By Nicolas Rabener, FactorResearch (@FactorResearch)

INTRODUCTION

Europeans seem far more focused on the environment than Americans, which might be considered unusual given that both share an interest in the outdoors and have great national parks. Perhaps this is explained by Europe’s higher population density, which puts living space at a premium and creates more awareness for the close surroundings.

The Chernobyl disaster in 1986 also likely increased the consciousness for the environment as it affected almost everyone in large parts of Europe. It stopped children from playing on playgrounds and adults from eating certain foods like mushrooms and freshwater fish, which left memorable impressions on how precious nature is.

It is therefore not surprising that 46% of European investors have allocated to ESG, compared with only 28% of Americans, according to survey results from JP Morgan Quant conferences in 2019. Attendees also discussed the risk of an ESG bubble forming as stocks with high ESG scores might become expensive and disconnected from fundamentals as more capital shifts to ESG products.

In this short research note, we will investigate how expensive highly ranked ESG stocks in the US have become by analyzing ESG-focused ETFs.

ESG ETFS & VALUATIONS

We define our universe by selecting ETFs that broadly target ESG in the US stock market and exclude funds with specific themes like gender diversity, vegan climate, or best employers for ex-military personnel.

ESG-focused ETFs in the US manage less than $10 billion of assets, which is surprisingly low given the prominence of ESG in investor discussions. However, these ETFs have been growing their assets under management and Blackrock expects that ESG ETFs globally will reach $400 billion by 2028.

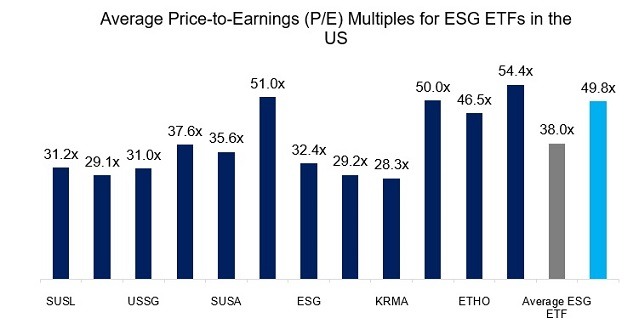

We analyze the valuations of highly ranked ESG stocks by aggregating the price-to-earnings (P/E) ratios of each stock in our universe of 12 ETFs. The simple average P/E ratio across all ETFs highlights that these trade at a lower valuation than the stock market on average, which will be a relief for investors focused on ESG investing.

Source: FactorResearch

However, average P/E ratios are frequently skewed by a few abnormally expensive stocks that make them misleading. Therefore, we calculate the weighted-average and median P/E ratios, which provide a different perspective. ESG ETFs are trading at a slightly more expensive valuation than the US stock market.

In addition, we analyze the valuation multiples of Value and Growth stocks by taking the Russell 1000 Value and Growth indices as proxies. Although we observe that stocks with high ESG scores are more expensive than the stock market on average, they are considerably cheaper than Growth stocks.

Given that ESG investing is at an early stage in the US, this result is perhaps to be expected.

Source: FactorResearch

ESG ETFS: BREAKDOWN BY SECTORS

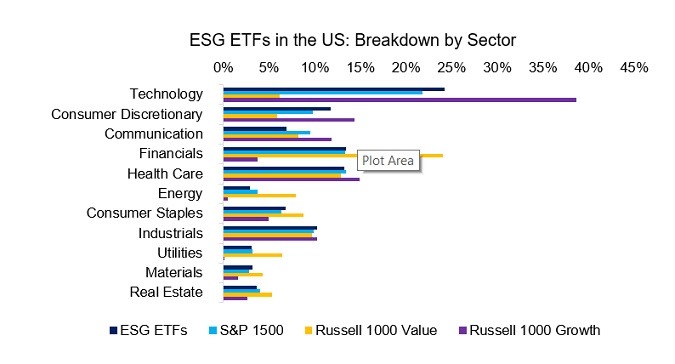

We can explain the differences in valuation by sector biases. Compared to the stock market, ESG ETFs have overweights in technology and consumer discretionary as well as underweights in communication and energy sectors. Technology companies are trading at higher valuation multiples than the stock market while energy stocks are trading more cheaply.

Some of these sector biases are intuitive and structural in nature. Technology firms have been treating their employees well in recent years given a fierce war for talent and often have little to zero manufacturing plants that pollute the environment, which makes it relatively easy for them to achieve a high ESG score. In contrast, energy firms fracking for oil in Texas are more likely to feature a low ESG score and there is little they can do about their core business activities.

