20% of all Asia-Pacific hedge funds, and 10% of Asia-Pacific private capital.

Starting Firms, Launching Funds

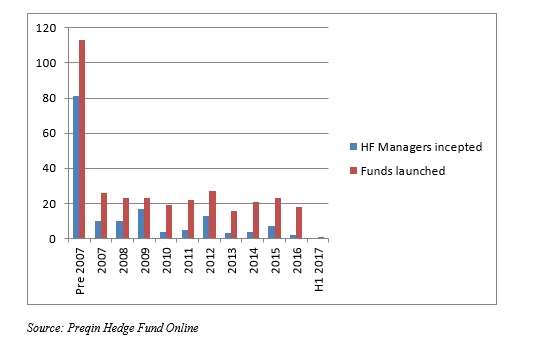

The graph below, adapted from Fig. 1.5 in the report, gives a sense of the growth of the hedge fund side of alternative investment in the region, both in terms of the inception of new hedge fund management firms and of the inception of new funds, and especially over the last decade.

For the above graph, the vintage year of the first fund is taken as the year of inception of the corresponding manager.

The chart represents steady growth during this period. The average number of firms begun each year is eight: the average number of new vehicles is 22. But the fact that there was only one new vehicle in the first half of this year, and that there were no new firms as of that time, indicates a slowing.

Top Performances

The top performing fund in the region in the PE/VC category right now is nearly 20 years old. It is the AMWIN Innovation Fund, 1998 vintage, from CHAMP Ventures. The runner-up in that group is Quadrant Capital Fund III, a buyout fund from Quadrant Private Equity.

The top-performing fund in the region in the real estate category is a comparative spring chicken, the Propertylink Australia Industrial Partnership, from Propertylink, with a 2013 vintage. The runner-up there is Altis Real Estate Equity Partnership Vintage 2, from Altis Property Partners, also 2013 vintage.

The top-performing hedge fund in the region is the PM Capital Global Companies Fund, of Sydney based PM Capital, with a net return of 34.69%. Its runner up is Optimal Japan Absolute Long Master Fund of Optimal Fund Management, also Sydney-based, with a net return of 30.47%. The top eight performers on this league table all define themselves as equity strategies funds. The best performing hedge fund outside the equity strategy realm is MGH Investment Fund (macro strategies, Wellington.)

New Zealand

Part of the report focuses specifically on New Zealand, where though the alternatives industry is smaller than that of Australia; it is active across a number of asset classes.

Geographically, its heart is Auckland, the home of 26 fund managers and 21 institutional investors active in this space. The corresponding numbers for Wellington are 11 and 12 respectively.

By strategy, New Zealand has 31 PE & VC fund managers; 9 hedge fund managers; 6 real estate fund managers, 3 natural resource fund managers, and 1 each of infrastructure and private debt funds.

Offshore Capital

The report incorporates an essay from James Wall, of Commonwealth Bank of Australia, about why Australia “will continue to be a magnet for offshore capital.” The answer is in his first paragraph, Australia has a “relatively stable political backdrop, well-understood legal system, transparent business practices and regulatory settings” which are all good for securing a country ‘haven’ status.

Lately, a lot of Chinese money has been finding its way into Australia.

In 2014, YanCoal, ENN Ecological Holdings, and Cheung Kong Infrastructure all made significant investments in Australian enterprises.

Likewise, in the last 18 months, Chinese institutions bought six healthcare companies in Australia. These transactions were in total worth more than A$5 billion.

As the world’s economic gravity moves into Asia, and as Australia continues to offer a safe haven with proximity to Asia, Wall is confident that Australia “will remain in a strong position to offer attractive opportunities for a range of institutional investors” looking to invest in alternatives.