A recent article in the Journal of Risk and Financial Management takes a fresh look at a familiar issue: whether the development of exchange-traded funds (ETFs) and related instruments tracking the commodities industry (or, in short, the financialization of commodities) has had an impact on the volatility of the prices of the underlying assets. The new article is by Wing Hong Chan and two other scholars. Wing is with Wilfred Laurier University, in Waterloo, Ontario. The debate over the unintended (and possibly deleterious) consequences of financialization has been around at least since Michael Masters gave testimony on the subject before the Committee on Homeland Security and Government Affairs of the US Senate in May 2008. Masters said that the market demand consisting of the entry of institutional investors into commodities through such instruments is “one of [the] factors affecting commodity prices today” and that speculation on indexes by institutions may in fact be the primary factor in price inflation. Masters believed that the institutions were as of the time of this testimony contributing mightily to price increases in both food and energy commodities. Discussion has moved on over the last decade, and one can get a broad agreement from experts that Masters’ reading of the evidence was too selective and question begging. The issue, as redefined by subsequent scholarship (such as a seminal 2012 article by Tang and Xiong) is no longer about commodity prices as such, or about an allegedly broad increase in the price levels. It is, rather, about the volatility (in both directions) of commodity prices. It is the sharpness of the zig-zags these prices make on price charts, and the disruption both moves up and moves down can have on people’s lives, that justifies some concern about financialization.

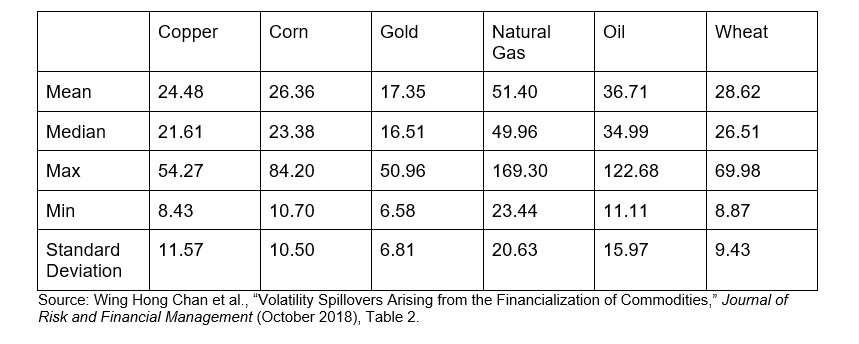

A Negative Correlation Wing and colleagues maintain that the impact of financialization on the volatility of certain commodities is the opposite of what the pessimists in these discussions think it is. The correlation is negative. Further, that negative correlation is likely causation—the new institutional investors, who have “very different investment incentives from the traditional market participants,” have damped down volatility. This impact is limited mostly to the non-energy commodities. These scholars say there appears to be no correlation of financialization and volatility at all for energy commodities. Tang et al. reach these conclusions using front-end futures prices on commodities traded in the United States between January 1998 and June 2016. There are four energy commodities in their data set, (WTI crude oil, diesel no, 2, RBOB gasoline, and natural gas), nine grains, six softs, four livestock commodities and five metals. The realized volatility has itself proven quite volatile. In the case of copper, for example, vol has gotten as low as 8.43 during the sample period and as high as 54.27. Summary statistics are as follows:  If this were a race, natural gas would clearly be the winner. It has the highest number in every row on that table. And oil has the second highest number: again, in every instance. This already illustrates that the energy and non-energy commodities are separate baskets. Why did other studies, such as that of Tang and Xiong show that the energy commodities experienced an increase in volatility after commodification, whereas this study finds no such impact?

If this were a race, natural gas would clearly be the winner. It has the highest number in every row on that table. And oil has the second highest number: again, in every instance. This already illustrates that the energy and non-energy commodities are separate baskets. Why did other studies, such as that of Tang and Xiong show that the energy commodities experienced an increase in volatility after commodification, whereas this study finds no such impact?

Two Differences and a Conclusion The short answer is the broader database created by an extended sample period. The Tang and Xiong study showed a positive correlation during the period of the global financial crisis. Most of the negative coefficients in the Wing et al. data come from the period not covered by that study. This raises the possibility that what Tang and Xiong actually detected was a positive correlation generated by the financial crisis itself, not one created by the financialization of commodities. It was a correlation without causation, and that correlation has disappeared as the crisis that created it has faded into the rearview mirror. Another consideration: Wing and his co-authors, Bryce Shelton and Yan Wendy Wu, use higher frequency data (monthly, not quarterly) and this convey a more granular sense of what is happening than earlier studies. The conclusion? Wing et al. believe that the new capital inflow into commodities has provided risk-sharing benefits and policymakers should be cognizant of this while considering possible constraints on that flow.