By Nicolas Rabener of FactorResearch (@FactorResearch)

INTRODUCTION

As Amazon has been decimating large parts of the retail industry over the last two decades, ETFs have done the equivalent to the mutual fund industry in the financial world. Today ETFs are covering nearly all areas of the markets, no matter how small the niche. Innovative strategies range from biblically responsible to marijuana ETFs.

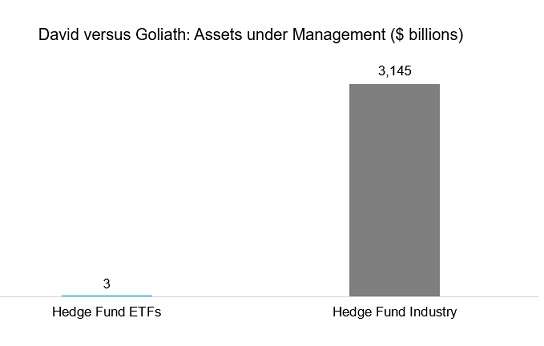

However, one market that is largely undisrupted by ETFs is the hedge fund industry. ETFs have been launched that offer hedge fund strategies and could be used by investors to replace expensive hedge fund allocations, but it does not appear that these have captured a meaningful portion of the $3 trillion managed by hedge funds.

In this short research note, we will analyze hedge fund ETFs available in the US and consider why they have not been commercially more successful.

HEDGE FUND ETFS

The hedge fund industry has grown significantly and manages more than $3 trillion as of 2018, which is approximately the same amount as private equity funds manage. The strategies offered have become diverse over time, however, it is worth noting that the industry should be relabelled to alternative funds as many strategies like shareholder activism or event-driven provide little or no hedge against a market downturn, given a lack of short positions.

In this analysis, we only consider ETFs that aim to offer returns uncorrelated to markets by being able to go long as well as short stocks or other securities. The resulting universe of hedge fund ETFs can be categorized into five types:

- Hedge fund index replicators

- Long-short equity

- Equity market neutral

- Merger arbitrage

- Managed futures

The current universe of hedge fund ETFs in the US features less than 30 products. The total expense ratio is 0.93% on average, which is significantly below hedge fund fees. The average management fee of a hedge fund is 1.60%, but in addition, there are performance fees, fund operating expenses, and other fees that often increase the total expense ratio to above 3%. Hedge funds are notoriously intransparent and investors typically do not see the total amount of fees being charged.

LONG-SHORT EQUITY

Long-short equity is likely the oldest hedge fund strategy and was pioneered by Alfred Winslow Jones in 1949. The aim is to offer exposure to the stock market, but with downside protection. A typical long-short equity fund has net exposure ranging between 30% and 70%, which is achieved by allocating more capital to the long than to the short portfolio. Stocks are selected on a discretionary or systematic basis.

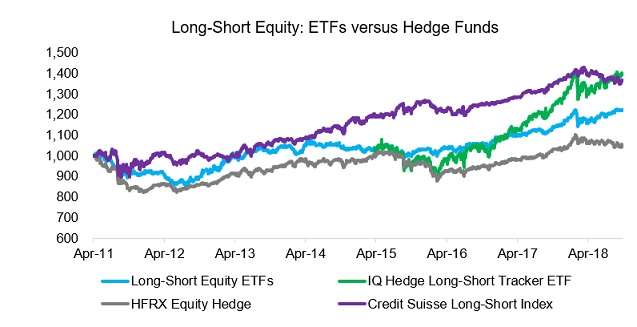

The first long-short equity ETFs were launched in 2011 and we aggregate these into an equally-weighted index. Credit Suisse and HFRX offer indices that can be used for benchmarking the long-short equity ETFs and we observe that the performance is approximately comparable to the benchmarks.

Investors would likely be pleased by the performance of the Credit Suisse Long-Short index, but less by that of the HFRX Equity Hedge index. The poor performance of the latter is surprising given that the index has significant exposure to the stock market, which more than doubled between 2011 and 2018.

