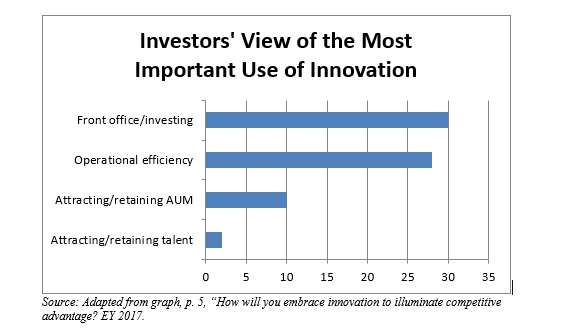

Ernst & Young has released a new survey on how hedge fund managers may “embrace innovation to illuminate competitive advantages,” that is, to attract and retain investors and their assets. Manager may need such advice, because the investors surveyed said they are more likely to decrease allocations to hedge funds in the next three years than they are to increase them. Further, 30% of the investors said that they would like to see hedge funds become more innovative in the front office (that is, the investing/trading core functions). Innovation in the front office is slightly more important to investors than is innovation in operational efficiency, as the chart below shows.  Accordingly, as the report observes, “managers of all strategies, even those deploying deep fundamental research, are tapping into technology such as AI or machine learning to complement their investment process.” New technology, which of course taps into the ubiquitous Big Data, gives savvy managers the tools to “create a distinct advantage in their quest to deliver alpha.” In the survey, managers were asked in which areas they have implemented something innovative to positively benefit their business. There was something of a mis-match between investors and managers here, because the front office came in last among managers as a place where they had been innovative, although as we’ve seen it came in first among investors as a place where they want to see innovation. The larger the managing firm, the more likely it was to have done something innovative in the front office. Firms with over $10 billion AUM were more likely to give that as an answer than firms with between $2 and $10 billion, who in turn were more likely to give that answer than firms with less than $2 billion AUM. What is Innovation? As to what “innovation” means in this context, the report quotes a European pension and endowment manager who said, “Innovation comes down to performance and finding unique, nontraditional investment ideas. That is why we use hedge funds; finding managers that are doing something really innovative.” Hedge fund managers can and should innovate by offering products outside of the realm of … the stereotypical hedge fund. The possibilities range from private equity to UCITS/ European funds and real assets. Asked which out of a group of seven such non-traditional offerings they’ll likely invest in over the next two years, the largest percentage of investors (76%) said PE. Other popular answers were real assets (66%) and long-only funds (53%). There wasn’t much enthusiasm for ’40 Act funds (27%) or sub-advisory capabilities (9%). Unfortunately, as the report observes, a manager can’t offer a new product just by pressing a button. New offerings “are expensive to develop, resulting in high barriers to entry, and face strong competition from specialty managers” already in the fields at issue. A Bright Spot The report reasons that separately managed accounts (SMAs) and their proliferation of late has been a bright spot for hedge fund managers – something that their investors want and that they are in a good position to provide. Over half of the managers surveyed offer them and, for those who do, nearly a quarter of the AUM resides in these accounts.

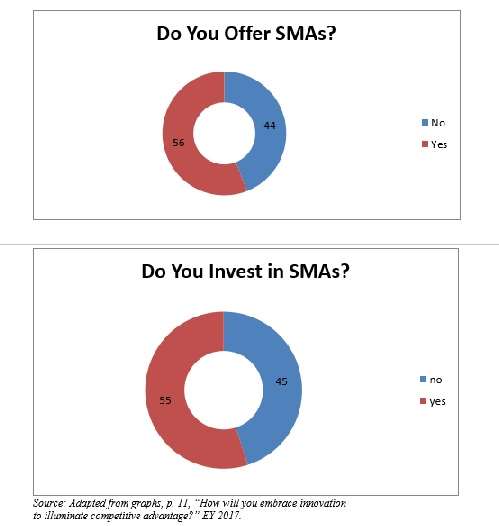

Accordingly, as the report observes, “managers of all strategies, even those deploying deep fundamental research, are tapping into technology such as AI or machine learning to complement their investment process.” New technology, which of course taps into the ubiquitous Big Data, gives savvy managers the tools to “create a distinct advantage in their quest to deliver alpha.” In the survey, managers were asked in which areas they have implemented something innovative to positively benefit their business. There was something of a mis-match between investors and managers here, because the front office came in last among managers as a place where they had been innovative, although as we’ve seen it came in first among investors as a place where they want to see innovation. The larger the managing firm, the more likely it was to have done something innovative in the front office. Firms with over $10 billion AUM were more likely to give that as an answer than firms with between $2 and $10 billion, who in turn were more likely to give that answer than firms with less than $2 billion AUM. What is Innovation? As to what “innovation” means in this context, the report quotes a European pension and endowment manager who said, “Innovation comes down to performance and finding unique, nontraditional investment ideas. That is why we use hedge funds; finding managers that are doing something really innovative.” Hedge fund managers can and should innovate by offering products outside of the realm of … the stereotypical hedge fund. The possibilities range from private equity to UCITS/ European funds and real assets. Asked which out of a group of seven such non-traditional offerings they’ll likely invest in over the next two years, the largest percentage of investors (76%) said PE. Other popular answers were real assets (66%) and long-only funds (53%). There wasn’t much enthusiasm for ’40 Act funds (27%) or sub-advisory capabilities (9%). Unfortunately, as the report observes, a manager can’t offer a new product just by pressing a button. New offerings “are expensive to develop, resulting in high barriers to entry, and face strong competition from specialty managers” already in the fields at issue. A Bright Spot The report reasons that separately managed accounts (SMAs) and their proliferation of late has been a bright spot for hedge fund managers – something that their investors want and that they are in a good position to provide. Over half of the managers surveyed offer them and, for those who do, nearly a quarter of the AUM resides in these accounts.  As one can see, the two donuts above look strikingly similar, showing no embarrassing gaps between suppliers and demanders. Fee Structures One way to attract and maintain investors is to offer a fee structure they find attractive. This is not a matter of undercutting the rest of the industry on the numbers; it is a matter of doing something innovative with the structuring thereof. Asked whether they have adopted “or would consider adopting,” any nontraditional fee structures, 41% of those surveyed said they have done so. Another 25% said they have not, but would consider it. That leaves roughly one-third: 34%, committed to the traditional structure. Hurdle rates are the most popular such innovation, followed by the negotiation of an expense cap, or the creation of a fund which has no performance fee, only the management fee. Other ideas, such as the creation of a fund with only a performance fee, or the development of a cost pass-through model in lieu of a management fee, have failed to catch fire.

As one can see, the two donuts above look strikingly similar, showing no embarrassing gaps between suppliers and demanders. Fee Structures One way to attract and maintain investors is to offer a fee structure they find attractive. This is not a matter of undercutting the rest of the industry on the numbers; it is a matter of doing something innovative with the structuring thereof. Asked whether they have adopted “or would consider adopting,” any nontraditional fee structures, 41% of those surveyed said they have done so. Another 25% said they have not, but would consider it. That leaves roughly one-third: 34%, committed to the traditional structure. Hurdle rates are the most popular such innovation, followed by the negotiation of an expense cap, or the creation of a fund which has no performance fee, only the management fee. Other ideas, such as the creation of a fund with only a performance fee, or the development of a cost pass-through model in lieu of a management fee, have failed to catch fire.

- Programs

- Events and Webcasts

- Resources

- About

- Official Merchandise

Search

Search Close

Close