Although ESG ETFs have a bias towards the technology sector, it is far less extreme than that of the Russell 1000 Growth index. There are some additional overlaps with Growth stocks, but also differences in sector weights. For example, financial and utility stocks are neutral weights from an ESG perspective, but underweights in a Growth strategy.

Source: FactorResearch

Some ESG data providers rank stocks relative to their peers that will lead to less extreme sector biases. However, this approach results in firms like weapons manufacturers being able to receive high ESG scores. Retail investors are usually disappointed to find such stocks in their portfolios as they tend to believe that ESG products exclude sin stocks like alcohol, tobacco, defense, or gambling firms.

Unfortunately, this highlights the common issue of conflicting objectives when creating investment products. Naturally ESG strategies can be created that exclude all firms that are commonly considered bad corporates, however, that leads to sector biases and unwanted tracking errors to benchmark indices.

SAMPLING ESG STOCKS IN THE US

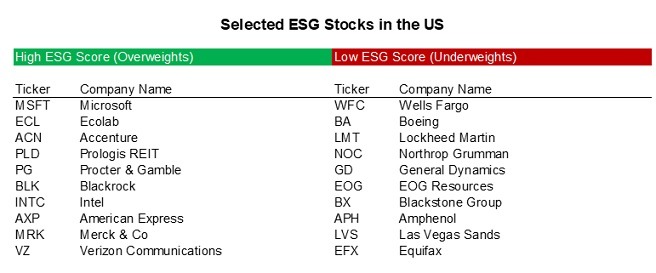

It is interesting to explore which stocks in the US feature high and low ESG scores. We identify the stocks that received a significantly higher weight on an absolute basis in the ESG ETFs compared to their benchmark. The top 10 stocks of this list are perhaps not the most obvious firms to receive overweights in the ETFs as they represent rather diverse businesses that are not immediately associated with high ESG scores. It is interesting to note that Microsoft received the largest overweight, but none of the other well-known FAANG stocks feature in the top 10 list.

Next, we derive the top 10 stocks in the benchmark index from a market capitalization perspective that have a zero weight in the ESG ETFs. This list of stocks includes firms like Lockheed Martin, General Dynamics, and EOG Resources that are typically associated with low ESG scores due to the nature of their industries.

Source: FactorResearch

Some firms such as the defense contractor Northrop Grumman will likely be associated with a low ESG score by most investors, while other firms like Wells Fargo or Boeing had a good reputation until it was wrecked by corporate activity like charging for fake accounts or selling faulty airplanes.

Investors might hope that a focus on ESG might avoid exposure to stocks before their downfall, especially catastrophic ones like Enron. Such a benefit might reflect in ESG strategies outperforming their benchmark or offering lower risk.

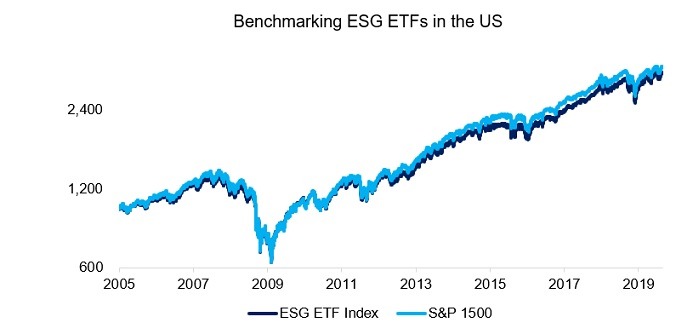

We aggregate the ESG ETFs in the US into an equal-weighted index and observe that this underperformed the S&P 1500 since 2005. This indicates that ESG scores, similar to credit ratings, are unlikely to have predictive power for identifying corporate behavior that will lead to relative underperformance.

However, the annualized volatility of ESG ETFs was also slightly lower than that of the benchmark, which results in similar risk-adjusted returns. Investors could regard ESG as attractive from this perspective, although there are better options for reducing equity risk like Low Volatility strategies.

Source: FactorResearch

FURTHER THOUGHTS

Given the immense interest in ESG, it is natural for investors to question if a valuation bubble is forming. However, the amount of assets allocated directly to ESG strategies in the US is still negligible and highly ranked ESG stocks are not trading at abnormally high valuations, especially when compared to Growth stocks.

If the trend towards ESG investing continues as projected by market participants, then investors should be more concerned with crowding than with valuations. Certain types of stocks trade structurally at high valuations, which represents a lesser risk than when few natural buyers are left.

RELATED RESEARCH