Instead of selecting single hedge fund ETFs, investors can also allocate to a replication index from IndexIQ, which seeks to replicate the returns of publicly available long-short equity indices like the ones from Credit Suisse and HFRX. Since its launch in 2015, the index tracker generated higher returns than the single hedge fund ETFs or the benchmark indices, which is likely explained by higher exposure to equities.

Source: HFRX, Credit Suisse, FactorResearch

EQUITY MARKET NEUTRAL

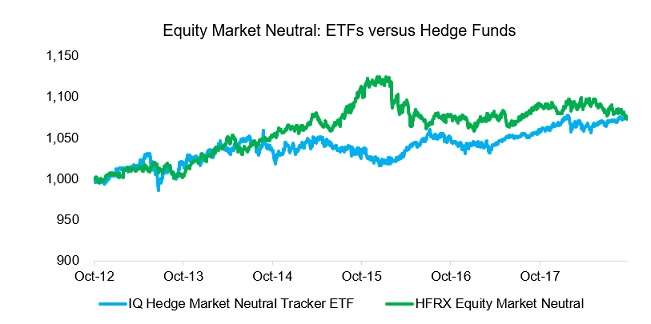

Equity market neutral strategies comprise approximately 5% of the hedge fund assets under management and aim to offer returns completely uncorrelated to financial markets, which makes them attractive products for diversifying traditional equity-bond portfolios. However, there are almost no ETFs that offer this strategy, although it is available as an index tracker.

We observe that the performance of the IQ Hedge Market Neutral index tracker and the HFRX Equity Market Neutral index differed significantly. The performance seems almost negatively correlated between 2015 and 2016, where the HFRX index experienced a minor boom-and-bust cycle. Investors familiar with factor investing will recall that this cycle is explained by exposure to the Momentum factor. It is challenging to explain why the index tracker had the opposite factor exposure of the HFRX index, which it aims to replicate.

Source: HFRX, FactorResearch

MERGER ARBITRAGE

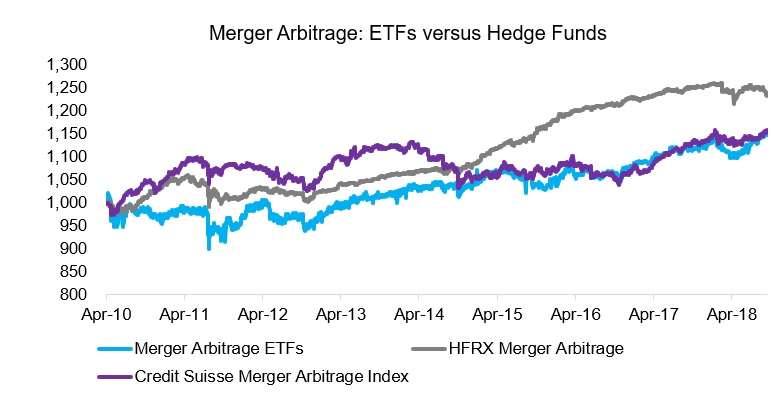

Merger arbitrage funds are typically completely market neutral and seek to exploit the uncertainty around corporate merger situations. A typical portfolio comprises multiples pair trades consisting of long positions in the companies to be acquired and short positions in the acquirers.

There are only two ETF that offer that strategy, but one these manages close to $1 billion in assets and is therefore one of the most successful hedge fund ETFs. The performance of ETFs and the benchmarks are comparable in terms of trends. The HFRX benchmark index featured much lower volatility, which is likely explained by a larger universe of constituents.

Source: HFRX, Credit Suisse, FactorResearch

MANAGED FUTURES

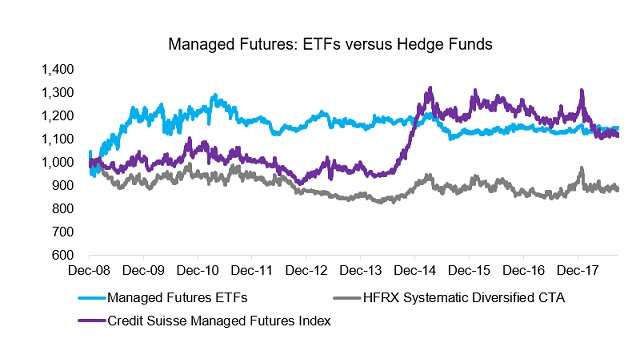

Managed futures funds differ from the rest of the hedge fund industry by being relatively transparent as most funds have to regularly report their returns to the CFTC. This kind of funds has been available for several decades, which provides investors with a good data set for analyzing the returns.

