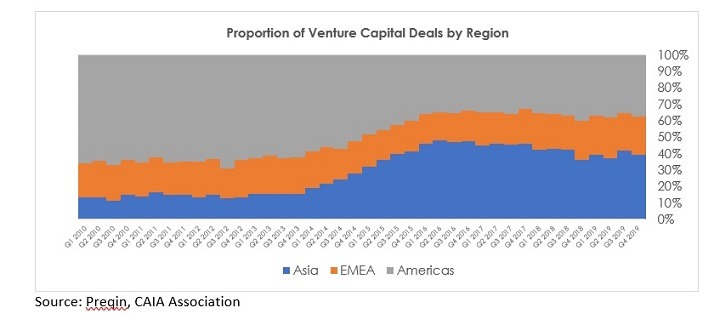

Aaron Filbeck, CAIA, CFA, CIPM, Associate Director, Content Development at CAIA Association I live in the state of Ohio, which has effectively been on lockdown since the beginning of March. Thankfully, most of my daily activities haven’t been disrupted, save for a few. However, my wife, who is always looking for things to do around our city, has been going crazy not being able to go anywhere. Who knew she was suddenly into LEGOs and puzzles? It’s always funny when my work life and personal life intersect (happens more than you think). I was struck by this blogpost from Dean Roney on LinkedIn titled “Building a successful private equity portfolio from scratch, a practitioner's guide.” The post provided some solid foundations for a private equity investor, but through the lens of a first-time private equity investor. It was even more fitting for me to read Roney’s piece as my wife struggled to build a LEGO Batmobile. Roney focuses on four important considerations a new investor might want to consider when making their first capital commitment decisions: time horizon, portfolio construction, manager selection, and ongoing monitoring. I would encourage you to read his full post, but I’ve elaborated on a few of the key considerations below. Time Horizon—Private Equity is for Patient Capital Typically, private equity takes a long time to bear fruit. Investors in private equity must be patient, which can be tough for a newcomer who may not see the benefits of investment until years later. Vintage year, or the year of first investment, can have a meaningful influence on performance figures. Current market environments, starting valuations, and the future operational success of portfolio companies can cause returns to vary widely. For example, the median private equity fund with 2007 and 2009 vintage years returned approximately 11% and 16%, respectively, according to Cambridge Associates. A first-time investor may want to consider diversifying their portfolio by vintage year, choosing to invest in funds across time in order to avoid putting all their eggs in one basket. Along those lines, most private equity funds will have drawdown periods during the first few years of its life as capital is invested. Later, distributions will be returned to the investor (hopefully) in excess of capital invested, but those first few years will impact total portfolio returns. Known as the J-curve, this issue is somewhat unavoidable at the fund level, but can be mitigated through vintage year diversification. Portfolio Construction—More Than Just the Asset Class Beyond asset allocation, portfolio construction becomes essential—what do you own? Imagine opening a brand-new LEGO set and seeing hundreds of 2x2 LEGO pieces… There’s not much you can do with those if you’re trying to build something with a curve! Similarly, private equity is heterogenous, and an investor can diversify their private equity programs according to investment strategy (venture, growth, buyout, etc.), geography, fund size/market cap, and industry concentration. For a long time, private equity (especially venture capital) deals were concentrated in in the Americas. In fact, according to recent Preqin data, the proportion of venture capital deals in the Americas, EMEA, and Asia accounted for 66%, 21%, and 13%, respectively, in 2010. However, this relationship has changed over the past decade and, as of Dec. 31, 2019, the proportion of new deals were 39%, 23%, and 38%, respectively. While this exercise only represents one investment strategy within private equity, it still underscores the importance of avoiding home country bias and building a globally diversified portfolio.  Manager Selection—Size Matters If you’re building a 500-piece puzzle vs. a 1,000-piece puzzle, you might approach the puzzle differently. The time it takes to complete the puzzle, or the potential for failure, might be greater depending on the size of the pieces. In private markets, manager selection is often described as one of the largest drivers of performance, primarily due to large return dispersion among managers. Fund size, as measured by AUM, can magnify this performance dispersion. Roney emphasizes this point greatly, and it can be corroborated by McKinsey & Co.’s most recent Private Markets Annual Review, which displays the relationship between fund size and dispersion.

