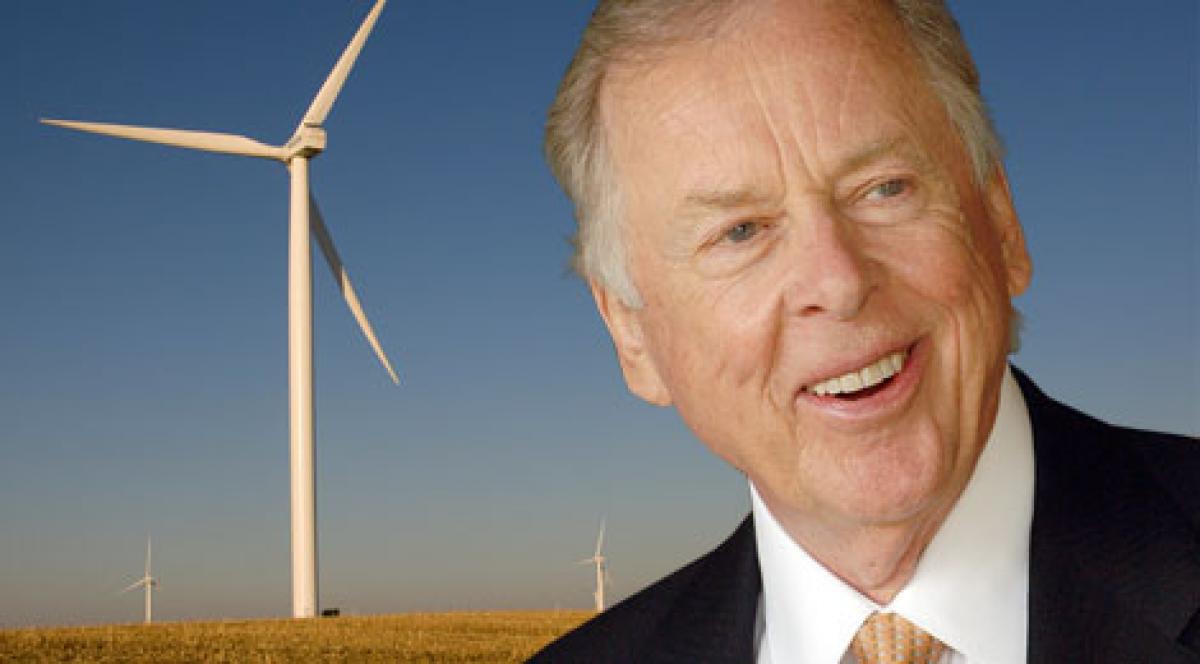

T. Boone Pickens died quietly at home in Dallas, Texas on Sept. 11, 2019.

In his long career Pickens did a good deal to give the current hedge fund industry, as well as the broader asset management industry and the energy commodities markets, their character, in a life that sometimes seemed “as big as Texas.”

He was the son of Thomas Boone Sibley Pickens, who was in the business of leasing oil and mineral rights as his boy grew up, first in Oklahoma and later in Texas.

The boy and namesake known as T. Boone, born in May 1928, grew up and in due course received a degree in geology from Oklahoma A&M, and went to work for Phillips Petroleum in 1951.He didn’t stay long. He wasn’t a hierarchy-climbing sort of guy, more the hierarchy-shaking sort. He was a wildcatter 1954-56 and at the end of that period founded Mesa Petroleum.

Bursting onto the Stage

Pickens didn’t become the stuff of legend, though, until his fifties, when he transformed himself into a takeover artist, shaking up the corporate world of the 1980s. Mesa bought Hugoton Petroleum, a company 30 times its size in 1981. In 1983, even more audaciously, he bid for Gulf Oil, then one of the so-called “Seven Sisters” dominating the industry.

Gulf resisted, and ultimately (late 1984) merged with a friendlier suitor, Chevron. This stirred up a political hornet’s nest: Pickens was on the cover of Time in March 1985.

The Gulf deal was typical of this period for Pickens. It did not end with Mesa taking over the target, but the very prospect of such a takeover opened an auction, and that in turn let Pickens and those who had invested in, cash out, selling their stock in the target company to the eventual highest bidder. This business of putting a company “in play” is standard operating procedure for the capital markets in the 21st century, but it seemed dirty pool at the time, and Pickens became in the minds of many the archetype of a boardroom pirate, a “corporate raider.”

To Pickens, there was more than self-enrichment involved. There was the principle that a company belongs to its shareholders, and that accordingly the managers must be accountable to those shareholders. The typical scenario for a corporate raid was one in which there was value to be unlocked in a company precisely because the management had ceased to be accountable.

In the 1990s, Pickens-esque methods were turned against Pickens. Darla Moore and Richard Rainwater took over Mesa, and unceremoniously booted the founder.

Pickens created his hedge fund, BP Energy Fund in the 1990s. The name was later changed to BP Capital Management, which invested in Halliburton, Schlumberger, the Shaw Group, Suncor Energy, Occidental, and ExxonMobil.

A Sage, a Bet, a Legacy

As the century/millennium ended Pickens adopted a new role as a champion of the development of alternative forms of energy, beyond the crude oil and its derivatives which had made him his first few billions. In 2008, he backed a referendum in the state of California that would have mandated the sale of $5 billion in state bonds which would have gone toward alternative energy rebates and incentives. The voters rejected the plan.

In 2009, Pickens famously lost a bet with John Stossel, a television reporter then about to shift from ABC News to the Fox Business Channel. By this time Pickens was widely regarded by the mainstream press as a venerable oracle on all matters oil and gas. Tom Brokaw interviewed Pickens in this capacity, and Pickens told him that the price of crude oil, then at a historic low around $50 a barrel, “would be back to $100 a year from now.” Two weeks after the interview, Stossel made Pickens a very public bet of $10,000 to a specified charity that oil would not rebound that quickly.

The wager’s reference date was May 22, 2010. The price of oil was only $69.92 at that time. Pickens paid Stossel’s charity.

One might say, with due respect for the deceased, that Pickens was a more benevolent force in the world when he was a disruptor and being denounced as a raider, then he was in his later years, settling too comfortably into the role of sage.

Just two years ago, Pickens reflected on his own legacy in an interview with Forbes. “I have always believed that maintaining the status quo inevitably leads to failure.”