By Bill Kelly, CEO, CAIA Association

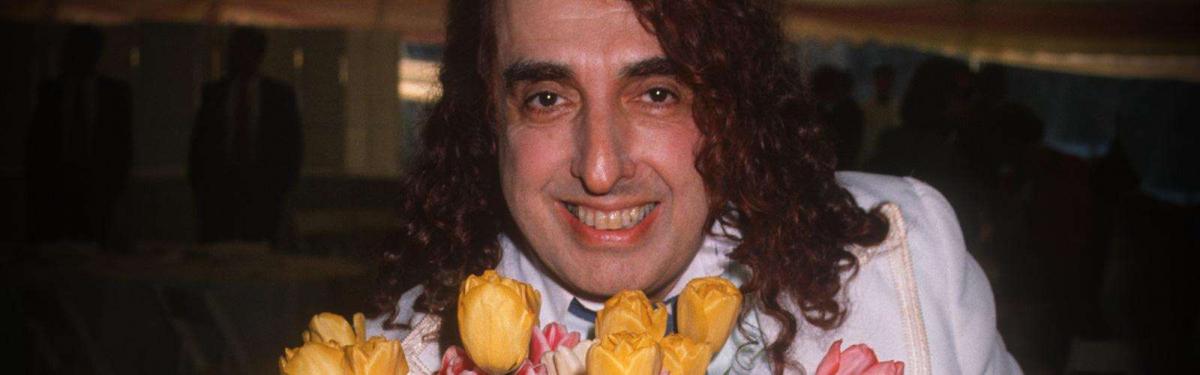

Fifty years ago, Tiny Tim, the ukulele-wielding father of falsetto, released his self-aggrandizing album entitled God Bless Tiny Tim. Love it or hate it, those of a certain generation will never forget Track 2 entitled “Tiptoe Thru’ The Tulips With Me.” In the modern day Kardashian world in which we live, it is a certainty that Tiny Tim would not have made it beyond the first round of American Idol, but if you watch his rendition, it is hard to turn away.

The irony and application of tulips and the prepositional line of “With Me” are collaterally back in the news this past week. Mention tulips to anyone in the financial services space via a quick round of word association and it is unlikely they’ll come back at you with Tiny Tim. Tulips, and more specifically the bulbs from whence they come, have become symbolic to massive bubbles where price discovery no longer matters, and speculation and animal spirits drive a market to unsustainably high prices. We have certainly seen, heard, and read these parallels in what might be happening in the current cryptocurrency space.

Last week, sources who declined to be identified indicated that the Yale Endowment under the leadership of the highly regarded David Swensen, was making its first “big bet” on cryptocurrencies. These same sources named a second crypto fund in which Yale also took a position earlier this year. There are not a lot of facts to work with here and if the cryptos and other investors are ready to pounce on the Tiny Tim-esque “with me," let’s take a breath and see what we do know.

The two opportunities that Yale might have invested in are funds that have reportedly raised about $400 million each. Assuming Yale took a very unlikely high 50% interest in both funds, it would provide the $30 billion endowment with about a 1% exposure to this space; is that really a “big bet”? Based on what is publicly available about these private funds, they do perhaps hold digital coins and cryptocurrencies, but also invest in blockchain and distributed ledger technology, exchanges and other innovations in the infrastructure of this broader market. The public does not have access to the weightings of these various investments.

Yale is also a very long term-oriented investor and their annual report, and how they think about investing, was featured in a previous post in this column. The average holding period for their outside managers is a very patient 13 years. They are constantly on the hunt for exposure to uncorrelated investment opportunities. When it comes to pure beta, they pay very little for that exposure for investments typically found in highly efficient markets. Where there are greater inefficiencies, high volatility, and poor price discovery, the alpha-seeking missile for the smart and patient investor is in overdrive. We do not know the source of alpha in these particular funds in which Yale has chosen to invest, nor do we know the entry point of where they came in. If bitcoin is the benchmark, it is certainly not heady times to enter this realm, and if such entry is coming at the expense of, say, a queasy limited partner via a secondary offering (pure speculation), the price point could present an opportunity with very little downside, and one that is certainly not available to most investors.

If you want to tiptoe with Swensen, you are likely not skipping along in a pari passu kind of way. Is this a signpost that bears watching? Absolutely…but we have a long way to go with pricing transparency, regulation, and custody before we have a truly organized market. The United Nations recognizes about 180 global currencies in a world that has spawned 1,600 cryptocurrencies in the post-Satoshi world order. There is likely something to it, but careful tiptoeing, patience, and the discipline to not simply be a “with me” groupie are essential. Seek diversification, education and know your risk tolerance. Investing is for the long term.

Bill Kelly is the President and CEO at CAIA Association. Follow Bill on Twitter and LinkedIn.