The most common managed futures strategy is trend following, which results in a diverse portfolio of long and short positions across equities, fixed income, commodities, and currencies. A managed futures portfolio tends to have low correlations to equity and bond markets, which makes the strategy attractive for diversifying portfolios.

Managed futures funds generated attractive returns during the global financial crisis in 2008 and 2009, however, the track record thereafter has been poor. We observe that managed futures ETFs and the two benchmark indices share some trends, but also periods of substantial divergence, e.g. 2009.

Source: HFRX, Credit Suisse, FactorResearch

GLOBAL MACRO

Global macro can be considered the supreme discipline of hedge fund strategies as portfolio managers tend to have few limits on what type of securities they trade. Strategies tend to be either systematic or discretionary. The latter might appeal to hedge fund managers as it provides an unparalleled amount of flexibility, but it requires managers to be akin to masters of the universe, which is highly challenging.

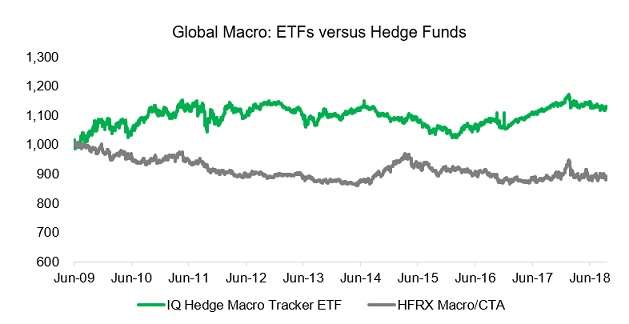

There is an index tracker focused on global macro, but no single ETF. The performance of the index tracker and the HFRX Macro/CTA index was not comparable over the last decade, perhaps because CTAs are included in the benchmark HFRX index. Neither performance has been particularly appealing since 2009.

Source: HFRX, FactorResearch

THE FUTURE OF ETFS?

Broadly speaking hedge fund ETFs have provided returns comparable to their benchmarks, albeit with daily liquidity and full transparency on fees as well as portfolio holdings, which are attractive characteristics. Given this, it is somewhat challenging to explain why ETFs have captured only approximately 1% of hedge fund assets.

The low commercial success is likely explained by a host of factors like less effective marketing and sales by ETF issuers, the intransparency and mystery of hedge funds, and performance chasing of investors. ETFs are mainly sold to retail investors and financial advisors, while typical hedge fund investors are pension funds, endowments, and family offices. These are continuously courted by hedge fund salesmen that emphasize the unique characteristics of hedge funds. Given that there are thousands of hedge funds, there will always be some with great performance at any given point, which often results in performance chasing by investors. Hedge funds do not tend to reveal their strategies, which makes it challenging to analyze and benchmark them.

The key to success is likely better investor education that shows that core hedge fund strategies can be offered as low cost and transparent ETFs, which this analysis supports given comparable performance between hedge fund ETFs and their benchmarks.

Source: BarclayHedge, FactorResearch

FURTHER THOUGHTS

Given better data and technologies, investors have become aware that most outperformance can be explained by exposure to factors like Value or Momentum. Manager alpha has therefore been shrinking continuously and even if identified, often turns out to lack consistency. Although investors have adopted this new perspective primarily for long-only products like mutual funds, it naturally applies to hedge funds as well.

Investment banks are already disrupting the hedge fund industry by offering systematic strategies via low-cost indices. Although these products are attractive from a cost perspective, they lack the winning characteristics of ETFs like full transparency and accessibility. Given the significant inflows into ETFs, it is likely more a question of when and not if ETFs will disrupt the hedge fund industry.