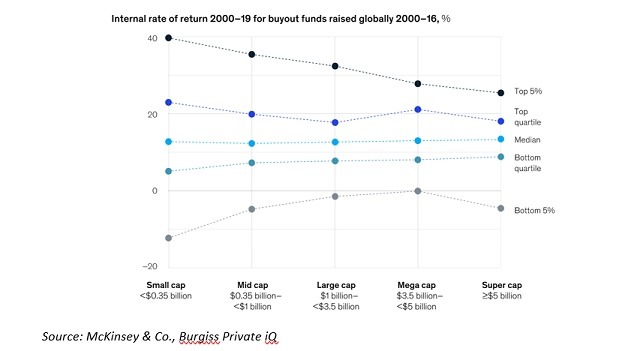

Manager Selection—Size Matters If you’re building a 500-piece puzzle vs. a 1,000-piece puzzle, you might approach the puzzle differently. The time it takes to complete the puzzle, or the potential for failure, might be greater depending on the size of the pieces. In private markets, manager selection is often described as one of the largest drivers of performance, primarily due to large return dispersion among managers. Fund size, as measured by AUM, can magnify this performance dispersion. Roney emphasizes this point greatly, and it can be corroborated by McKinsey & Co.’s most recent Private Markets Annual Review, which displays the relationship between fund size and dispersion.  Source: McKinsey & Co., Burgiss Private iQ What’s interesting is the median performance across different AUM tranches remains relatively similar, but the dispersion is much wider for smaller funds. A new investor should understand these characteristics ahead of time, since it can better inform their return expectations and risk-budgeting process. Beyond relative performance or dispersion measures, there’s a qualitative side to the art of manager due diligence, research, and selection that aren’t always captured in the numbers. Roney emphasizes the importance of GP and LP alignment, personnel assessment, and operational due diligence. As more investors clamor for private equity exposure, evidenced by surveys and dry powder levels, alignment of interests may become a focal point of the due diligence process. Portfolio Monitoring—Measuring Success Imagine building a LEGO set and, once it’s completed, walking away and never looking at it again! One of the seemingly less glorious parts of the portfolio management process is the monitoring stage, yet this is still an important part of the process and should not be ignored. Investors go through a rigorous process of determining an appropriate asset allocation, portfolio construction, and manager selection program, but the ongoing monitoring process should be just as rigorous. Investors should consider benchmarking services to analyze the relative performance of their underlying managers and measure them using multiple statistics. Some statistics might include Net Internal Rate of Return (IRR), Public Market Equivalent (PME), Distributions to Paid-in-Capital (DPI), Residual Value to Paid-in-Capital (RVPI), and Total Value to Paid-in-Capital (TVPI). No performance measurement statistic is perfect but using many of them can serve as valuable inputs into the monitoring process. Bringing It All Together I think Roney’s post could be especially relevant for new investors in the coming years, as institutional investors are expected to increase allocations to the asset class over time, and regulators are ready to open the floodgates to newcomers in the future. Private equity investing is meant for patient investor, which seemingly makes moving into the asset class seem daunting. Just like LEGOs or puzzles, investing in private equity has a lot of “moving parts,” but building a solid framework is a good starting point.

Source: McKinsey & Co., Burgiss Private iQ What’s interesting is the median performance across different AUM tranches remains relatively similar, but the dispersion is much wider for smaller funds. A new investor should understand these characteristics ahead of time, since it can better inform their return expectations and risk-budgeting process. Beyond relative performance or dispersion measures, there’s a qualitative side to the art of manager due diligence, research, and selection that aren’t always captured in the numbers. Roney emphasizes the importance of GP and LP alignment, personnel assessment, and operational due diligence. As more investors clamor for private equity exposure, evidenced by surveys and dry powder levels, alignment of interests may become a focal point of the due diligence process. Portfolio Monitoring—Measuring Success Imagine building a LEGO set and, once it’s completed, walking away and never looking at it again! One of the seemingly less glorious parts of the portfolio management process is the monitoring stage, yet this is still an important part of the process and should not be ignored. Investors go through a rigorous process of determining an appropriate asset allocation, portfolio construction, and manager selection program, but the ongoing monitoring process should be just as rigorous. Investors should consider benchmarking services to analyze the relative performance of their underlying managers and measure them using multiple statistics. Some statistics might include Net Internal Rate of Return (IRR), Public Market Equivalent (PME), Distributions to Paid-in-Capital (DPI), Residual Value to Paid-in-Capital (RVPI), and Total Value to Paid-in-Capital (TVPI). No performance measurement statistic is perfect but using many of them can serve as valuable inputs into the monitoring process. Bringing It All Together I think Roney’s post could be especially relevant for new investors in the coming years, as institutional investors are expected to increase allocations to the asset class over time, and regulators are ready to open the floodgates to newcomers in the future. Private equity investing is meant for patient investor, which seemingly makes moving into the asset class seem daunting. Just like LEGOs or puzzles, investing in private equity has a lot of “moving parts,” but building a solid framework is a good starting point.

Aaron Filbeck, CFA, CAIA, CIPM is Associate Director, Content Development at CAIA Association. You can follow him on Twitter and LinkedIn.

Interested in contributing to Portfolio for the Future? Drop us a line at content@caia.org